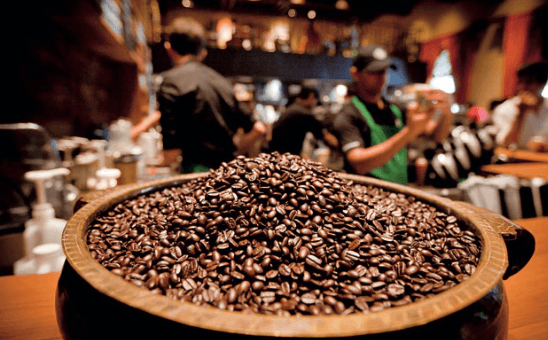

People are staying indoors. While this is not good news for the entire economy, these are trying times and putting an end to the spread of COVID-19 is the most important task at hand. The economy, however, will take a massive hit. Companies that depend on foot traffic to their stores to generate revenue, such as restaurant chains without any online presence or a delivery network, will see their sales falling off a cliff in the first half of this year. Some companies would be hit harder than others because of structural differences. Starbucks Corporation (NASDAQ:SBUX) would never have wanted to be in this situation. The global leader in specialty coffee, however, is in a strong position to weather the storm and deliver stellar returns to investors in the coming years. The company showed resilience during the financial crisis as well, which is an indication of what to expect in the next couple of years.

As far as I see, two important questions need to be answered to make a case for or against Starbucks.

- How did the company perform during the last recession? Will the performance be similar to or different from the previous instances?

- Jobless claims are surging. What would be the impact of an uptick in unemployment levels on Starbucks?

The subject of this analysis is to find reasonable answers to these questions in a bid to project where the share price would be in the next couple of years.

Lessons from the financial crisis

Billions of dollars were wiped off global equity markets when the housing bubble crashed in 2008. Many companies, especially banks, had to be bailed out by the government. Similar efforts are taken by the federal government to rescue sinking cruise lines and airline operators today.

Amid the chaos more than