Originally published March 26, 2020

I want to begin by saying that, despite the disquieting events of the past three weeks, the structure of municipal bond ETFs, which have proven to be both efficient and effective in the delivery of tax-free income, remains intact. Up to this point, neither process nor credit quality is, at least for now, inhibiting the free flow of normalized activity that underpins this market. It is, rather, a temporary "freeze-out" experienced by banks and traders, unable to source more capital to provide the liquidity to meet the massive flows in the short end of the marketplace.

Over the prior several trading days, dealers found their balance sheets frozen by an overwhelming supply of new positions, coming from various portfolios in need of cash to meet redemptions. Further, the unwinding of certain short-term vehicles known as variable rate demand notes (VRDNs), which are used to provide leverage in closed-end fund portfolios, caused short rates to move ever higher (as high as 7-8%) to attract buyers. Now, with significant governmental intervention, a decided thaw has emerged.

The U.S. Federal Reserve (Fed) announced this past Friday that they would make a variety of asset purchases to inject liquidity into all marketplaces. The news included comments that they were planning to buy highly rated, short-term municipals, including VRDNs. This has helped lead us to a resumption of more normalized market activity in the last 24-48 hours.

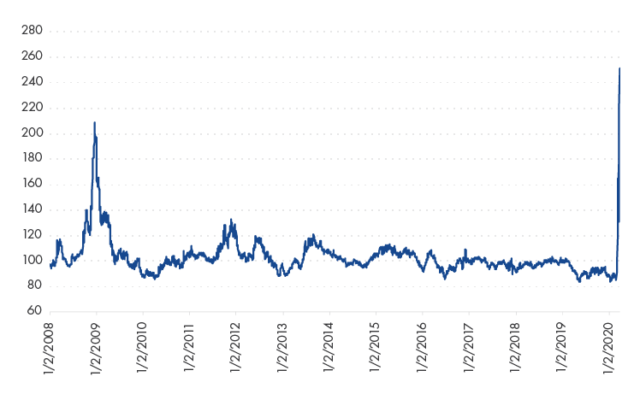

Amazingly, since the beginning of March, the municipal yield curve has seen a shift of some 150 basis points-to higher yields. With that, we are seeing far more interesting points of entry back into municipals. We are also seeing relative value measures with, for example, muni to treasury ratios far above 100%, a signal not seen in several years. This is already bringing in crossover buying support, such as insurance companies, banks and hedge funds to tax exempt products.

30-Year Muni/U.S. Treasury Ratio

Source: J.P. Morgan.

What Do We Expect to Happen Next?

Because of the anticipated decline in economic activity due to the extraordinary efforts to contain the coronavirus, continued volatility should be expected. However, we also believe this will lead to significant opportunities to redeploy assets into the municipal market, in a manner not seen since 2009-2010.

DISCLOSURE

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

VanEck does not provide tax, legal or accounting advice. Investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service.

Please note this represents the views of the author and these views may change at any time and from time to time. MUNI NATION is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck. MUNI NATION is a trademark of Van Eck Associates Corporation.

Municipal bonds are subject to risks related to litigation, legislation, political change, conditions in underlying sectors or in local business communities and economies, bankruptcy or other changes in the issuer's financial condition, and/or the discontinuance of taxes supporting the project or assets or the inability to collect revenues for the project or from the assets. Bonds and bond funds will decrease in value as interest rates rise. Additional risks include credit, interest rate, call, reinvestment, tax, market and lease obligation risk. High-yield municipal bonds are subject to greater risk of loss of income and principal than higher-rated securities, and are likely to be more sensitive to adverse economic changes or individual municipal developments than those of higher-rated securities. Municipal bonds may be less liquid than taxable bonds.

The income generated from some types of municipal bonds may be subject to state and local taxes as well as to federal taxes on capital gains and may also be subject to alternative minimum tax.

Diversification does not assure a profit or protect against loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

IMPORTANT MUNI NATION® DISCLOSURE

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

VanEck does not provide tax, legal or accounting advice. Investors should discuss their individual circumstances with appropriate professionals before making any decisions. This information should not be construed as sales or marketing material or an offer or solicitation for the purchase or sale of any financial instrument, product or service.

Please note this represents the views of the author and these views may change at any time and from time to time. MUNI NATION is not intended to be a forecast of future events, a guarantee of future results or investment advice. Current market conditions may not continue. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck. MUNI NATION is a trademark of Van Eck Associates Corporation.

Municipal bonds are subject to risks related to litigation, legislation, political change, conditions in underlying sectors or in local business communities and economies, bankruptcy or other changes in the issuer's financial condition, and/or the discontinuance of taxes supporting the project or assets or the inability to collect revenues for the project or from the assets. Bonds and bond funds will decrease in value as interest rates rise. Additional risks include credit, interest rate, call, reinvestment, tax, market and lease obligation risk. High-yield municipal bonds are subject to greater risk of loss of income and principal than higher-rated securities, and are likely to be more sensitive to adverse economic changes or individual municipal developments than those of higher-rated securities. Municipal bonds may be less liquid than taxable bonds.

The income generated from some types of municipal bonds may be subject to state and local taxes as well as to federal taxes on capital gains and may also be subject to alternative minimum tax.

Diversification does not assure a profit or protect against loss.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a fund carefully before investing. To obtain a prospectus and summary prospectus, which contain this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.