These are the closed-end funds that I purchased when we hit the initial 10% correction territory. We have gone down further since. However, I believe these are still attractive names to be holding.

Co-produced by Stanford Chemist

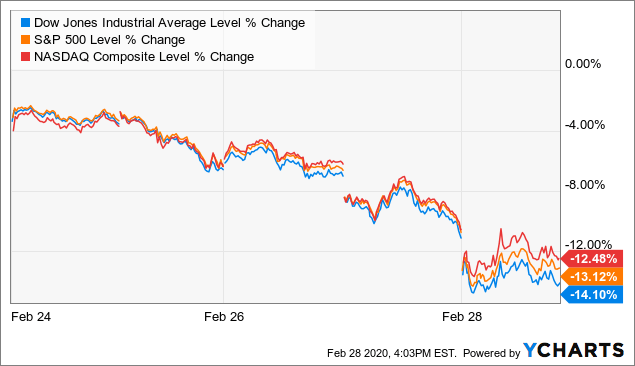

It certainly has been a wild week for the market. We have now entered into correction territory at the fastest pace in history. This was on the back of what the Coronavirus could do to the global economy. On top of that good news, we have also experienced the worst week since the 2008 GFC. Certainly, that is not what most individuals want to hear. We aren't even done with Q1 of 2020. This was also preceded by what seemed like progress in January for the U.S.-China trade negotiations. The focus of the two governments is, rightfully so, not on such subject matter for the moment.

I'm not sure when such volatility will be over or when the bottom will be in. However, as a long-term focused investor, I'm not particularly worried either. This tumultuous fallout in the market has provided an opportunity to pick up shares of some of the most solid CEFs around. It may take 3 months, 6 months or maybe a year before the latest debacle is sorted out or we stop hearing about it. Though, in the grand scheme of things, it most certainly isn't likely to end the long-term trend of continued increasing investment values over time. It also isn't likely that we see CEFs not continue to provide income through a diversified portfolio.

What does a correction or bear market in 2020 really mean to an investor like me? An investor that is looking for income and long-term total return? When we have 5, 10, or 20 years+ to invest? There are even those investors that are looking only to pass on

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!