When my book 'Rich Dad's Prophecy' was released in 2002, most financial newspapers and magazines trashed it because I discussed a looming stock market crash. -- Robert Kiyosaki

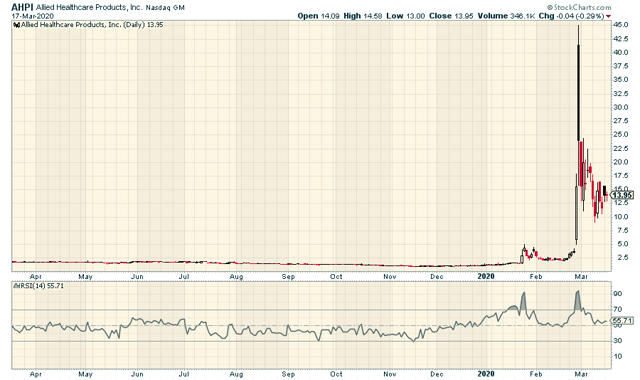

Recently, the stock price of Allied Healthcare Products (AHPI) jumped more than 500% over the course of two days in late February, pushing it to new multi-year highs. The catalyst, of course, was the coronavirus outbreak, which has been spreading rapidly across the United States and Europe and has resulted in a surging demand for medical supplies and other healthcare equipment.

AHPI, which specializes in the production of home respiratory care products, oxygen cylinders and emergency medical products, has drawn the attention of investors looking for exposure to companies and industries which figure to benefit from the virus’ spread. The healthcare sector has been one of the market’s best performers over the past month with the medical devices group enjoying particular success. The near-term catalyst has been the development and mass production of a reliable coronavirus test kit, something that, thus far, has proven elusive. Recently, Co-Diagnostics (CODX) has made available its COVID-19 testing kits, boosting the value of other coronavirus names, including AHPI, in the process.

From a fundamental standpoint, however, AHPI could be a trap. This was a stock in the $1-2 range as recently as January and the coronavirus boost could ultimately be little more than a short-term boost for the company.

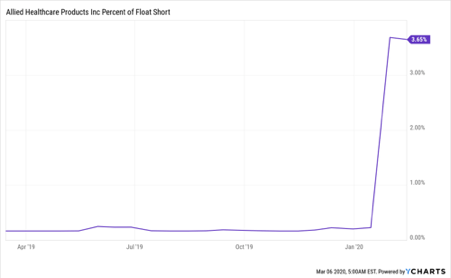

Investors have certainly been positioning themselves for a move back to the downside as evidenced by the recent short interest chart.

It’s natural that the short interest in any stock, which has risen from $1 to as high as $45 in just a few trading sessions, would increase and could indicate that the recent mania surrounding AHPI has begun to subside. Since the initial spike, AHPI has indeed pulled back to the $15 area, but

Risk-off warnings were given January 27.

Risk-off warnings were given January 27.

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.