"People will tell you anything but what they do is always the truth." - P. J. O'Rourke

Believe it or not, fourth-quarter earnings results are still coming across the wire. Given the current state of hysteria around Covid-19 and tumbling markets, it is easy to see why so many of these postings are getting little shrift from investors at the moment. Today, we check back in on small biopharma that just delivered another quarter of explosive revenue growth that was mostly overlooked thanks to the current conniptions in the markets.

Company Overview

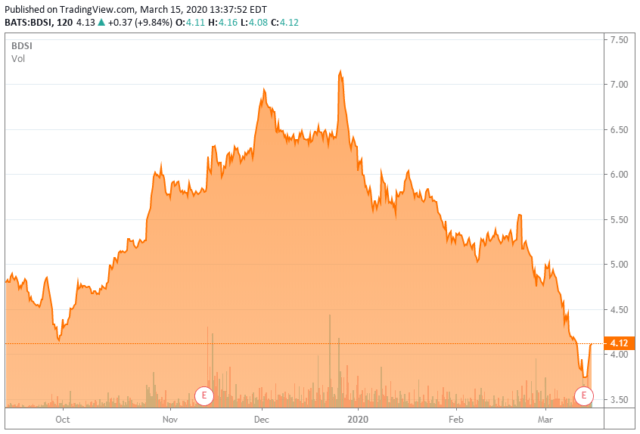

BioDelivery Sciences (BDSI) is a pain management focused "Tier 3" biopharma based in North Carolina. The company's main product is BELBUCA targeting pain relief and has a relatively low risk for developing dependence. This product has been the beneficiary of an increasing focus on the opioid crisis in the United States and the need to find less addictive pain management solutions. The stock currently trades just over $4.00 a share and has an approximate $400 million market capitalization.

Fourth-Quarter Results

Revenue for the fourth quarter came in at $31.6 million, up 75% from a year ago. Sales growth was driven by BELBUCA which posted revenues of $28.3 million, up 78% on a year-over-year basis. For FY2019, BioDelivery had $111.4 million in overall sales, just over double FY2018's levels.

Source: Company Presentation

EBITDA in Q4 was $4.1 million compared to $3.5 million in the third quarter of 2019 and a negative $3 million in the fourth quarter of 2018. Operating cash flow turned positive in Q4, which was a significant milestone for the company.

Source: Company Presentation

Analyst Commentary & Balance Sheet

H.C. Wainwright reissued its Buy rating and $7 price target on BDSI right after the quarterly results were posted. So far in 2020, Cantor Fitzgerald has maintained

Live Chat on The Biotech Forum has been dominated by discussion of these type of buy-write opportunities over the past several trading sessions. To see what I and the other season biotech investors are targeting as trading ideas real-time, just initiate your two-week no obligation free trial into The Biotech Forum by clicking HERE.