The question everyone is asking, of course, is whether this financial stimulus by the Federal Reserve will really be enough to jump-start the economy and end what has been a "Black Swan" event in most commodities and financial markets. The fiscal stimulus has been weakening the dollar this week and supporting commodities such as gold (GLD), but I think at these prices, chasing the gold market higher when central banks and investors may have to sell gold to raise cash, could be a mistake.

I first warned about the portending doom, some 3 weeks ago when the DOW as trading over 26,000 and commodities such as crude oil (UCO), were close to $40 a barrel.

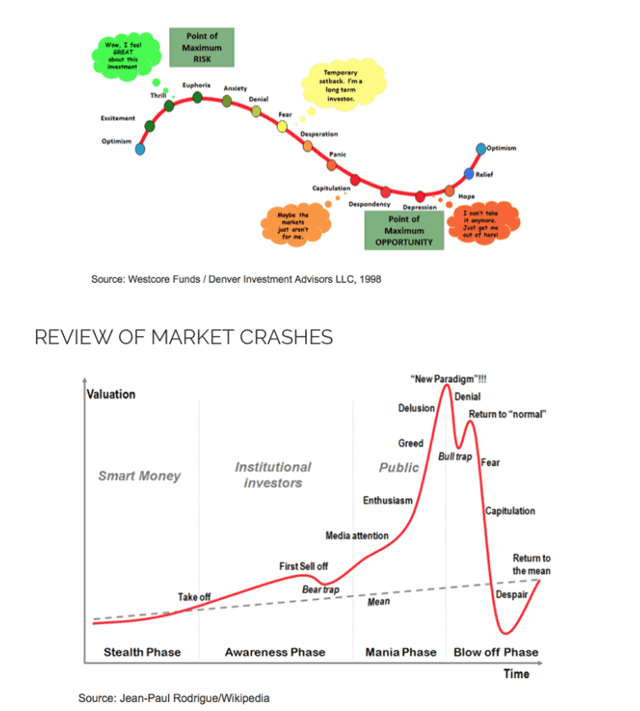

I posted this chart about the psychology of market "bubbles" and that we were not even close yet to the "fear" stage. Since them, most markets have collapsed some 20% or more.

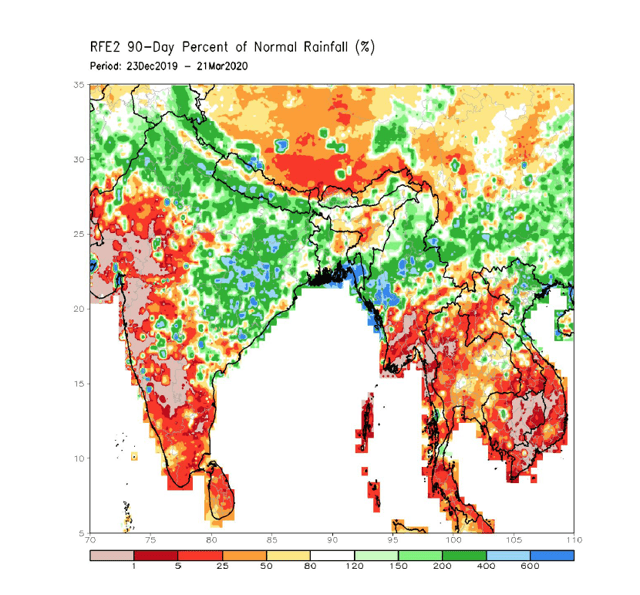

With respect to weather and commodities. There are two markets that have been affected, not only by transportation difficulties in South America and pent up strong demand are soybeans (SOYB) and coffee (JO) but by weather problems.

For coffee, a developing drought in Vietnam could lower 2020 Robusta coffee production, while Brazil coffee areas have seen major weather extremes from drought to floods. A recent post of mine on Seeking Alpha, recommended buying the coffee ETF JO more than a month ago. Prices have rallied about 20% since then.

Source: NOAA. Rainfall % last 90 days 5-10% of normal in Vietnam

Source: NOAA. Rainfall % last 90 days 5-10% of normal in Vietnam

Soybean prices have rallied back smartly due to the following reasons:

- Logistical problems create bean export issues in South America. For example, at the Port of Santos, Brazil, union workers were supposed to vote to strike, or not.

- Seasonal factors – soybeans tend to trend higher into April.

- Big short position in