Market Completes A 50% Retracement

"If you wonder why we're seeing such a HUGE divergence the past 3 weeks between the economy and where investor psychology has taken the market… just remember…it's all about the Fed.

Market psychology is having a 'V' shaped recovery from total panic while the economy still looks horrible. S&P futures implied volatility is down 50% from the 'max panic' level it hit mid-March.

Can the 'psychological rally' be sustained? Is this just a vicious 'Bear Market Rally?' Will the 'reality' of a devastated global economy pull the market back down? And if market price action shows us that investors are growing fearful again will the Fed just throw up their hands and say, 'Sorry, we gave it our best shot and that's all we could do?' I don't think so. In for a penny…in for a pound." - Victor Adair, PI Financial

Victor is correct.

As I noted in Friday's MacroView:

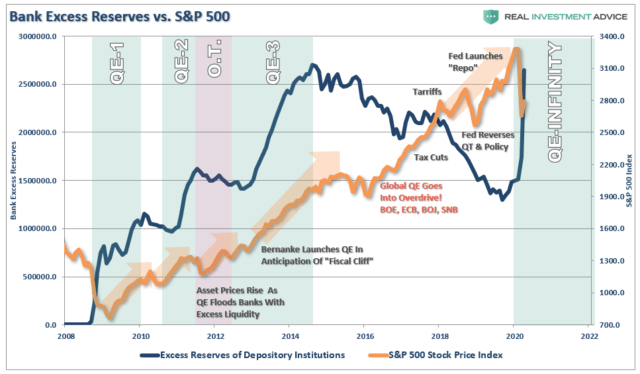

"In the short term, the Fed is massively increasing the liquidity of banks (excess reserves) through the various 'QE' facilities to stave off a second 'financial crisis.' Given the banks do NOT want to loan out any funds not guaranteed by the Federal Reserve, the excess liquidity flows into asset markets."

Not surprisingly, as discussed previously:

"From a purely technical basis, the extreme downside extension, and potential selling exhaustion, has set the markets up for a fairly strong reflexive bounce. This is where fun with math comes in.

As shown in the chart below, after a 35% decline in the markets from the previous highs, a rally to the 38.2% Fibonacci retracement would encompass a 20% advance.

Such an advance will 'lure' investors back into the market, thinking the 'bear market' is over."

Over the last couple of weeks, we have indeed had