Overview

Without any close competitor, DocuSign (NASDAQ:DOCU) is very well positioned to grow and maintain its share in the ~$50 billion TAM opportunity. To realize further growth opportunities, the company strategically broadened its vision by launching the Cloud Agreement software suite that covers the entire enterprise agreement lifecycle in the first half of 2019. Overall execution and the move towards the enterprise segment have been promising. In Q4 2020, revenue grew by a staggering 39% YoY, which was 200 bps higher than a year ago. Billings also grew by 40% YoY while the company generated positive cash flows. Driven by the company's market leadership, strategic M&As, and the addition of key hire Rob Giglio as CMO, we expect the company to gain more enterprise traction to sustain its solid growth and achieve its $1+ billion revenue target by the end of 2020.

Catalysts

eSignature makes up ~$25 billion of the $50 billion Cloud Agreement TAM, and DocuSign has been the market leader for some time. The name DocuSign itself has also become synonymous with eSignature. DocuSign is far ahead of the other well-known eSignature players such as Adobe Sign (ADBE) or Hellosign (DBX). In 2019, DocuSign recorded a revenue of $974 million, which is primarily driven by its eSignature solution.

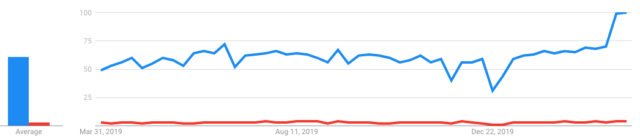

(Trends in DocuSign-blue vs. Hellosign-red as search terms. source: google trends)

The semi-monopoly position allows DocuSign to pursue various growth opportunities in the $50 billion underpenetrated markets. The company's 585,000 customers merely represent ~1% of the estimated enterprises and other DocuSign's target markets worldwide. As the company aims to achieve a $1 billion revenue target, the company will on board more enterprise clients, to which the Agreement Cloud is a huge value add. In that sense, the acquisition of SpringCM in 2018 was a pivotal move. SpringCM has enabled DocuSign to augment its eSignature product with the CLM (Contract Lifecycle Management) feature, which is