Workiva (NYSE:WK) stock price has fallen roughly 48% from its 52-week high, mostly due to multiple adjustments from the recent market turmoil. Despite the big drop in share price, I believe that Workiva has a strong track record with growing brand name and switching costs. At $32.33, it is undervalued by roughly 24% based on my base-case assumptions.

(Source: Google)

Workiva has grown steadily in recent years

Revenue for Workiva has grown from $53M in 2012 to $298M in 2019, compounding at 25% year on year. Throughout the same period, gross margins have expanded from 70% to 75%.

According to its S1, Workiva estimates its total addressable market at roughly $26.4B for America and Europe, which would have grown since 2014. Based on Workiva's recent 2019 revenue of $298M, it puts Workiva's market penetration at 1.1%. This shows that Workiva still has a long runway for growth to expand its market share with product innovations and customer acquisitions.

Workiva has a strong brand with switching costs

As of December 31, 2019, 3,510 organizations, including nearly 75% of Fortune 500® companies, subscribed to Workiva's platform. This shows that large companies trust Workiva to provide it with a reliable and connected reporting and compliance platform. Workiva provides a clear customer value proposition for these companies as many manual steps from their workflow are removed, thereby improving data integrity throughout the entire reporting process.

As large enterprise customers integrate their enterprise systems of record with our platform, it increases the switching costs for Workiva. Large enterprises also tend to have stronger inertia when it comes to switching platforms. Companies generally do not want to risk lost data and productivity which leads to business disruption. An imperfect data migration could lead to huge amounts of frustration and business risk that would cause any company to think twice about switching from Workiva.

There are also signs of network effects as the number of users grows within the organization. Workiva is also aware of this strength and is likely to concentrate on strengthening it to preserve its higher margins.

The Workiva platform can exhibit a powerful network effect within an enterprise, meaning that the usefulness of our platform attracts additional users. Since solution-based licensing offers our customers an unlimited number of seats for each solution purchased, we expect customers to add more seats over time. As more employees in an enterprise use our platform, additional opportunities for collaboration and automation drive demand among their colleagues for additional solutions. Furthermore, converting customer contracts to solution-based licensing typically generates a one-time increase in contract value for each solution.

(Source: Workiva latest 10K)

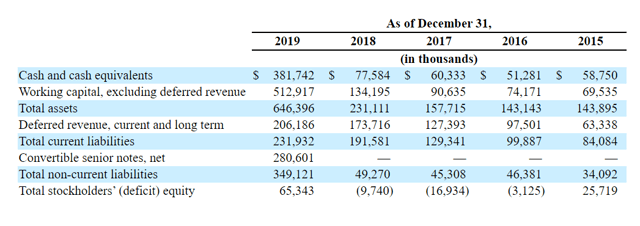

Workiva's balance sheet looks reasonable

To ensure that smaller companies like Workiva do not run into liquidity issues, one way to determine that is to monitor its cash and debt balances, as well as its cash burn rate.

Looking at its latest balance sheet, Workiva has $381M of cash with $280M of convertible senior notes. Since Workiva also had positive cash flow in 2019, this provides a large cushion for Workiva to invest in growth. It also helps Workiva tide through any operational difficulties in this volatile period.

(Source: Workiva latest 10K)

Investment risks

When the economy experiences a downturn, customers might cut back on non-essential services to conserve cash flow. If these businesses deem that Workiva is not crucial to their operations, it might lead to a larger-than-expected churn rate for Workiva.

According to Gartner, Workiva also faces competitors in this space that may lead to slower customer adoption on its platform. Some of these competitors such as Oracle (NYSE:ORCL) and Workday (NASDAQ:WDAY) are very large with resources to challenge Workiva directly. Workiva has to ensure that its platform continues to delight customers to gain market share and keep them from switching over to competitors.

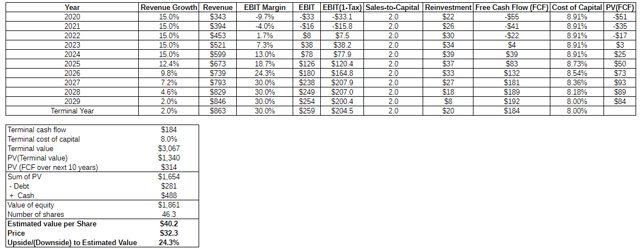

Workiva is undervalued based on my estimates

The key drivers for Workiva's valuation include the following:

- Revenue: I estimated that growth will be roughly 15% going forward for the next five years, then tapering off to 2% in the future. This growth rate assumption is mainly due to Workiva's positive track record of executing and achieving decent growth rates. However, my analysis of investment risks above shows that competition could be an issue that could cause growth to be negatively impacted if competitors are stronger than expected.

- Operating Margin: Workiva's gross margin has been high, at 75% in the most recent year. This gives it room to invest in growth and overhead such as sales and marketing. By being a company that deals with higher fixed costs, Workiva would be able to drive operating leverage once profitability and efficiency become a priority. However, higher-than-expected costs from challenging strong competitors could also put some downward pressure on margins

- Cost of Capital: On average, the cost of capital for U.S. companies is 6.9%. Being in a higher growth industry and losing money, investors should demand a higher cost of capital for taking on this increased risk. As such, I allocate roughly 9% of the cost of capital to Workiva for the initial years but tapering off to 8%. Once Workiva achieves profitability and higher free cash flows, the cost of capital should reflect the reduced risk.

(Source: Author creation using Workiva financials) (Figures are in $millions except per share data and percentages)

The value I derived for Workiva is roughly $1.8B for the entire company. This represents a 24% upside from its current price. As with all DCFs for high-growth companies, my point estimate valuation of $40 is likely to have a large spread of possible outcomes. To overcome this shortcoming, I compare its pricing multiples against other software companies.

| Companies | Price/Sales Ratio | EV/Sales Ratio | YOY Sales Growth (%) | Operating Margin (%) |

| Workiva | 5.3 | 4.8 | 21 | -15 |

| BlackLine (BL) | 10 | 9.7 | 26 | -9.7 |

Oracle | 4.16 | 4.7 | 1 | 35 |

Workday | 8.6 | 8.6 | 28 | -13.9 |

(Source: Author creation using data from Seeking Alpha)

Compared to other high-growth peers, Workiva looks fairly cheap in terms of price/sales and EV/sales ratios. Workiva is priced cheaper than BlackLine and Workday, which has roughly the lower growth profile and similar operating margins. Workiva is slightly more expensive than Oracle, but still growing at 20%, while Oracle is barely growing.

Takeaway

- Track record is positive: Workiva has steady growth over the years and has room to grow. Workiva's brand and switching costs help maintain its strong competitive position.

- Forward-looking data is positive: Based on my assumptions, Workiva is undervalued by 24%. Workiva's liquidity position is also strong enough to support growth and handle operational difficulties.

Potential investors have to decide if they believe Workiva will be able to execute according to my base-case assumptions in the long run. If competition turns out to be stronger than expected and pushes down future sales growth, the recent pullback might not make Workiva a definitive buy.