DISCLAIMER: This article is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this article is not an offer to sell or buy any securities. Nothing in it is intended to be investment advice and it should not be relied upon to make investment decisions. Cestrian Capital Research Inc or its employees or the author of this article or related persons may have a position in any investments mentioned in this article. Any opinions or probabilities expressed in this report are those of the author as of the article date of publication and are subject to change without notice.

Park Aerospace Refresher

We first covered Park Aerospace (NYSE:PKE) back in January. As a reminder, this is a small cap company (at the time of writing, market cap $272m, EV $114m) serving a handful of mid- and large-cap customers, among them Aerojet Rocketdyne (AJRD - $3bn EV) and Lockheed Martin (LMT - $113bn EV). PKE provides high-end materials used in aerospace, space and defense applications - for instance the materials used to construct hypersonic missile re-entry vehicles, or the materials used in rocket engine nozzles.

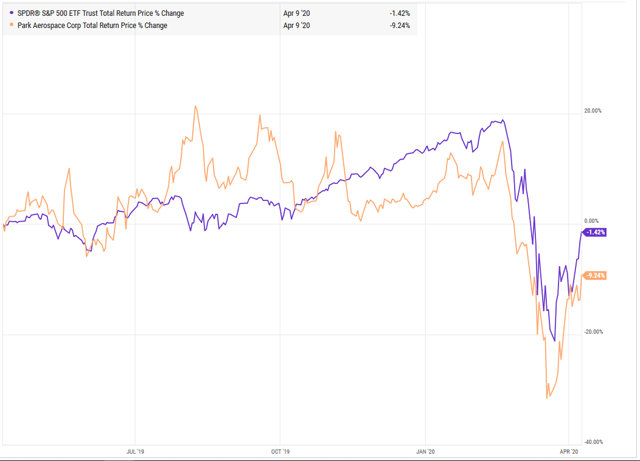

PKE has lagged the S&P500 on a total return basis over the last year. Rather surprisingly however, it has matched the market blow for blow during the recent descent into the abyss and rapid return.

Source: YCharts.com

This is where things get interesting, in our view. It's where real life meets Fedonomics.

No-One Thinks Equities Are Worth What They Were Worth in Q2 2019

Do they? Really?

Here's SPY over the last five years. You see two big corrections and rebounds, the Q4 2018 Taper Tantrum, and the Q1 / Q2 2020 Covid Correction. The former was not a real thing, it was just finance stuff. The second, that's a real thing. Like, big impact to Main St

Thanks for reading our note. If you enjoyed it, try our SA subscription service, The Fundamentals.

Here's what you get:

- Deep sector expertise in space, defense, technology and telecom.

- Pro-grade analysis, easy-to-understand presentation.

- 100% independent, clear and direct opinion of stocks' prospects.

- Long-term investment picks and short-term trading ideas.

- Absolute alignment with our own investing. We run a real-money service and alert you to every move we make in covered stocks. Any such trade we make, you get to trade first.

- Round-the-clock availability in our members' chatroom.

We speak directly to our companies, from CEO level down.

Click HERE to learn more!