Gildan Activewear (NYSE:GIL) looks like an attractive opportunity right now trading at 11.9x TTM P/E. The company has a nicely profitable operating history that allows it to pay a dividend currently yielding 3.9%, before adding additional average annual share repurchases of 1.9% over the past decade. A free cash flow analysis touched on later in this article indicates free cash flow yields around 7.1% at current prices.

Introduction to the Company

Gildan is a leading manufacturer of everyday basic apparel, including activewear, underwear, socks, hosiery, and legwear products sold in North America, Europe, Asia-Pacific, and Latin America. The company manufactures around 90% of the products it sells under its own brands, under licensing agreements (such as an exclusive deal to sell socks in the U.S. and Canada under the Under Armour brand name), as well as sales to leading global athletic and lifestyle companies that market these products under their own brands. Brands owned by Gildan include names such as Gildan, American Apparel (which it purchased the brand rights to for $88 million in 2017), Gold Toe, and Anvil.

Headquartered in Montreal, Canada, with 53,000 employees globally, Gildan operates through a vertically integrated supply chain, encompassing yarn production, textile and sock manufacturing, garment dyeing, and sewing operations. The company's manufacturing operations are located in Central America, the Caribbean Basin, North America, and Bangladesh.

Profitable and Growing

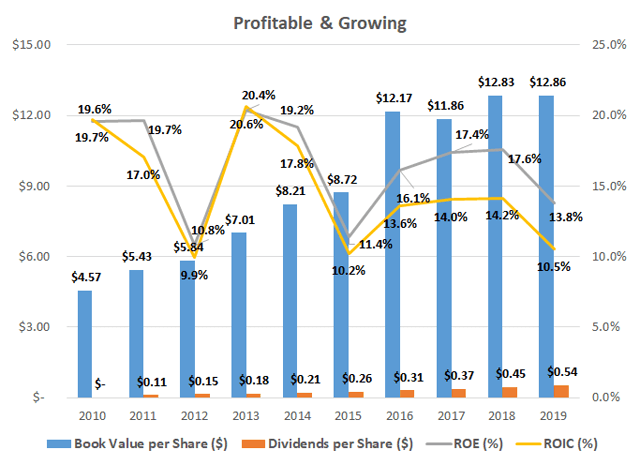

Gildan's vertically integrated global footprint have allowed it to achieve an average return on equity (ROE) and return on invested capital (ROIC) of 16.6% and 14.8%, respectively, over the past decade. While cyclical along with the competitive textile industry, this level of profitability is well above my rule of thumb of 15% ROE and 9% ROIC, allowing me to be confident that, in my opinion, the company is able to maintain and continue to increase its intrinsic value over a business cycle.

Source data from Morningstar

Nice Cash Flow Generation

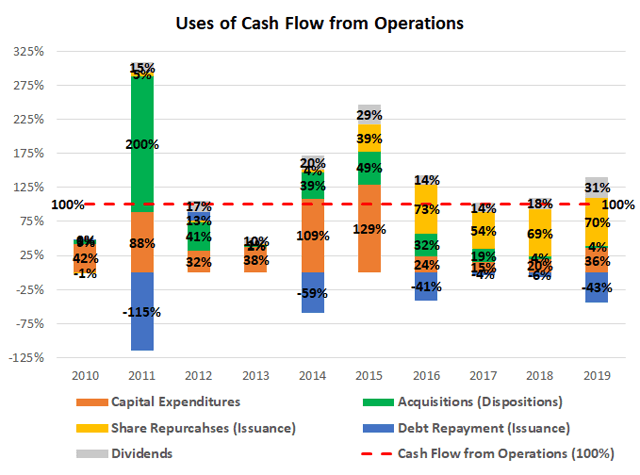

To get an idea of the sustainability of dividends and share repurchases, we can take a look at what percent of cash flow from operations is available to be returned to shareholders after making the necessary capital expenditures. As can be seen below, Gildan does a decent job of returning cash flow to shareholders in the form of dividends and share repurchases. With capital expenditures and acquisitions only taking up on average 53% of cash flow from operations over the past decade, this leaves approximately 47% to be returned to investors in the form of dividends and share repurchases. With average cash flow from operations of $454.1 million over the past five years, this 47% would imply free cash flow to shareholders of $212.0 million for around a 7.1% free cash flow yield at the current $3.0 billion market capitalization. For reference, the largest such acquisition over the past decade was in 2011, when Gildan purchased sock supplier Gold Toe Moretz for $350 million.

Source data from Morningstar

How About The Debt?

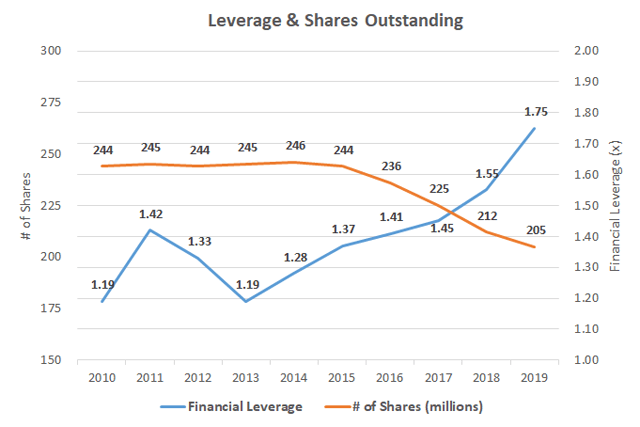

Financial leverage at Gildan has seen a notable rise since the beginning of the decade, with the company making a definitive change in capital structure. Financial leverage has moved from practically nil at 1.19x in 2010 to a still-low but relatively higher 1.75x in 2019. With this still conservative leverage ratio, Gildan's interest coverage ratio remains a healthy 8.8x in 2019. Over this time frame, the company has also repurchased 17.4% of its outstanding shares since 2010 for an average annual repurchase rate of 1.9%.

Source data from Morningstar

Price Ratios and Potential Returns

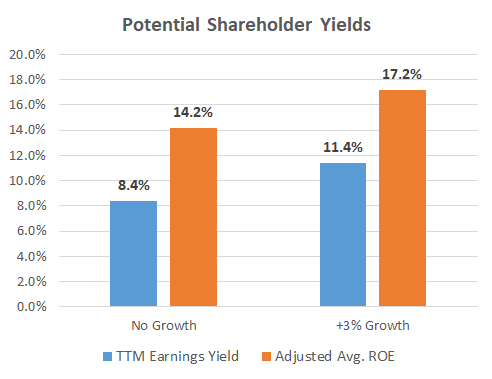

I always like to examine the relationship between average ROE and price-to-book value in what I call the Investors' Adjusted ROE. This relationship is especially important for cyclical companies, and is something I consider similar to Shiller's CAPE ratio but a little simpler to calculate, in my opinion. It examines the average ROE over a business cycle and adjusts that ROE for the price investors are currently paying for the company's book value or equity per share. With Gildan earning an average ROE of 16.6% over the past decade and shares currently trading at a price-to-book value of 1.2x when the price is $15.10, this would yield an Investors' Adjusted ROE of 14.2% for an investor's equity at that purchase price, if history repeats itself. This is well above the 9% that I like to see, even before adding a 3% growth rate to represent the company growing alongside GDP, which could increase this potential total return up to 17.2%.

Takeaway

Gildan looks like a fine opportunity at 11.9x TTM P/E with great profitability through its vertically integrated business. The company has done a good job of returning cash to shareholders through both dividends and share repurchases, and its financial leverage still looks healthy at these levels. Long-term investors could be nicely rewarded holding this company through the COVID-19 pandemic.

If you enjoyed this article and would like to read more of my work, click the "Follow" button at the top of the page to receive notifications when I post a new article!