That which is common to the greatest number has the least care bestowed upon it, everybody is more inclined to neglect the duty which he expects another to fulfill.”

- Aristotle, Politics

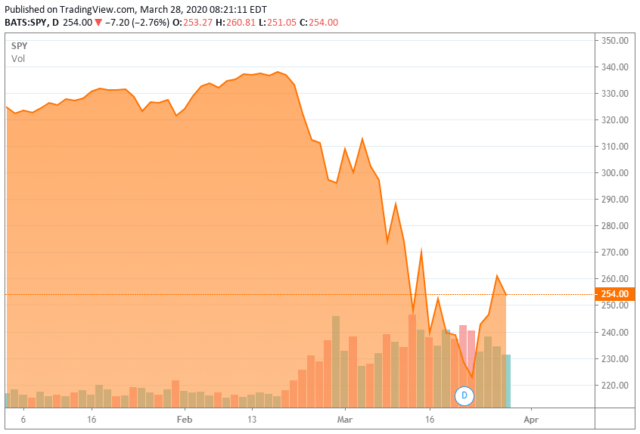

Markets stabilized somewhat last week after a month of Wuhan coronavirus or Covid-19-triggered meltdown. A historic over-$2 trillion stimulus package was signed on Friday. It contains its fair share of waste, pet projects that have nothing to do with the virus, poorly thought-out initiatives with their share of "moral hazards", but will also get lots of money to impacted individuals and businesses in the weeks and months ahead. It is probably not the last of such legislative support.

I still say when all is said and done, the Covid-19 death toll in the States will be somewhere between the approximately 12,500 Americans that died of the Swine Flu of 2009/2010 and the roughly 80,000 that perished during the very bad flu season of 2018.

And no, I am not saying Covid-19 is like the flu. It is much more lethal, and we do not have a vaccination for it yet. And left to its own devices, it could well kill hundreds of thousands in the nation. However, given the unprecedented local, state, and Federal responses, that is very unlikely. It is certainly also not the "Black Death" that many in the media have sensationalized it to be.

I came into the meltdown with nearly a third of my personal portfolio in cash. Not because I anticipated the impacts of Covid-19. The S&P 500 rose nearly 30% in 2019 on no earnings growth and felt at least somewhat overbought. I expected some sort of pullback in the first half of 2020, but not like this, in all honesty.

I have put most of that cash to work during this

Live Chat on The Biotech Forum has been dominated by discussion of these type of buy-write opportunities over the past several trading sessions. To see what I and the other season biotech investors are targeting as trading ideas real-time, join us on Live Chat and become a member of the Biotech Forum by clicking HERE.