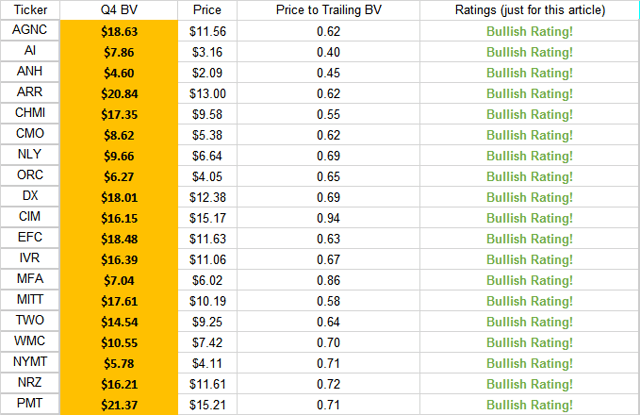

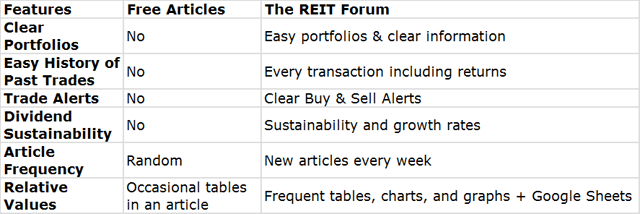

One of the most important steps in evaluating mortgage REITs is finding the price to book value ratios. Using the mortgage REITs' book value gives us an idea for the general range where the mortgage REIT should trade. We expect that all mortgage REITs holding similar assets will generally be correlated with each other.

If you see several mortgage REITs trading at 15% or greater discounts to book value, you should expect comparable mortgage REITs to also trade at material discounts to book value. If a few are trading at premiums, while others trade at huge discounts, it usually represents an opportunity.

The mREITs

I put most of the residential mREITs, two ETFs, and one ETN into the table:

American Capital Agency Corp. | |

Arlington Asset Investment Corporation | |

Anworth Mortgage Asset Corporation | |

ARMOUR Residential REIT | |

Cherry Hill Mortgage Investment | |

Capstead Mortgage Corporation | |

Annaly Capital Management | |

Orchid Island Capital | |

Dynex Capital | |

Chimera Investment Corporation | |

Ellington Financial | |

Invesco Mortgage Capital | |

MFA Financial | |

AG Mortgage Investment Trust, Inc. | |

Two Harbors Investment Corp. | |

Western Asset Mortgage Capital Corp. | |

New York Mortgage Trust | |

New Residential Investment Corp. | |

PennyMac Mortgage Investment Trust | |

iShares Mortgage Real Estate Capped ETF | |

VanEck Vectors Mortgage REIT Income ETF | |

UBS ETRACS Monthly Pay 2x Leveraged Mortgage REIT ETN |

The goal here is to have a fairly large sample size, so we can identify trends and similarities throughout the sector. The mREIT sector only contains about 25 total organizations, but the investing and hedging strategies have very material differences.

Price-to-Book Value

We are using the total book value per share under GAAP. It includes intangible assets, but those are relatively rare. The notable inclusions are for AGNC and NYMT, both of which have "Goodwill" from buying a company which was externally managing all, or part, of their portfolio.

We also correctly handled preferred equity. If you're seeing a value that is dramatically different (in some other tool) than what we are presenting, the most common cause is a failure of the other tool to properly handle preferred equity. We are regularly challenged on these numbers, but we are consistently right.

Source: The REIT Forum

Due to decreases in book value, the actual discount today is lower than what we calculate using the price-to-trailing book value. However, the decreases haven't been big enough to merit this kind of damage.

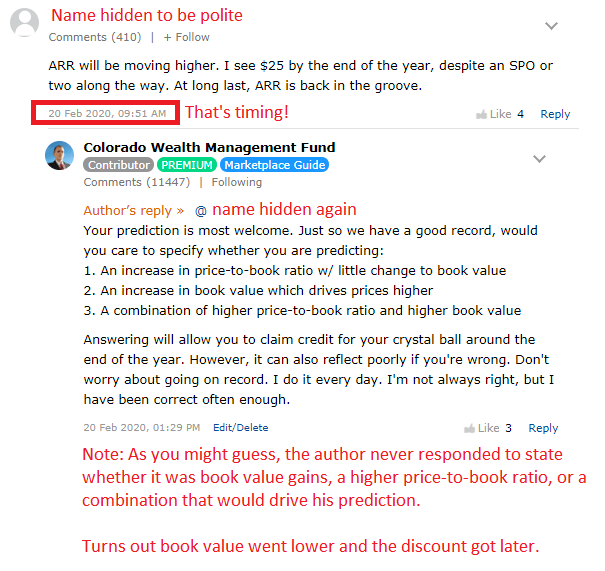

It won't hurt us the way it may hurt the pride of some of our critics:

Source: Seeking Alpha

When you're predicting what happens with mortgage REITs, you should always be able to break down your forecast between the book value and the price-to-book ratio. If you can't break that down, you don't have enough information to have an informed opinion.

So, to be extremely clear:

- I believe we will see Q1 2020 book value reported materially lower than Q4 2019 book values.

- However, I'm forecasting that, in the future (perhaps tomorrow, perhaps a month from now), we will see materially higher price-to-book ratios.

- Consequently, I predict higher prices on the basis of the increase in price-to-book ratio outweighing a reduction in book value per share.

Feel free to disagree.

When you do, please be very precise in your reasoning so I can highlight your comment in a future article.

Ratings

We're updating our ratings. You may recall that, in past articles, we had quite a few bearish ratings. It was only about a month ago when we said we were bearish on most of the sector. We were even hitting the ETFs with sell ratings for good measure.

That's gone today.

Normally, we focus on the relative size of the discounts between different mortgage REITs. We want to figure out which one offers the BEST deal.

Today, opportunities are abundant. That's also the case in preferred shares. We added new positions in 5 preferred shares today thanks to the sector declining between 10% and 35%. That's amazing. The preferred share bargains are out of this world.

One-Day Price Movements

I'd like to share part of a buy alert we issued today:

Common Share Prices

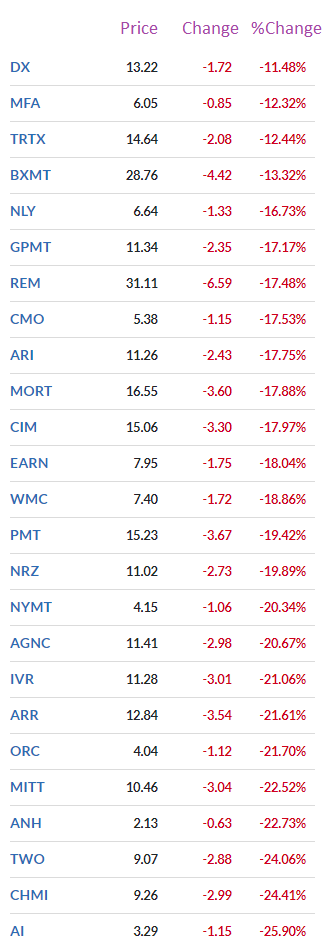

The following chart shows the change in share prices so far today:

Source: Seeking Alpha

Prior Sales Like This

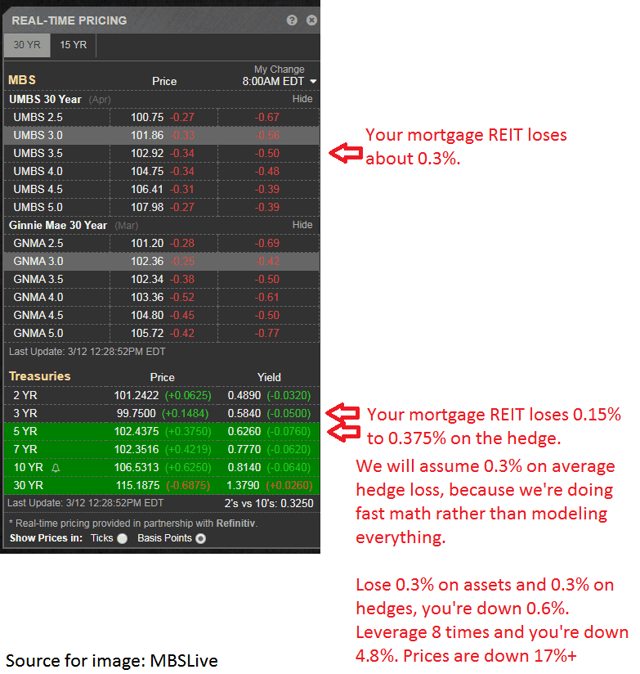

I recall one day where mortgage REITs went on sale like this. It was in January of 2016. Common shares plunged by around 8% to 15% throughout the sector. On that day, they bounced back in the final 2 hours of trading. We can't say that this will turn out the same, but I recall scratching my head and wondering what I could be missing. This time, I'm ready to go. Here are some very quick rough estimations:

Assuming agency mortgage-backed securities, you're looking at a portfolio that may have lost around 4.8%. Now there's a question of how much non-agency mortgage-backed securities should be down. I'll leave that for Scott. I don't foresee massive losses on those loans because home prices haven't plunged. I don't foresee a reason that home prices would plunge. Keep in mind, even falling 5% wouldn't be a plunge.

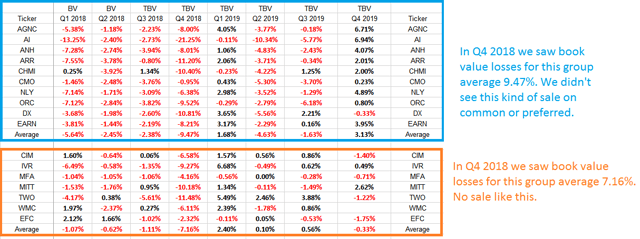

To put this in even greater detail, we run a table tracking changes in book value per share over time. The quarter-over-quarter change in book value per share is shown below:

Source: The REIT Forum

In Q4 2018 there were big losses in book value. We didn't get opportunities like this! Those losses averaged 9.47% for one group and 7.16% for the other. This current sale pricing is insanity.

As an added note, the spread widening continued throughout the day. If we do the same "napkin math" now, instead of 4.8%, we would get something closer to 7%. Adding that to prior damage to book values and quite a few mortgage REITs might be looking at declines greater than 10%. We'll have more precise numbers after Scott Kennedy does the next week of updates.

We utilize estimates from Scott Kennedy on the current book value per share. Those estimates give us better information on where the value is today, rather than relying on past values. So, the values I provide here are simply designed as a quick rough-estimate.

We're thrilled to have Scott Kennedy joining The REIT Forum as a key author for the service. Our ratings and outlooks on REITs will generally have an enormous amount of overlap since he handles so much of the fundamental research for The REIT Forum.

What Are People Thinking?

We're seeing a few things. General panic in equity markets. That is warranted, as we've been warning investors for weeks, COVID-19 is a substantial threat to the economy. Changes in behavior to avoid the disease can cause a dramatic decrease in GDP growth, which could easily put us into a recession.

However, there are at least 4 factors in play that compound the issue here:

- Many investors bought mortgage REITs for the yield with no idea how they work.

- Many investors who understand the importance of book value don't understand how to model it. Not even a rough estimate.

- Spreads between MBS and Treasuries widened today. Investors who only knew a little bit about book values are predicting the apocalypse. They were wrong before and they are wrong now.

- Price-to-book ratios were laughably high only a few weeks ago. We tried to warn investors. Some listened and got out. Others predicted that gains would continue forever.

Those 4 factors drove mortgage REITs to fall by 10% to 25% today.

Conclusion

We're usually not suggesting mortgage REITs for the buy-and-hold investors due to the risk from swings in interest rates. However, we do enjoy buying mortgage REITs when they trade at exceptionally large discounts to book value. The strategy has been exceptionally successful for us because it capitalizes on having superior information on book value estimates and knowledge of historical price-to-book ratios.

Note: If a buy-and-hold investor wants to buy mortgage REIT common shares, today looks like the best opportunity since January of 2016. That's just my view though. You do what you need to do.

Of course, as prices and book values change, our views may change.

Let me reiterate that. When the fundamentals change, our ratings change. We aren't stuck in a certain rating forever.

Normally, we only provide a few ratings in our public releases. However, given the magnitude of the movement and the general panic, we're going to do something different. We aren't highlighting the exact buy-under targets or the exact book value estimates, but we will share our outlook across these mortgage REITs with our largest "rating" section ever. See below.

Ratings in this article:

Ticker | Ratings |

AGNC | Bullish Rating! |

AI | Bullish Rating! |

ANH | Bullish Rating! |

ARR | Bullish Rating! |

CHMI | Bullish Rating! |

CMO | Bullish Rating! |

NLY | Bullish Rating! |

ORC | Bullish Rating! |

DX | Bullish Rating! |

CIM | Bullish Rating! |

EFC | Bullish Rating! |

IVR | Bullish Rating! |

MFA | Bullish Rating! |

MITT | Bullish Rating! |

TWO | Bullish Rating! |

WMC | Bullish Rating! |

NYMT | Bullish Rating! |

NRZ | Bullish Rating! |

PMT | Bullish Rating! |