Since I started helping mutual fund and hedge fund investors pick stocks in the 1990s, I've experienced seismic-level shocks, such as 9/11 and the Great Recession, and smaller, yet still meaningful, dislocations, including Long-Term Capital Management's failure and the Internet Bust.

The current COVID-19 is a similarly heart-stopping crisis. It took just 16 days to enter bear-market territory - twice as fast as it took during the Great Depression or in 1987, when the bear market decline included the biggest single-day drop on record, an over 20% one-day drop on October 19, 1987.

The rapid decline has many saying COVID-19 is unlike anything investors have ever encountered. It's true investors haven't navigated a pandemic of this size in a lifetime, but "this time is different" is a common refrain during periods of market crisis. Like in the past, focusing too much on the singular difference of any particular cause of a bear market drop is likely less useful than remembering emotional reactions rhyme, regardless of the catalyst. It's investor sentiment that drives capitulation and eventually, a recovery.

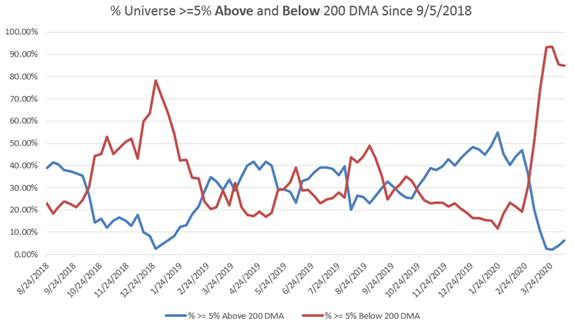

Back in late January, we highlighted how unbridled optimism had lifted our overbought oversold indicator to frothy levels warranting caution. Following the drop, this indicator recorded an extremely oversold reading in mid-March. Today, it remains deeply oversold with only 6.2% of our 1,500 stock universe trading 5% or more above its 200-day moving average (DMA). Readings can remain at or near extreme readings for weeks, but this measure still says risk/reward favors long-term buyers, rather than sellers.

Source: Top Stocks For Tomorrow.

Undeniably, the current market is scary. Bear market relief rallies often generate 20% plus returns before stalling, so the possibility of a retest because of looming economic contraction this time around shouldn't be ignored. That's a big reason why we

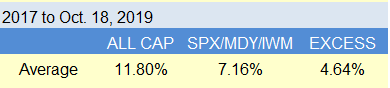

Never miss a money-making idea. Weekly large cap, mid cap, small cap and ADR rankings. Know what sectors, industries, and stocks to buy and when to buy them. Over 400 bps of excess return in the following 52 weeks since 2017. Free trial, special introductory pricing, and you can cancel anytime. Join the conversation. Sign up for Top Stocks For Tomorrow.