The coronavirus outbreak and the effects of COVID-19 have gone deeper and wider than most people would have expected. That applies just as much to markets as anywhere. Whether it's a tech sector that is supporting our new work from home or re-rating as expensive EV/Sales multiples make less sense; a healthcare industry under the spotlight to find a vaccine, a cure, or provide treatment to patients; or various parts of the financial sector that have shown acute strain as the economy goes into the freezer for a few weeks, at least, there are no real safe havens or quiet zones.

While this week has seen the markets generally recover, there have still been acute areas of concern. REITs are today's topic, and they're taking heat from various sides. The mortgage REIT market appeared to seize up in the first half of the week, beleaguered mall REITs faced clients who decided to stop paying, and all the while VNQ outperformed the SPY for the first four days of the week, closing some of the bear market gap.

What's going on here? We ask some of our most read Marketplace authors on the category for their take. Our panel includes:

- Rida Morwa, author of High Dividend Opportunities

- Dane Bowler, author of Retirement Income Solutions

- Julian Lin, author of Best of Breed

- Jussi Askola, author of High Yield Landlord

- Colorado Wealth Management Fund, author of The REIT Forum

- Brad Thomas, author of iREIT on Alpha

These questions went out Wednesday morning, and answers came back in Wednesday or Thursday. Disclosures are at the end of the article, and Seeking Alpha questions are listed in the header font.

Using VNQ as the starting point, REITs have taken a harder hit than the S&P 500 as a whole. What do you make of the reaction in the sector so far, what's driving this underperformance?

Rida Morwa, author of High Dividend Opportunities: Equity REITs, those that own and lease properties, have been hit by the fear that their tenants will be unable to pay full rent in the coming months. There is a significant amount of uncertainty in regard to whether rent will be paid on time, whether insurance companies will provide business interruption coverage, and most importantly - how long it will be before things return to normal. Mortgage REITs have been hit substantially by the volatility in the credit markets. Some mREITs reporting that they cannot cover their margin calls adds to the fear and uncertainty. Note that this selling is not due to the fundamentals of the mortgage business, rather we have seen broad selling across all bond markets, and the MBS market does not have the liquidity to support it.

Dane Bowler, author of Retirement Income Solutions: REITs are often more volatile than the broader market in terms of pricing. There is a bit less institutional price support which makes them more susceptible to panic selling. I would note, however, that this volatility does not necessarily translate to REIT fundamentals. Many REITs have layers of protection that could cause their revenue and earnings volatility to be lower than that of S&P companies.

Julian Lin, author of Best of Breed: Wall Street appears to be worried about a repeat of the 2008-2009 financial crisis. Aside from the stock price action, however, REITs are dramatically different now. It's night and day.

Jussi Askola, author of High Yield Landlord: Historically, REITs have provided better downside protection than the S&P 500 during most recessions. However, what is unique about this market crash is that it was caused by a global health concern. People are forced to stay at home, and the market quickly turned that into a highly pessimistic scenario for real estate.

If people are just sitting at home, we don't need hotels, malls, and offices, right? The market fears that this crisis will lead to lease defaults, unpaid rents, rising vacancy rates, and ultimately, lower cash flow and property values. We think that there is some truth to that, but the fears are greatly overblown. Most importantly, this is a temporary crisis. Most tenants will continue to pay their rent in full and on time. And when they are unable to do so, REITs will find flexible solutions with their tenants to avoid vacancies. As an example, landlords may allow tenants to defer rent payments by 3 months in exchange of a lease extension from 6 years to 10 years. In the end, REITs may even benefit from such transactions because they are in the position of power.

Colorado Wealth Management Fund, author of The REIT Forum: Several types of REITs can be heavily exposed to recessions. Investors need to evaluate which subsectors they are willing to invest in. Hotel REITs clearly have high exposure to recessions, but many healthcare REITs were also particularly exposed because of their reliance on skilled nursing facilities.

In this particular case, we're seeing an additional negative impact from the "stay at home" orders. For any REIT owning retail property or "experience-based" properties, this is a major headwind for their tenant. We have to ask what types of REITs are still providing services that can be used without the consumer leaving their home. The answers are:

- Data centers

- Cell Towers

- Industrial (shipping your online purchases)

- Housing

Due to the wave in unemployment, housing still took a pretty big hit. How can investors mitigate the damage? Focus on REITs with stronger balance sheets and great management. Chasing high dividend yields is a recipe for failure. Focus on quality first. It has to come before yield, and many investors refuse to consider that. A long-running example is SUI and ELS vs. UMH.

SUI and ELS are two excellent manufactured housing park REITs. UMH is an over-leveraged lump of poor-quality properties with too much ownership of the mobile homes. Investors don't want to own the mobile home, they only want to own the land.

The physical structure declines in value. By failing to recognize that, investors regularly overvalue UMH's FFO per share. We measured returns over the last 3 years (ending 3/26/2020), SUI delivered 53.84%. ELS delivered 46.46%. UMH delivered negative 13.17%. That includes dividends. UMH was a sucker yield and people fell for it.

Brad Thomas, author of iREIT on Alpha: First off, remember that VNQ is made up of over 150 companies (mostly REITs) and is market cap weighted. VNQ also has 11.4% retail exposure, 9.1% office exposure, 3.4% hotel exposure, and 9.7% healthcare exposure. Collectively, these sectors account for around 35% of VNQ's business model, and these sectors are also some of the hardest hit categories related to the coronavirus. Within the top 10 list, VNQ has exposure to Simon (NYSE:SPG) and Welltower (WELL).

In other words, VNQ is now under more pressure with its retail exposure, because shoppers are avoiding brick-and-mortar stores and restaurants right now and the healthcare, specifically senior housing operators, are challenged with admitting new customers.

The good thing about VNQ is that there is diversity, and the adage, "you get the good, the bad, and the ugly". However, we believe that investors would be better served to cherry pick the property sectors that are less challenged.

It's true that REIT yields are much more attractive than they have been for a long time, but investors need to be cognizant of the danger of dividend cuts and/or suspensions. As I remind my friends, it's now is a great time to be a REIT portfolio manager.

There's been a lot of credit instability over the past few weeks, and REITs by nature have leveraged balance sheets. What do you make of the financial market volatility specifically, and how it affects the REITs you follow?

Rida Morwa: For eREITs, we do not see real significant risks. REITs are substantially less leveraged than they were in 2008, and it has become far more commonplace for REITs to carry revolving lines of credit with large enough availability to refinance debt maturities for 1-2 years. We will see some REITs cut dividends in order to preserve excess liquidity. For REITs with less flexibility, we might see deals made with their lenders to waive covenants. Physical real estate holds significant value and is highly favored as collateral. It is that strength that prevented most REITs from going bankrupt in 2009, and that hasn't changed.

Dane Bowler: This is where company-specific analysis is crucial. REITs that are close to covenants or have significant maturities in the near term may experience some difficulty renegotiating the covenants or rolling debt. Those with stronger balance sheets and less near-term maturities are better positioned to weather the downturn. These statements are rather obvious, I just wanted to emphasize the importance of looking at specific companies rather than taking a categorical approach.

Julian Lin: Just as banks were required to de-risk their balance sheets with higher CET1 ratios, REITs have also dramatically changed their balance sheets through credit facilities, which help to provide short term liquidity. REITs have far less danger of failing to meet debt maturities than is being implied in their stock prices. The market is expecting a wave of REIT bankruptcies and/or secondary offerings. Reality should be far different than in 2008-2009.

Jussi Askola: Right now, leverage is at an all-time low in the REIT sector. Moreover, most REITs have well-staggered balance sheets with limited, if any, maturities in 2020.

Therefore, we do not expect widespread issues on this front, but as in any other sector, you need to be selective. We favor companies with ample liquidity to face the crisis. As an example, one of our favorite picks is EPR Properties (EPR). It is priced for a high risk of bankruptcy. In reality, it has $1.25 billion in cash, which is very significant for a company with a $1.6 billion market cap. They could skip all rent payments in 2020 and 2021 and still survive. Ultimately, this is a temporary crisis and therefore, we are not too concerned.

Colorado Wealth Management Fund: We can break REITs down into 3 major categories here:

- Equity REITs with strong balance sheets

- Equity REITs with weak balance sheets

- Mortgage REITs

The first batch is perfectly positioned to get through this. These are the equity REITs we like to spend our time on. The second batch is positioned for pain. They can get through for the moment, but they need the economic environment to improve so they can refinance their debts. The third group is the most interesting right now. One of the major mortgage REIT ETFs, MORT was down 66% year-to-date as of 3/24/2020. That is a staggering decline.

However, it has also roared back over the last 2 days. What happened? Banks were aggressively marking down the value of collateral and pushing mortgage REITs to sell positions. The consequence of so many sellers was a decline in the market price for those assets. That resulted in another wave of markdowns on collateral. That's the general situation we've seen for the mortgage REITs. However, the Federal Reserve announced a plan to buy an unlimited amount of agency MBS. That's precisely what the REITs needed. Perhaps one of the most interesting impacts was the preferred shares. The preferred shares take seniority over the common shares. Many of these mortgage REITs are likely to return to trading in the mid to low $20s. As of 3/26/2020, 4 of our 8 mortgage REIT preferred shares with a risk rating of 1 are already trading over $20 again.

Brad Thomas: First off, remember that most REIT balance sheets are already well positioned to support their business models, and they have the lowest leverage metrics in more than 20 years. For example, the aggregate debt/EBITDA ratio across all equity REITs was 5.7x in 2019, compared to 7x to 8x in 2007-2008 (according to Nareit).

While no one could have predicted the coronavirus pandemic, lower leverage is especially critical during these times, and that's why we are only recommending REITs with the best leverage metrics at this time.

REITs also have prepared themselves for economic uncertainty by building up cash and maintaining substantial unused lines of credit. According to Nareit, REITs have over $28 billion in cash and nearly $120 billion in untapped lines of credit.

Some of the strongest REITs, like Ventas (VTR), have drawn down their revolving credit facilities due to uncertainty (VTR drew down $2.7 billion). We expect to see more REITs take similar cautionary steps to manage through the next weeks and months.

Furthermore, we are already seeing some of the "weak knees" buckling as REITs like Whitestone (WSR) and City Office (CIO) have cut their dividend. Most all Lodging REITs have suspended dividends, and we expect to see more cuts soon in the retail, gaming, and net lease REIT sectors.

Given the onset of the bear market and that volatility, are you making any adjustments to what sort of REITs do you want in your portfolio?

Rida Morwa: We are prioritizing eREITs with significant cash on hand, taking advantage and buying some REITs in the triple-net sector at multi-decade discounts, buying preferred equity, and mREITs that primarily hold agency MBS.

Dane Bowler: There are plenty of freshly created opportunities as the selloff was rather indiscriminate. Some strong companies have been sold to oblivion along with the weaker companies. In particular, we like the triple net REITs which now have very high cash flow yields. We were already underweight hotels going into the crash, but have sold that position fully to zero. Beyond the unprecedentedly low demand in the near term, hotel REITs have industry structure issues that will plague profitability for the foreseeable future.

Jussi Askola: In today's environment, we put most of our capital to work in REITs with:

- Fortress balance sheets.

- Recession-Proof Properties.

- Ample liquidity to survive an extended crisis.

- Enormous margin of safety in their valuation.

- And >8% dividend yield to pay us while we wait.

Our favorite sectors include: residential (everyone needs shelter), healthcare (essential to fight the pandemic), net lease (long leases provide protection) and specialty (unaffected demand). Many of these REITs should not have dropped nearly as much as they did, but as capital was pulled out of ETFs and Index Funds, they suffered indiscriminate selling. We are now loading up on them at High Yield Landlord.

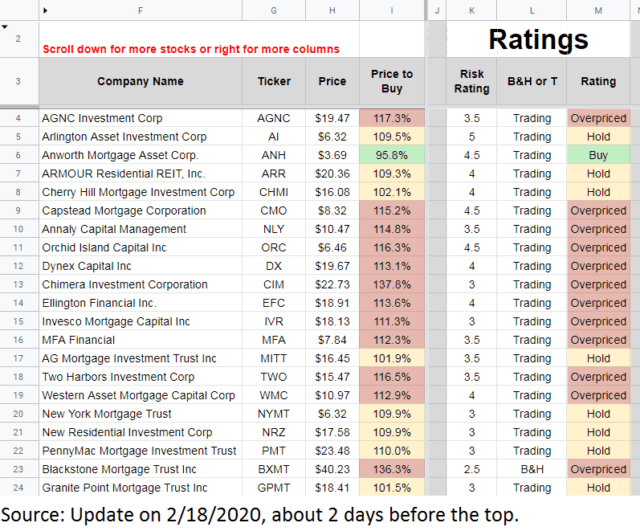

Colorado Wealth Management Fund: We warned investors that mortgage REITs were overvalued back on 2/18/2020. That's a couple of days before the top was hit. We used the following image to demonstrate the high valuations:

What's the most common word you see on that image? Overpriced. More than half of our ratings were bearish.

So, how are we adjusting? Well, with the massive decline in prices we were buying shares. We picked up a few positions in the common shares and some huge allocations to the preferred shares. The preferred shares offer us strong dividend yields and the dividends are cumulative. So long as we're picking mortgage REITs that can withstand this environment, we're in a good position. So far, that's been working very well for us.

We're also monitoring prices for "relative valuations". The idea is pretty simple. Market prices are set by supply and demand. Occasionally, we see demand surge higher in one particular preferred share, or we see too much supply coming to the market in another share.

Shares of TWO-A (TWO.PA) have a higher coupon rate, but they also had a lower price. The combination gave us a significantly higher yield for the same credit risk.

- On our 347 shares of TWO-A, we have a projected annual income of $704.8438.

- On our 346 shares of TWO-B (TWO.PB), we had a projected annual income of $659.5625.

Note: Two Harbors temporarily suspended their dividends as they transition from a non-agency mortgage REIT into an agency mortgage REIT. We are comfortable with the decision.

Brad Thomas: Absolutely. We have totally recalibrated our portfolios by focusing on quality names. It's very clear that all REITs have become "cheap" and we believe that it's now more important than ever to be laser-focused on "quality".

Black swan events, which are defined as rare and unexpected events with severe consequences, have come and gone throughout history.

These declines can be severe, but most have been short-lived as markets typically return to previous peak levels in no more than a couple of "months". The key word here is "months".

Nobody knows the extent time (for recovery) of the economic disruption related to the coronavirus, and while the President hopes for an Easter recovery, I am much less optimistic, and I tend to think it could be late summer.

My biggest concern is the potential devastation for many businesses and consumers. The longer it takes to restart the economy, the greater potential for corporate and personal bankruptcies.

While many have used the words "retail apocalypse" in the past to describe the impacts related to Amazon (AMZN) and e-commerce, my fear is that the coronavirus could in fact become the "tipping point" to accelerate a complete disruption to retail brick-and-mortar.

This is why we have become extremely more bearish, anticipating a wave of mall closures that could accelerate the rationalization of the mall sector.

We are already seeing an increase in loan defaults and if schools are not open in August, retailers, restaurants, hotels, and other experiential-related businesses will be forced to close and/or seek bankruptcy protection.

As REIT analysts, we have become more fixated on the property sectors that are most defensive, and the REITs that are offer the best risk-adjusted returns. It's important to recognize that not all REITs are the same, and while there is a tremendous opportunity to mine for gold in this chaos, investors should be cautious and focus on the highest quality REITs.

At iREIT, we believe the best way to do that is to analyze each company from the top-down. This allows us to model the impacts in order to determine the structural demand, which is a solid underpinning for fundamentals.

That volatility appears especially acute in the mortgage REIT (mREIT) sector. What do you see happening there, and how are you dealing with it?

Rida Morwa: We focus on the preferred shares, which get priority for dividends and are cumulative. So, even those that suspend now, they will resume payments and make up missed payments. The non-agency sector is being driven by lower prices, not from underlying defaults in the loans. Funds sell off at any price, triggering margin calls, which causes more forced selling at any price. Until there is some certainty as to whether or not lenders will provide the forbearance needed to stop forced sales, the common equity of non-agency and commercial REITs should be avoided. REITs that buy mostly agency MBS are a fantastic opportunity as the Federal Reserve is buying agency MBS, ensuring that prices stay high and there is ample liquidity. Agency mREITs are one of the best buys in the market right now.

Dane Bowler: We are sticking with equity REITs as mortgage REITs could be facing significant hardship. mREITs are generally higher leverage and their hedging is somewhat unreliable. One can hedge against parallel shifts in the yield curve quite effectively, but trying to anticipate and hedge for the twists, inversions, un-inversions and rapid fluctuations that have occurred lately is essentially impossible. When it comes to agency mREITs, prepayment rates have been quite high, which is causing their assets bought at premiums to par to be redeemed at par. We think the agency mREITs will live through this environment, but book values will likely be diminished.

Jussi Askola: Mortgage REITs are suffering an existential crisis. They produced very disappointing returns over the past cycle, and the recent market sell-off exposed some concerning flaws in their business model. Most importantly, their businesses are too dependent on interest rates, their direction and their spreads - which are very difficult to predict.

Earlier this year, we warned investors against Mortgage REITs in an article entitled: "The Dark Side of Mortgage REITs". There are a few opportunities, but we are staying away from most of these companies.

Colorado Wealth Management Fund: We need to identify three kinds of mortgage REITs - Agency, Hybrid (agency and non-agency), and Commercial Lending.

Agency mortgage REITs saw a huge INCREASE in their projected earnings per dollar of book value. That's right, an INCREASE. Why were shares selling off? Because book value was plunging. Why plunging? Agency RMBS prices were falling at the same time that Treasury prices were increasing. The mREIT lost on asset value and lost on hedges. What changed? The Federal Reserve stepped in to buy agency MBS. Over the last 4 days, from the morning of 3/23/2020 through 3/26/2020, agency MBS prices roared higher. Meanwhile, Treasury prices declined. The agency mortgage REITs saw a resurgence in book value this week. That resurgence is ending stupid myths about the sector being dead.

Hybrid mortgage REITs fell harder. For the hybrid mortgage REITs, it was generally the exposure to non-agency MBS and non-qualifying mortgages. The banks were pushing for negative marks to market. More sales meant lower prices and the cycle continued. Consequently, you may have heard about the mortgage REITs facing margin calls. Some are already suing the banks, and we think (not a lawyer) they have a strong case. The fair value of those positions isn't determined by the bid in a single day.

To be clear, it wasn't foreclosures. It wasn't projected foreclosures. It was the banks pushing for sales and creating a surge of supply while the lack of financing for buyers was holding back demand. Commercial mortgage REITs face the hardest challenge. Falling short-term rates hurt their gross interest income, and their loans are more exposed to impairments. Preferred Shares just went on sale. We've been buying preferred shares. Locking in high yields and big discounts.

Brad Thomas: We cover the commercial mREIT sector and we have avoided the residential sector due to the excessive risks. A few days ago we upgraded Ladder Capital (LADR) to a Strong Buy (sub $4.00 per share) and then days later shares jumped to $7.14 (+130%). That's one example of the volatility that we're seeing in the marketplace.

We are only focusing on quality REITs, that includes commercial mREITs, that are best prepared during times like these. Having access to capital is key, and it's important that the landlord/lender is in a strong financial position. Again, quality will win the race and "this too will pass".

What would need to happen in the mortgage REIT space for things to 'unstick' and for REIT investors to make it through whole?

Rida Morwa: Non-agency mREITs need the forced selling of loans and MBS to slow down. Non-agency is a fairly illiquid market, so large mutual funds being forced to sell at any cost easily floods the market. The best result would be that lenders provide forbearance for a period of time. If that happens, we will see MBS prices recover. This is a liquidity issue, not a quality issue. Defaults remain quite low and these securities are still producing great cash flow. The mREITs attempting to negotiate forbearance are no doubt promising to pass along most of that cash flow to pay down the borrowings and deleverage. If those negotiations fail, we will see more forced selling as the lenders dump the collateral, which will make prices even lower, causing more margin calls, and more forced selling. In that scenario, we see many bankruptcies in the space. The survivors will be those with the largest agency MBS portfolios as they can choose to either dump their non-agency portfolios or sell agency MBS to meet margin calls.

Colorado Wealth Management Fund: From the night of 3/24/2020 through the close on 3/26/2020, one of the mortgage REIT ETFs rallied 50.25%. The shorts are getting murdered on these positions. They bet on mortgage REIT bankruptcy, but they are getting their own instead. Remarkably, we still have a great deal of rally left in the tank. Mortgage REITs are still trading at low price-to-book ratios. Good preferred shares still carry yields in the mid to high teens. There was an amazing lack of common sense as herd mentality took over.

The WSJ reports: RBC (RY) seized client assets and attempted to unload them Wednesday. Beware paywall. The bank wanted to unload them the same day. AG Mortgage (MITT) was among the victims. MITT promptly sued RBC. They should've announced it themselves, since Bloomberg was running the story. MITT would like to block the sale since an immediate sale for hundreds of millions in non-liquid assets would create rock-bottom prices. Many other banks have agreed not to pursue remedies against the mREITs.

The bar for victory isn't very high. They only need to delay a sale so they can avoid those rock-bottom prices. Anything more than that is gravy. We've already contacted MITT to encourage them to have an immediate press release when the decision is made, to avoid having material information hidden behind a Bloomberg paywall.

The liquidity issues and the recession are the more near-term challenges for the sector. Looking to some post-lockdown/suppression state, do you think there will be any changes to customer/economic behavior that will affect REITs on a permanent basis? For example, the idea that work from home will hurt office REITs?

Rida Morwa: The idea of "working from home" has been one that has been slowly creeping up in our culture. It has been a headwind to the valuation of office REITs for some time. While popular among employees, it isn't always effective for a business, and businesses that have been contemplating the idea are getting a first-hand look at not only the benefits, but the problems. Humans, by nature, are social creatures. That isn't going to change because we reduce our interaction for a period of time. We know that social isolation increases depression and can actually lead to long-term physical and mental health issues. If anything, after not being able to interact in public spaces, once reopened we think people will frequent such places more. It is one thing to not go to a movie because you don't feel like it, it is another thing to know you can't go even if you want to. People with "cabin fever" setting in will go out just for the sake on not being at home.

Dane Bowler: In many cases, the behavioral changes have offsetting forces, and it is difficult to determine which will win. Regarding restaurants, I can see an argument for people getting more used to preparing meals at home and market share shifting toward grocery stores, but there is also a valid argument for pent up demand being unleashed. After weeks or even months cooped up in their homes, people may want to get out and socialize with their dining. Similar offsetting forces are true for casinos, theaters, and other experiential real estate. The threat to office is real, however, as some businesses will realize how much money they can save by downsizing office space. I would anticipate office, which is already oversupplied, to be a struggling real estate sector for the foreseeable future.

Julian Lin: The stock prices are implying that office tenants will move operations to work from home, and that consumers will never buy items in store again. I view both these narratives as plain false, but unfortunately, this will only be vindicated in time when the coronavirus subsides. The extreme pessimism breeds opportunity. Investors should use common sense and avoid acting on emotion.

Jussi Askola: We do not think that there will be material permanent changes to how we behave. Many people are now saying that people will reduce their social activities forever. We don't think that this is how human nature works. Sure, people will be a bit more reluctant at first to go to public places, but they will quickly forget about it and return to living their normal lives. No one enjoys spending 24/7 inside their homes.

Colorado Wealth Management Fund: We covered this idea extensively in a discussing of which REITs perform best against COVID-19. Our top four sectors for surviving COVID-19 are data centers, cell towers, industrial REITs and housing REITs. Fifth would be net lease REITs due to long lease terms. We see more negative impacts on hotels, malls, strip centers, offices, and healthcare (mainly nursing facilities).

Brad Thomas: For sure, as I alluded to previously, the "experiential" REITs will suffer longer if the recovery lingers. Conversely, we see demand for the increased use of electronic communications as millions of households and businesses avoid face-to-face interaction. This will benefit cell tower REITs like American Tower (AMT) and Crown Castle (CCI), as well as data center REITs like CyrusOne (CONE) and Digital Realty (DLR).

Darren Hardy said that "choices are at the root of every one of your results. Each choice starts a behavior that over time becomes a habit." I think that most of us will change certain habits over the next few weeks. I know I have.

Instead of going to my local gym every day, I now walk laps around my local Target store. I plan to cancel my membership at the gym and I may never renew it. That's one example, and I think there will be millions of people changing habits as a result of social distancing.

How are you trying to value REITs at this stage, and what are you looking at for long-term multiples? Do they change as compared to where we were on January 1st?

Rida Morwa: Over the very long term, multiples are fairly stable. There is absolutely no reason to believe that has fundamentally changed. The only thing that has really changed is evaluating near-term challenges. Is a REIT in a strong enough financial position to manage their debt, avoid defaults, and avoid issuing equity until things return to normal? If they are, then any disruption in near-term revenues is irrelevant in the long-term. REITs that have to make deals with their creditors, or are forced to issue equity at such low prices will be hampered when the recovery starts. Those with significant liquidity, and who are buying back shares right now, will outperform.

Dane Bowler: This again requires bottom up analysis of specific REITs. Some REITs will maintain full cash flows while the FFO of others will drop. Our general process is to look at as much data as we can to get a sense for where stabilized FFO will be after this clears up. We like to buy REITs trading sufficiently far below where we think their value is that it leaves room for error given the higher margins of error in the unusual environment.

Julian Lin: Many REITs trade at bargain multiples - the key is identifying REITs with adequate liquidity to survive the coronavirus lockdown period. REITs with strong balance sheets are the most likely to deliver even multi-bagger returns from this point.

Jussi Askola: At High Yield Landlord, we like to say that we think like landlords, not traders. Therefore, we also value our REITs as a landlord would value a rental property. We try to estimate the cash flow generation potential over the coming decades and then determine what it is worth.

When you do this exercise, you find a lot of deeply discounted opportunities because the market is excessively focused on short term results.

Colorado Wealth Management Fund: Eventually, we should see multiples expand again as we are an in era of low interest rates. Unless rates increase materially within the next few years, we should see those REIT multiples expand as the credit market improves.

In the near term, for equity REITs, we're focusing only on high-quality REITs with strong balance sheets. That means you won't see us grasping for yield. It's a bad strategy, and it leads to long-term underperformance. We've consistently seen that for equity REITs the single most important factor is quality. Growth dramatically beats current yield. It isn't even remotely close. So, we are looking at REITs with a great underlying business and a rock-solid balance sheet. If recession turns into depression, we want to be ready.

For mortgage REITs, we're using price to book value. We have Scott Kennedy running book value estimates frequently. Some of those estimates are as frequent as once per week. You won't find that anywhere else. That's part of how we stay ahead of the sector. By finding those estimated book values before the market, we can have better estimates on price-to-book value. Some investors still think book value doesn't matter. The recent rally should quiet that notion. The moment concerns about banks stealing their assets die down, the conversation returns to book value. It isn't a matter of dividend yields, despite investors believing otherwise. For high yields, see the preferred shares. The common shares are made for trading against investors who think you can't trade them. It's like sitting down to play poker against someone who thinks two pair beats a flush. Those players will get an expensive lesson.

Brad Thomas: We went through our entire REIT Lab to stress test based upon leverage metrics, liquidity, rent coverage, dividend safety, insider ownership, and tenant risk. Then, we looked at all of the property sectors in order to determine the underlying risks related to the coronavirus disruption.

We also modeled the cash flows for a number of high-profile REITs in order to determine whether or not the dividend was at higher risk. Finally, we assigned new Fair Value targets for each REIT in order for us to determine the risk-reward profile.

While this was somewhat time consuming, we believe that it serves investors well. We also updated our REIT ETF portfolios, MLP portfolios, and preferred database.

To put it in simple terms, it's a new paradigm, and recalibration is critical to managing risk.

Any REITs or stories you like at this point or are watching closely for potential investment opportunities?

Rida Morwa: mREITs that focus on agency MBS are the best buy in the market. They have been the babies thrown out with the bathwater, and with the Federal Reserve willing and able to support the market indefinitely, REITs like NASDAQ:AGNC will be raising their dividends and will be flush with cash.

Dane Bowler: There are dozens of REITs that look attractive right now, but for brevity I will just touch on 2 areas of opportunity. Dislocated preferreds: GNL preferreds, AFINP, FPI.PB, GMRE.PA and UMH preferreds have all fallen far more than is warranted. Each has stable underlying companies and we anticipate full recovery to par resulting in healthy IRRs. Uniti Group (UNIT) has made great progress in forming a deal with Windstream, and this progress has gone largely unnoticed by the market with all attention absorbed by the pandemic.

Julian Lin: I continue to remain bullish on mall REITs including Simon Property Group (SPG) and Macerich (MAC). Both trade at valuations suggesting bankruptcy. I have highlighted two other REIT opportunities for subscribers in other sectors. This is the time for active management: many REITs appear to be offering multi-bagger return potential from current levels.

Jussi Askola: We are currently investing in several Residential REITs because everybody needs shelter. Rentals are not immune to the crisis because it will delay move-ins, increase unpaid rents, and decelerate NOI growth; but to the most part, the cash flow should remain intact and growth should reaccelerate in 2021.

One of our favorite picks in this space is American Campus Realty (ACC). ACC is a legitimate blue-chip REIT with a fortress balance sheet, plenty of liquidity to face the crisis, a BBB stable investment grade rating and a track record of superior shareholder alignment. As an example, it is one of the few companies to not have cut its dividend during the 2008-2009 crisis.

ACC will take a hit in 2020 as many universities send students back home for the spring semester, but this is only a temporary bump for the company. Things will return to normal by next year, and ACC is one of the most defensive REIT investments to hold in anticipation of a recession. This is because students will go study either way.

So, clearly, ACC is not in deep trouble. Yet, because the market is failing to see the bigger picture, ACC has now dropped by over 50%, putting its share price at just half of its estimated NAV. In other words, if you wanted to buy similar assets in the private market, you would be paying the double for each dollar of NOI. On top of getting a deep discount to fair value, you get professional management, diversification and liquidity for free.

The 8% dividend yield is safely covered with a 76% payout ratio and as the panic eventually goes away, we expect ~100% upside as the company reprices itself closer to where it was just 30 days ago. We own a small position right now, and as new capital comes in, our intention is to build ACC into a Top 5 position in our Core Portfolio.

Colorado Wealth Management Fund: Sure. Calling it out here may destroy the opportunity though. Annaly Capital Management (NYSE:NLY) runs a portfolio that is mostly agency MBS. They should recover to trade near book value and they've already moved dramatically closer to book value. While book value should be lower in Q1 2020, that doesn't hurt the preferred shares. They have 4 series of preferred shares, but we want to focus one:

NLY-I (NLY.PI) trades at $19.50 and has an 8.71% stripped yield. NLY can't reduce or delay the dividend unless they drop the common dividend to zero. That hasn't happened yet. For Q1 2020, NLY declared their regular common stock dividend of $.25 per share. If the preferred dividend were suspended, it is still cumulative. So, it would need to be repaid in full before a single penny went to common shareholders.

Shares have call protection through 6/30/2024. After that, they switch over to a floating rate of 4.99% plus the short-term rates. That's a pretty solid deal when you're able to buy shares for less than $20. Since you're getting 1.25x as many shares, you're not just getting the 4.99% plus short-term rates. Within a year it wouldn't be surprising if NLY-I traded back up near $25.00 again. For most of the time since shares were introduced, they traded above $25.00. The recent panic gave investors a nice bargain.

There are several other preferred shares we cover with moderately higher risk, but exceptionally high yields. We expect many of these to recover over the next year, in many cases it may be within the next month.

Brad Thomas: Our story has never changed. We focus on (1) quality and (2) value. By screening for the highest quality REITs, we believe that investors will be rewarded in the long-term. As you know, I have lived through multiple recessions and it's because of my "extreme conservatism" that I have been able to invest wisely and make prudent recommendations.

I'm staying in close contact with many REIT management teams right now and paying very close attention to the news. Every stock is seemingly cheap right now, but at iREIT on Alpha, we are laser-focused on the cash the business will generate and on its balance sheet as opposed to the opinions of other investors in the market. As Benjamin Graham said, "Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end, we could count great compensations."

***

Thanks to our panelists for joining us. We hope you find it helpful as you review your REIT holdings.

We're continuing our corona-focused discussions next week with a look at the travel sector. We also plan to cover the healthcare sector, bonds/fixed income, the macro outlook, and the market specific outlook. Any other suggested topics? Please let us know. Have a great weekend and stay safe!