Introduction

Ok, you understand we've been in Neverland the last few years, don't you? A few years back we took a night flight with Peter and Wendy, and the whole gang of Lost Boys (naturally maintaining 6-feet of separation), and went to where fantasies bask in the morning sun, and Lollypops grow on trees.

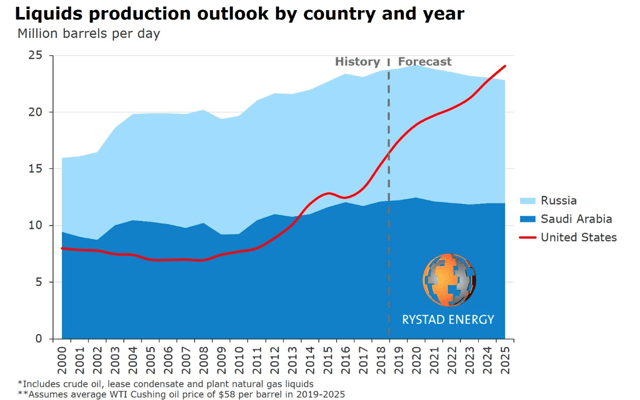

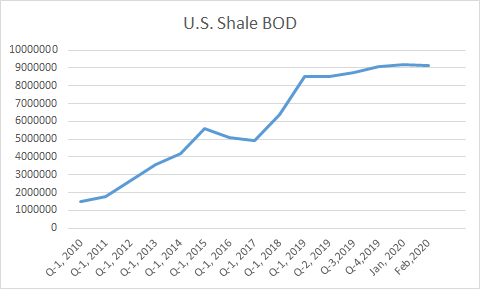

The fantasy to which I am referring was the one of ever-increasing shale production eclipsing the combined output of Saudi Arabia and Russia!

Come on. Seriously?

You can't blame Rystad for their ebullience on the production growth potential of the American shale industry. After having had a near death experience in 2016 as a result of an earlier Saudi tantrum, American shale had come roaring back as prices rose back into the $50's. By late-2016, technology and cracking down on their supply chain had made most shale production economic at half the previous cost of $90 bbl.

EIA, Chart by author

Rystad had plenty of companies with bullish forecasts. There were a lot of respected analysts tossing out similar drivel.

Of course we now know that the trip back from Neverland has hit some bumps. You know what they are so I will spare you a recap. If you're reading this article you are hoping for a reason to plunk down some cash in the hope of seeing a return when things get better.

In this article we will discuss why we think Baker Hughes (NASDAQ:BKR) is worthy of consideration in that scenario.

Baker Hughes

One of the key metrics we've been using to evaluate whether a company has the internal resources to make it to a better oil-price future without restructuring, is the balance sheet. Baker Hughes was recently singled out by a well-known analyst at J.P. Morgan for an upgrade due to