The huge swoon in the overall market over the last five weeks has put many stocks in oversold territory. I ran a scan of the S&P 500 to see how many stocks are in oversold territory based on their 10-week RSI readings. Of the 500 stocks, 426 have an RSI reading below 30 at this time.

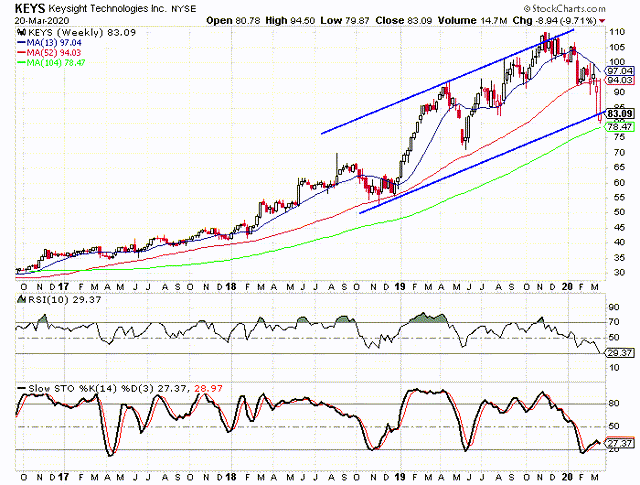

One of the members of the S&P 500 that just entered oversold territory in the past week was Keysight Technologies (NYSE:KEYS). The stock closed the past week at a price of $83.09 and a 10-week RSI reading of 29.37. That RSI reading is the lowest reading since the first quarter of 2016.

For those of you that might not be familiar with Keysight Technologies, it is a worldwide provider of electronic design and test solutions to its customers. Those customers include companies in commercial communications, networking, aerospace, and the automotive industry. The company is based in Santa Rosa, California, and was founded as part of Hewlett Packard in 1939. Keysight was launched as a separate company on November 1, 2014.

Since the stock started trading in November 2014, the only time it has been in oversold territory was in the first quarter of 2016. The stock was trading between $22 and $25 back then and it peaked at $110 this past November.

Even with selloff, Keysight has remained above its 104-week moving average and it is one of a few stocks that can still make that claim.

Just Like a Rising Tide Lifts All Boats, a Falling Tide Causes All Boats to Drop

If you have been around the investment world long enough, you have probably heard the old adage that, “A rising tide lifts all boats.” While that is the saying about bull markets, the opposite is also true for bear markets. And I believe this is the

If you would like to learn more about protecting and growing your portfolio in all market environments, please consider joining The Hedged Alpha Strategy.

One new intermediate to long-term stock or ETF recommendation per week

One or two option recommendations per month

Bullish and bearish recommendations to help you weather different market conditions

A weekly update with my views on the market, events to keep an eye on, and updates on active recommendations