Annaly Capital (NYSE:NLY) has drawn a lot of attention lately as it is rare to see the best in the business (perhaps tied with AGNC) drop so far. NLY shares have dipped over 60% in just a few weeks. Dips of this magnitude can be partially caused by overselling or panic, but more often than not there is an underlying fundamental concern. We see 3 main concerns:

- Book Value

- Interest income

- Liquidity

We dig into each of these concerns to try to ascertain the fundamental outlook and conclude that it will be a bit rocky but Annaly will quite likely be fine in the long run. Due to the diminished earnings potential and weakened book value, we are neutral on the common shares. The preferred, however, looks very attractive.

Book value

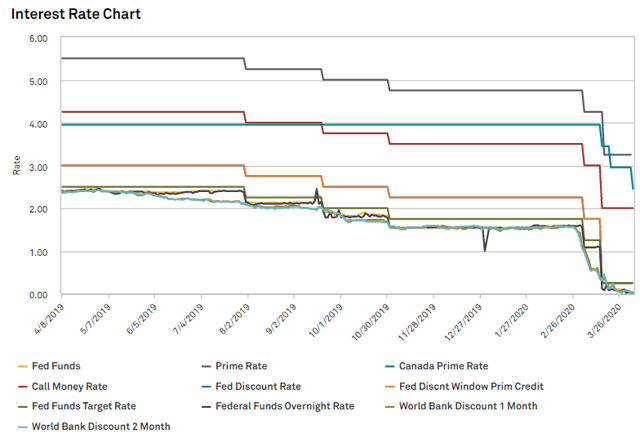

Book value is affected by a variety of things with some of the more volatile swings coming from mark to market of the securities and their hedges as related to changes in interest rates and spreads. As you know, interest rates have generally gone down recently due to cuts from central bankers of the world and the ensuing demand for “safe yield”.

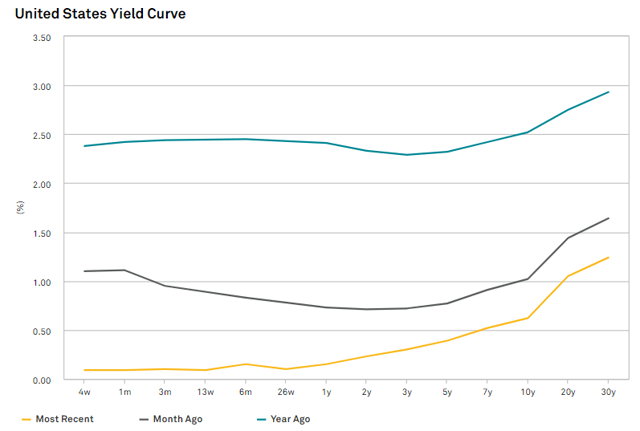

Since the Fed only controls the short end of the curve, the recent cuts have caused a healthy steepening as the short end dropped close to 0.

Note how the recent curve looks significantly healthier than the partial inversions of 1 month and 1 year ago.

As of the most recent quarter, Annaly’s book value had been rising to $9.66 from $9.21 in 3Q19. This was at least partially due to the interest rate dynamics discussed above.

However, the economic shutdown has done some wonky things in which spreads have blown out which in combination with higher CPR (prepayment rates) and/or defaults has significantly hurt book value.

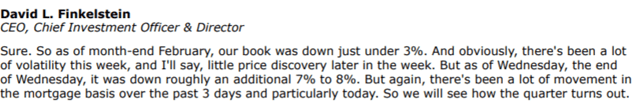

On March 16th, Annaly held an investor call in which their CEO gave some clarity on the book value.

So that is a 10-11% drop through the 11th followed by a hint at some volatility in the period between Wednesday the 11th and the time of the call on the 16th.

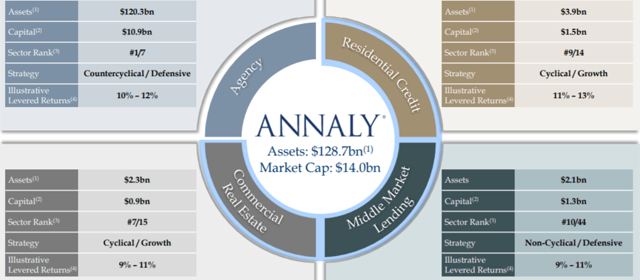

We anticipate book value roughly stabilizing at this lower level as the Fed has come in with potentially an additional $400B of purchases of agency MBS which will go a long way to stabilize prices. Theoretically, the Fed is not trying to bid up prices but rather will purchase as needed to keep a steady floor. As seen below, this is the overwhelming majority of Annaly’s business, so stable prices in agency securities goes a long way toward stabilizing NLY’s book value.

We see these declines as being somewhat harmful to common shares, but they are miles away from hurting preferred shareholders. Recall that book value is measure of GAAP common equity, so anything above $0 means the preferreds still have a book value of $25.

Getting close to $0 should and usually does make the market anxious about the preferreds, but Annaly is nowhere near 0 as GAAP book value is still around $12.2B adjusted for the data in the March 16th call.

Interest income

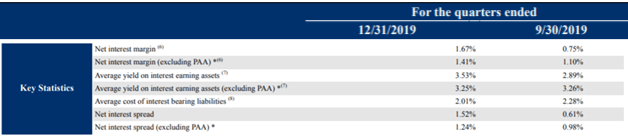

As of 12/31/20, interest income looked pretty good, coming in substantially higher than 9/30/19.

Source: Supplemental

Source: Supplemental

Many believe this has since declined due to elevated prepayments. Most agency securities are purchased at a premium to par and a prepayment causes redemption at par. Thus, the premium is lost. These are commonly bought at 102% to 104% of par so early redemptions from prepayment causes a loss of that 2 to 4 percent. This is then reduced from revenue, thereby hurting interest margin.

With the Fed Funds rate close to zero it is easy to imagine that some of the mortgages signed years ago are highly incented to refinance. Speculation can run wild that prepayment rates will go to crazy amounts like 40-60%, but I don’t see this as all that likely.

Frankly, there is not enough banking personnel to process that many refinances. A couple decades ago there were over 500,000 people employed in mortgage banking and that number is under 300,000 today. Add onto that the delays associated with social distancing and the pace of claims processing is significantly slowed.

In other words, CPR is likely to be high, but it is rangebound. Revenues will decline, but this is offset by lower cost of financing from the Fed cuts.

Overall, net interest margin or NIM will likely be lower but still significantly positive.

Liquidity

Liquidity has recently entered the scene as a concern. Ordinarily, given the extremely high credit of government backed assets, liquidity is ample. However, the sell everything mentality of the market has led market participants to sell whatever they could sell and since Agency MBS is so high credit, it was often the thing that could be sold.

As a result, spreads blew out in the sector and it became somewhat difficult to offload even Agency MBS. Add to this the fact that the repo market has been questionable and there is some potential for a liquidity crunch.

In my opinion, the risk of such a liquidity crunch has been significantly reduced by the Fed stepping in with unprecedented support.

In addition to buying agency securities directly, the Fed has pledged to inject liquidity wherever it is needed. Fed money has been supporting the repo markets for a while and Powell seems ready to provide unlimited capital to ensure liquidity. Thus, the outlook for the sector is still somewhat risky, but perhaps not as risky as it was a few weeks ago.

Annaly is better positioned than most.

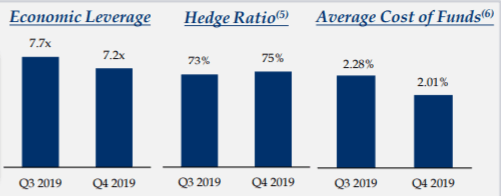

For one thing Agency MBS is substantially better positioned than non-agency. Further, Annaly has lower leverage than most of its peers

Source: NLY

Source: NLY

7.2X may seem blisteringly high for those of us used to equity REITs, but in the mortgage REIT sector this kind of leverage is typical. NLY’s peers are around 8X to 9X making NLY close to the most conservative balance sheet in the sector.

Overall, our base case is that Annaly is stable but its business is diminished in terms of both lower earnings and lower book value.

Preferred route

Investment in common shares is tied to how well Annaly does. In the long run, the common share price will reflect the fundamental value. In my opinion, the fundamental value is somewhat diminished from what it once was. It is likely a bit above current market pricing, but given the level of risk we do not see it being all that great from a reward/risk perspective.

The preferred is a bit different. It only cares about the fundamental outlook being above a certain line. Anything above mere stability is irrelevant to the value of the preferred because it is only worth a maximum of its liquidation preference ($25) plus dividends.

The sunshine and rainbows scenario is equivalent from the perspective of preferreds to the mildly diminished fundamentals scenario. In either case, the preferred is worth $25 plus dividends.

Given that we see it as highly likely that NLY will be somewhat weakened but very likely still in a stable position, the preferred is much better positioned than the common. The government backed nature of NLY’s core business somewhat caps the downside scenario and makes it quite unlikely that NLY would become unstable. This is a highly favorable outcome for the preferred as it is trading at a sizable discount to par.

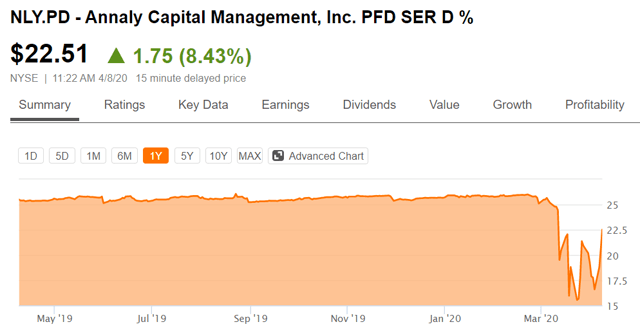

Source: SA

At $22.51 some of the rebound has already happened, but we still see a par from the company merely remaining stable. That is a low bar for a solid return.

Due to the stability inherent in agency backed securities, NLY’s preferred has consistently traded slightly above par, but in the recent market sell-off everything sold down. We think this might have been one of the babies thrown out with the bathwater.

For a full toolkit on building a growing stream of dividend income, please consider joining Retirement Income Solutions. As a member you will get:

- Access to Two Real Money REIT Portfolios

- Real-Time Trade Alerts

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Retirement Income Solutions, we don’t only share our ideas, we also discuss best trading practices and offer members a chance to participate and grow.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $240 before it expires!