My investment thesis has constantly harped on the price tag people were willing to pay for Twilio (NYSE:TWLO). The company runs an exceptional cloud communications business, but the stock constantly trade at over 10x sales estimates. After the recent $55 dip in Twilio, the stock is finally very appealing for long-term investors.

Image Source: Twilio website

Sudden Value Play

The company makes it easier for corporations to communicate with consumers such as gig economy workers delivering passengers and goods. A shutdown of the economy actually reduces the need for communications when people are working, traveling and ordering goods. Ultimately, Twilio should benefit from companies needing to manage communications with consumers when the economy reopens.

In the short term, a lot of their work could see declined usage. Over time, the business will return so investors are selling the stock in panic here despite a bright long-term future.

The stock has dipped from a high of $133 in early 2019 with a current price below $80. In the process, Twilio trades at only 5x '21 sales estimates while the stock regularly topped a 10x multiple back in the 2019 stock peaks.

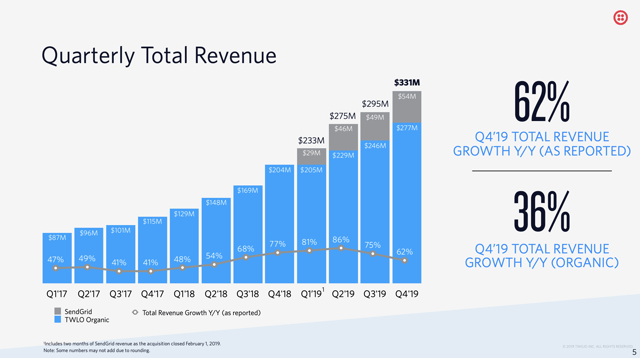

The stock now trades at the lowest multiples in the last couple of years. Twilio grew organic revenues 36% in Q4 and 47% for all of 2019. The problem with the stock trading at over 10x sales estimates is that investors clearly focused more on the 62% revenue growth rates, not the sustainable levels.

Source: Twilio Q4'19 presentation

For 2020, Twilio guided to revenue growth of at least 30%. The organic growth rate will approximate around these levels as the SendGrid deal was consummated early last year.

Analysts have 2021 revenues growing at a 26% range so investors should value the stock based on normalized growth rates in the upper 20% range. With

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.