One of the greatest yield-offering opportunities today is Tanger Factory Outlet Centers (NYSE:SKT). After a slide in the share price over the past year, but with the distribution having been raised yet again for the current fiscal year, the REIT's yield today stands at 20.5%. Such a high level is often a sign of trouble ahead for unitholders. After all, what must transpire eventually is either a resurgence in the share price or a cut to the distribution as a changing reality for the firm sets in. Often, what comes to pass is the latter. In Tanger's case, though, the picture may very well be the former. In its 2020 guidance, released when the company reported 2019's financial results in late January, the REIT made clear some very big troubles it is facing, but when you drill down and look at its cash flow, you come to realize that the business is still stable… for now.

An ugly transition

Source: Tanger Outlet

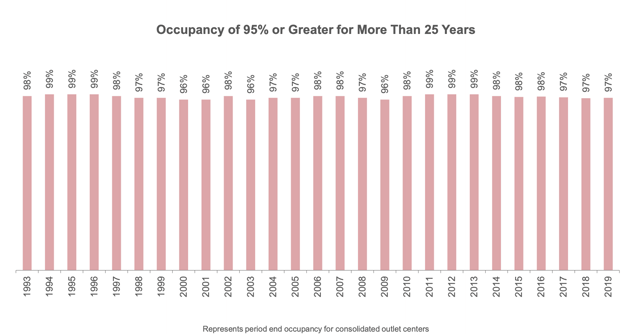

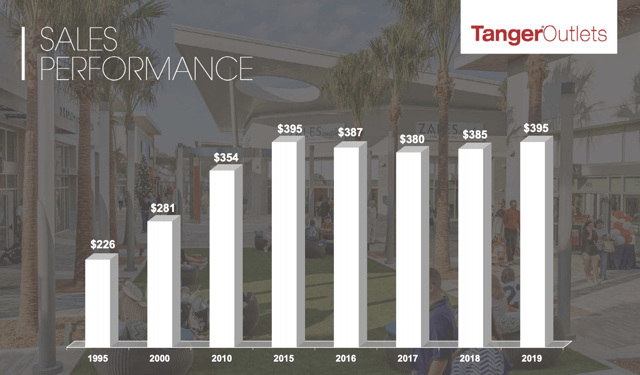

Tanger has a long history of boasting strong financial results. To see this, we need to only consider the image above. In it, you can see the high occupancy rates the business has been able to maintain over the years. Last year, for instance, occupancy ended at a robust 97%. In the image below, you can also see another encouraging metric boasted by the firm: tenant sales per square foot. In 2019, tenants at the REIT's properties generated sales per square foot of $395. This was up $10 from the $385 per square foot seen in 2018.

Source: Tanger Outlet

Looking solely at these results, you might think everything is great for Tanger, but that would be where you're wrong. As part of the retail space crumble, management has done well to ensure that the firm's exposure was limited. But any firm inexorably

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!