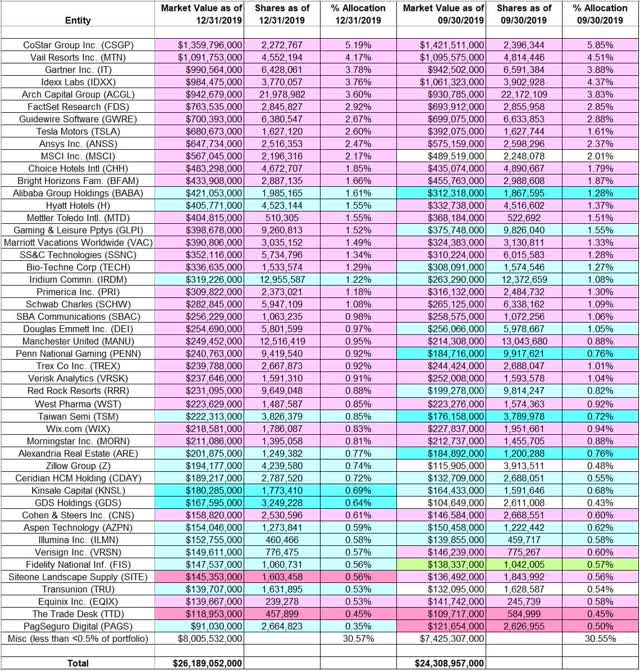

This article is first in a series that provides an ongoing analysis of the changes made to BAMCO Inc.'s 13F stock portfolio on a quarterly basis. It is based on Ron Baron's regulatory 13F Form filed on 02/18/2020. The 13F portfolio value increased ~8% from $24.31B to $26.19B this quarter. The holdings are diversified with recent 13F reports showing around 350 positions. There are 48 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are CoStar Group (CSGP), Vail Resorts (MTN), Gartner Inc. (IT), IDEXX Labs (IDXX), and Arch Capital Group (ACGL). They add up to 20.50% of the portfolio.

Ron Baron started managing client assets in 1975, founded Baron Capital in 1982, and BAMCO Inc. in 1987. Baron Capital currently has ~$30B under management. The assets are distributed among several mutual funds with the common theme of long-term research-driven growth investment solutions. Its flagship mutual funds are Baron Asset Fund (MUTF:BARIX) incepted in 1987 and Baron Partners Fund (MUTF:BPTIX) incepted in 1992. Both funds have produced significant alpha over their lifetimes - 11.88% annualized for Baron Asset Fund compared to 10.35% & 9.98% respectively for the Russell Midcap Growth & S&P 500 Indexes respectively and 13.39% annualized for Baron Partners Fund compared to 10.05% & 9.89% respectively for the Russell Midcap Growth & S&P 500 Indexes. The other funds in the group are Baron Discovery Fund (BDFIX), Baron Growth Fund (BGRIX), Baron Small Cap Fund (BSFIX), Baron Focused Growth Fund (BFGIX), Baron Durable Advantage Fund (BDAIX), Baron Fifth Avenue Growth Fund (BFTIX), Baron Opportunity Fund (BIOIX), Baron Emerging Markets Fund (BEXIX), Baron Global Advantage Fund (BGAIX), Baron International Growth Fund (BINIX), Baron FinTech Fund (BFIIX), and Baron Health Care Fund (BHCHX), Baron Real Estate Fund (BREIX), Baron Real Estate Income Fund (BRIIX), and Baron WealthBuilder Fund (BWBIX).

Note: Some of the top holdings in its Emerging Market, International and Global funds are not in the 13F report as they are not 13F securities. Such holdings include Tencent Holdings (OTCPK:TCEHY), Samsung Electronics (OTCPK:SSNLF), Sberbank of Russia (SBRCY), Reliance Industries, Midea Group, RIB Software SE (RSTAY), and Trainline plc (OTCPK:TNLIF).

New Stakes

None.

Stake Disposals

None.

Stake Increases

Alibaba Group Holding (BABA): BABA is a 1.61% of the portfolio position first purchased in 2014 at prices between ~$85 and ~$115 following its IPO in September 2014. The stake was built over the next three years at prices between ~$59 and ~$191. 2018 saw a ~27% selling at prices between ~$130 and ~$208 while last year there was a 75% increase at prices between ~$140 and ~$210. The stock currently trades at ~$181.

Hyatt Hotels (H): The 1.55% H stake was established in the high-20s price range in 2009 following its IPO that November. The next five years saw the position almost doubled at prices between ~$29 and ~$64. 2016 saw a ~30% selling at prices between ~$37 and ~$58. Since then, the stake has remained relatively steady although adjustments were made every quarter. The stock currently trades at ~$47.

Note: Baron Capital owns ~12.4% of Hyatt Hotels.

Iridium Communications (IRDM): IRDM is a 1.22% of the portfolio position first purchased in 2014 at prices between ~$6 and ~$10. The position had remained relatively steady since. H1 2019 saw a one-third stake increase at prices between ~$18.50 and ~$28 and that was followed with minor increases over the last two quarters. The stock currently trades at $19.50.

Note: Baron Capital owns ~10% of Iridium Communications.

Taiwan Semiconductor (TSM): A very small position in TSM was established in 2013 at prices between ~$16 and ~$20. Since then, every year has seen consistent buying. Recent activity follows: 2018 saw a ~30% stake increase at prices between ~$35 and ~$46 and that was followed with a ~12% further increase last year at prices between ~$35 and ~$59. The stock currently trades at $44.53 and the stake is at 0.85% of the portfolio.

Alexandria Real Estate (ARE): ARE is a 0.77% of the portfolio stake established in 2009 at prices between ~$32 and ~$64. The sizing had remained relatively steady over the last decade. Last year saw a ~25% stake increase at prices between ~$113 and ~$162. The stock currently trades at ~$123.

Zillow Group (Z): The 0.74% Z position goes back to 2011 when it established a very small stake following Zillow's IPO that July. Shares started trading at ~$34 per share. 2015 saw the position built to ~3.8M shares at prices between ~$23 and ~$125. Since then, the stake has wavered. Recent activity follows: last four quarters have seen a ~50% stake increase at prices between ~$29.50 and ~$50. The stock currently trades at $27.19.

Note: Baron Capital owns ~5% of Zillow Group.

Ceridian HCM Holding (CDAY): The 0.72% CDAY stake was established in Q2 2018. CDAY had an IPO in April 2018 and shares started trading at ~$34 per share. The position has since been increased by ~85% through consistent buying every quarter. The stock currently trades at $47.76.

Kinsale Capital (KNSL): KNSL is a 0.69% of the portfolio stake. A very small position was established in 2016 following Kinsale's IPO. Most of the current position was built next year at prices between ~$28 and ~$45. Last four quarters have seen a ~22% stake increase at prices between ~$57 and $107. The stock currently trades at $86.37.

Note: Baron Capital owns ~8% of Kinsale Capital.

GDS Holdings (GDS): The 0.64% GDS stake was established in 2018 and built over the last four quarters at prices between ~$23 and ~$54. The stock is now at $51.46.

Aspen Technology (AZPN), Fidelity National Information Services (FIS), Illumina Inc. (ILMN), PagSeguro Digital (PAGS), TransUnion (TRU), and VeriSign Inc. (VRSN): These very small (less than ~0.60% of the portfolio each) positions were increased during the quarter.

Stake Decreases

CoStar Group: CSGP is now the largest position in the 13F portfolio at 5.19%. It is a very long-term position that has been in the portfolio for almost two decades. The position was first purchased in 2000 and the stake remained very small for the next three years. The bulk of the current stake was built in the 2003-2004 time frame at prices between ~$17.50 and ~$47. 2014 also saw a ~45% stake increase at prices between $142 and $212. Since then, the position had remained relatively steady although adjustments were made in most quarters. Recent activity follows: last two years saw a ~13% selling at prices between ~$311 and ~$634. The stock currently trades at ~$551.

Note: Baron Capital owns ~6.2% of CoStar Group.

Vail Resorts: MTN is a top-three 4.17% very long-term stake. During its first 13F filing in Q1 1999, the position was already very large at 11.6M shares. That original stake was sold down by around two-thirds in the 2003-2004 time frame at prices between ~$11.50 and ~$23. Since then, there has only been minor activity. Last four quarters saw a ~6% trimming. The stock currently trades at ~$145.

Note: Baron Capital owns ~11% of Vail Resorts.

Gartner Inc.: IT is a top-three 3.78% of the portfolio position first purchased in 2007 at prices between ~$16 and ~$28. The next three years saw consistent buying as the original position was increased by ~50% at prices between ~$9 and ~$28. The 2014-2015 time frame saw a ~22% reduction at prices between ~$66 and ~$93. Since then, the stake has been relatively steady. Recent activity follows: last four quarters saw a ~7% trimming at prices between ~$126 and ~$171. The stock currently trades at $83.24.

Note: Baron Capital owns ~7.2% of Gartner Inc.

Idexx Labs: IDXX is a top-five 3.76% of the portfolio first purchased in 2005. The next three years saw a large stake build-up at prices between ~$15 and ~$30. Since then, the position has remained relatively steady although adjustments were made every quarter. Last four quarters have seen a ~7% trimming. The stock currently trades at ~$183.

Arch Capital Group: ACGL is a top-five 3.60% of the portfolio stake first purchased in 2007 at prices between ~$7 and ~$8.25. The position remained relatively steady over the next three years. 2011 saw a ~17% stake increase at prices between ~$9.50 and ~$12.50 and that was followed with a similar increase in 2018 at prices between ~$25.50 and ~$31. Last four quarters saw a ~5% trimming. The stock is now at ~$26.

Note: Baron Capital owns ~5.4% of Arch Capital Group.

FactSet Research (FDS): FDS is a 2.92% long-term stake first purchased in 2006. The next two years saw a 4.7M share stake built at prices between $34 and $69. The position has since been reduced through minor selling almost every quarter. The position is now at ~2.85M shares and the stock is at ~$218. They are harvesting gains.

Note: Baron Capital owns ~7.5% of FactSet Research.

Guidewire Software (GWRE): The original 2.67% GWRE position was purchased in the 2012-2013 time frame at prices between ~$20 and ~$49. Guidewire had an IPO in January 2012. 2017 also saw a ~25% stake increase at prices between ~$51 and ~$83. Last four quarters have seen minor trimming. The stock currently trades at ~$82.

Note: Baron Capital owns ~7.7% of Guidewire Software.

Tesla (TSLA): TSLA was a minutely small stake first purchased in 2012. The current position was built from 2014 at an average cost of ~$220 per share. Last four quarters saw minor trimming. The stock currently trades at ~$428.

Note: Ron Baron has indicated that he is extremely bullish on Tesla and had held through the parabolic recent rise in the stock price.

Ansys Inc. (ANSS): The bulk of the 2.47% ANSS position was purchased at prices between ~$20 and ~$43 in 2009. The position was increased by ~15% over the next two years but was reduced since. The four years through 2018 saw a ~25% selling at prices between ~$143 and ~$190. Last four quarters have seen only minor adjustments. The stock currently trades at ~$213.

MSCI Inc. (MSCI): MSCI is a 2.17% of the portfolio position established in 2007. Next year saw the stake built to a ~9.9M share position at prices between ~$12.50 and ~$36. The 2012-2014 time frame saw the stake reduced by ~75% at prices between ~$26 and ~$50. Since then, the position has remained relatively steady. Last four quarters saw marginal trimming. The stock currently trades at ~$243.

Choice Hotels (CHH): CHH was already a huge 19.4M share position in its first 13F filing in Q1 1999. That original stake was reduced by ~90% to a ~1.9M share stake by 2004 at prices between ~$3 and $22. 2007 saw a ~70% stake increase at prices between ~$26.50 and ~$34. Since then the position was relatively steady till 2014. The last five years have seen minor trimming most quarters - overall, there was a ~15% selling during that period at prices between ~$42 and ~$105. The stock currently trades at $57.67.

Note: Baron Capital owns ~8.4% of Choice Hotels.

Bright Horizons Family Solutions (BFAM): The 1.66% BFAM stake was established in 2013 at prices between ~$28 and ~$38. BFAM had an IPO in Jan 2013 and shares started trading at ~$28 per share. The position has seen consistent selling over the last five years. The stake was reduced by ~50% over that period at prices between ~$46.50 and ~$165. The stock currently trades at ~$84.

Note: Baron Capital owns ~5% of Bright Horizons Family Solutions.

Mettler-Toledo International (MTD): MTD is a 1.55% of the portfolio position established in 2008 at prices between ~$68 and ~$110. Next year saw a ~150% stake increase at prices between ~$47 and ~$100. Since 2009, the position has seen consistent selling - ~80% reduction over the last decade at prices between ~$100 and ~$860. The stock is now at ~$645. They are harvesting long-term gains.

Gaming & Leisure Properties (GLPI): The 1.52% GLPI stake was established in 2013 as a result of its spin-off from Penn National Gaming. 2016 saw the stake increased by ~30% at prices between ~$25.50 and ~$36 while next year saw a similar reduction at prices between ~$30 and ~$39. Last four quarters have also seen a ~10% trimming. The stock currently trades at $19.13.

Marriott Vacations Worldwide (VAC): VAC is a ~1.5% portfolio position. A minutely small stake was purchased in 2012 and the following two years saw the stake built to a ~2M share position at prices between ~$42 and ~$75. 2018 also saw a ~50% increase at prices between ~$62.50 and ~$152. The stock is now at $48.81.

Note: Baron Capital owns ~7.2% of Marriott Vacations Worldwide.

SS&C Technologies (SSNC), Bio-Techne Corp (TECH), Primerica Inc. (PRI), and Charles Schwab (SCHW): These small (less than ~1.5% of the portfolio each) positions saw reductions during the quarter.

Note: Baron Capital owns ~5.7% of Primerica.

SBA Communications (SBAC), Douglas Emmett Inc. (DEI), Manchester United (MANU), Penn National Gaming (PENN), Trex Co Inc. (TREX), Verisk Analytics (VRSK), Red Rock Resorts (RRR), West Pharma (WST), Wix.com (WIX), Morningstar Inc. (MORN), Cohen & Steers Inc. (CNS), SiteOne Landscape Supply (SITE), Equinix Inc. (EQIX), and The Trade Desk (TTD): These very small (less than ~1% of the portfolio each) stakes were reduced this quarter.

Note: Baron Capital owns ~31% of Manchester United, ~14% of Red Rock Resorts, ~8.1% of Penn National Gaming, and ~5.4% of Cohen & Steers Inc.

Kept Steady

None.

Note: Although the positions as a percentage of the portfolio are very small, Baron Capital has significant ownership stakes in the following businesses: ~8.8% of ChaSerg Technology Acquisition (CTAC), ~6.9% of Endava plc (DAVA), ~5.6% of Repay Holdings (RPAY), ~4.8% of Altair Engineering (ALTR), ~11.4% of Benefitfocus Inc. (BNFT), ~5.6% of Installed Building Products (IBP), ~7.6% of Hudson Ltd (HUD), and ~13.2% of BRP Group (BRP).

The spreadsheet below highlights changes to Karr's US stock holdings in Q4 2019: