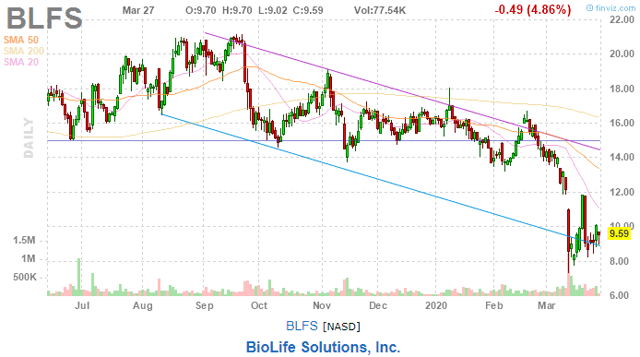

The shares of BioLife Solutions (NASDAQ:BLFS) have crashed with the market:

Since we are long in the shares of Biolife Solutions, it's worthwhile to start with our simple investment thesis which consists of the following elements:

- The market for gene and cell therapies is in the early innings

- The company is taking market share, raking in new customers

- As existing customers go through different regulatory phases, demand will automatically increase

- A big jump in customer revenue occurs when their therapy gets approval and goes from pre-commercial trials into commercial production

- The company is taking advantage of its favorable economics by acquiring adjacent companies, increasing the wallet share from customers and benefiting from revenue synergies

Here are some of the main conclusions from market research by Aritzon,

- Cell and gene therapies find their increased use in treating incurable disease conditions, providing safe and efficacious treatment compared to small molecule drugs and monoclonal antibodies. The market is likely to witness an absolute growth of around 270% during the forecast period.

- The increasing demand of cell and gene therapies for treating oncologic conditions like hematological malignancies and prostate cancer is expected to contribute to an incremental growth of close to $4billion during the forecast period.

- The market is expected to witness about 10-20 new product approvals every year till 2025.

- The US is the major revenue contributor as well as the fastest-growing region and is expected to post an absolute growth of 354% by 2024.

And here is the market today, from the earnings deck:

This gives us some idea of the market share that BioLife enjoys, as there are 1066 trials, and BioLife supplies to 400 of these, suggesting roughly a 40% market share (this is only a rough approximation as the size of the trials isn't considered).

In 2019, BioLife