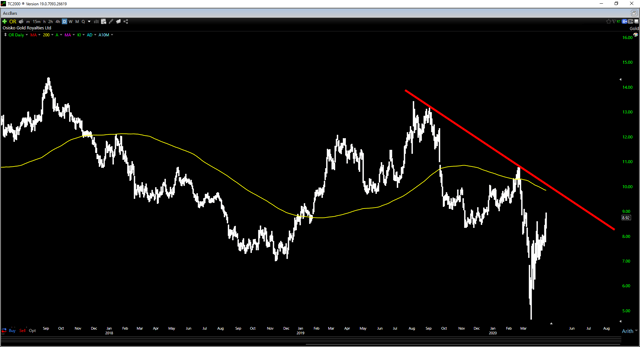

It’s been a strong start to April for the Gold Miners Index (GDX) as the Index has seen a miraculous recovery from its mid-March lows near $17.00. While a few of the leading names in the group are within a stone’s throw of new highs, others have seen 80% plus rallies off of their lows, but are still in the negative return column year-to-date. One of these companies is Osisko Gold Royalties (NYSE:OR), a niche royalty and streaming company that’s down 10% year-to-date despite its parabolic rise in the past few weeks. Unfortunately, while the stock’s recovery has been sharp, it has done nothing to fix the technical picture, as the stock is one of the few miners still below its 200-day moving average. Based on this, I believe investors looking to buy the stock would be wise to wait for a better entry point and not chase the stock above $8.80.

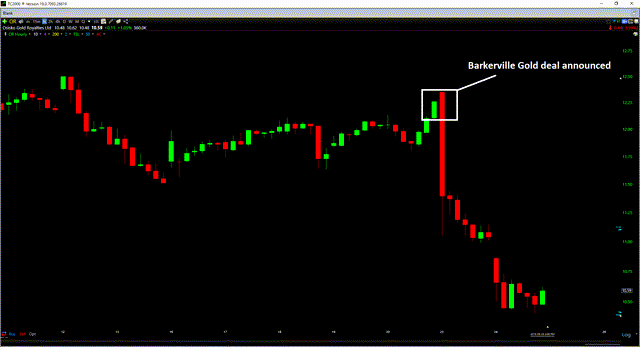

It was a busy last year for Osisko Gold Royalties (OR) as the company completed its offtake agreement for the Brucejack Mine with Pretium Resources (PVG), and announced the takeover of Barkerville Gold Mines in Q3, arguably the best acquisition from a price paid standpoint in FY-2019. For those unfamiliar with the deal, the company paid US$257 million to acquire Barkerville and its Cariboo Project in British Columbia, a deposit that boasts a resource of over 4 million ounces of high-grade gold. At a $1,500/oz gold price, the company paid less than 0.60x P/NAV for the project, given that the After-Tax NPV (5%) stands at US$441 million. Unfortunately, while this was an exceptional deal for Osisko, it deviated from the typical royalty/streaming model, and the market punished the stock.

Elsewhere in the company’s royalty portfolio, Victoria Gold’s Eagle Gold Mine is finally in production