During these turbulent times in the market, I have found myself searching for companies with secure cash flow that are on the receiving end of big dips. These companies, in my opinion, present the best buying opportunities as the markets shed excess weight.

VeriSign (NASDAQ:VRSN) was one of the companies that popped up on my list of cash flow stable firms. This business requires little cash to operate and is unlikely to be on the receiving end of a massive drop in revenues. Significant declines present a buying opportunity for long-term investors.

The Cash Cow

To convey what VeriSign does in the fewest words, imagine a toll road. If you're on it, you're paying. Well, VeriSign is that, but for the internet. For every .com domain name registered, the company collects $7.85 per year for every .net registered, a little bit north of $9. With no competition around, they are the internet's toll road.

Per VeriSign's Q4 release, there are now 362.3 million domain names registered, through them, across all top-level domains. The .com and .net TLDs, where the company sees the vast majority of their revenue coming from, sat at 158.8M registered. That's 158.8M pieces of recurring income.

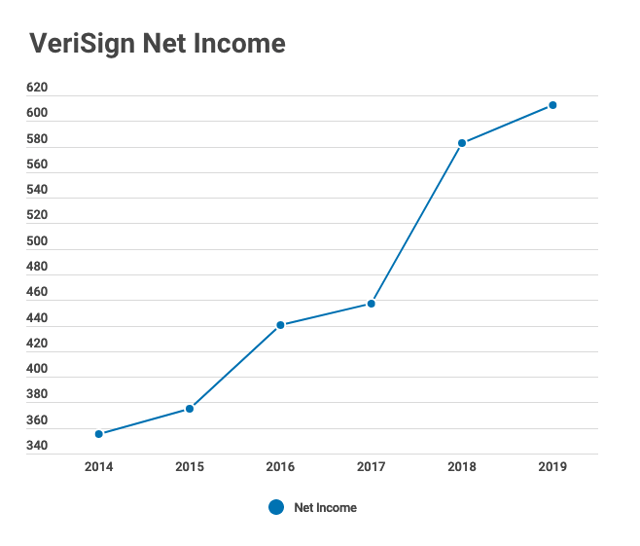

Image: Net Income per Seeking Alpha Quote Page

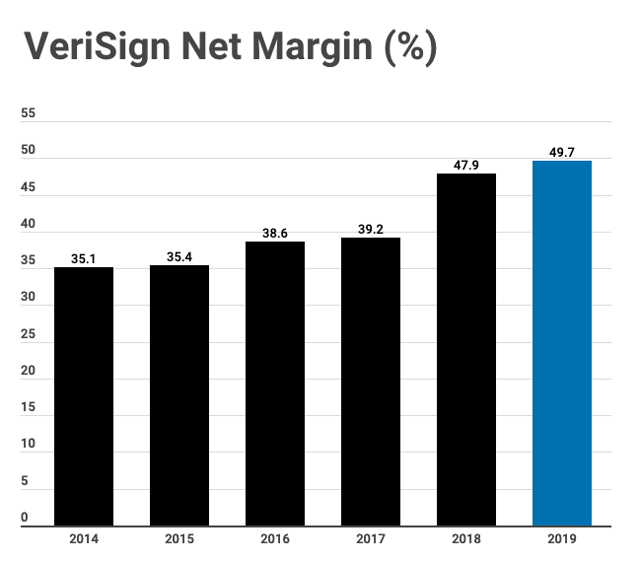

This recurring revenue comes with an outstanding net margin of 49% in the most recent year, and 47% in the year prior. The business itself requires very little cash to run, and with divestitures of non-core businesses over the last several years, VeriSign is a lean, mean, cash making machine.

Image: Net Margins calculated from data on Seeking Alpha Quote Page

Can The Monopoly Be Eroded?

Yes, but it's highly unlikely. VeriSign has had control of the .com registry for more than two decades without any significant issues during that time. While a competitor could always swoop