(Photo by Brett Sayles from Pexels)

Typically lower beta stocks, the death care industry stocks have sold off with the rest of the market, and although revenues from services are being squeezed by social distancing, it is likely that funeral services and memorials are being postponed rather than cancelled altogether. This article focuses on the two funeral services stocks that are publicly traded, Service Corp. International (NYSE:SCI) and Carriage Services Inc. (CSV). There are other companies that provide caskets and monuments, but it is the full service providers that I find interesting from an investment perspective.

Prepaid services (revenues held in trust) account for a significant portion of their businesses and postponed revenues will be realized once the pandemic has run its course.

Service Corp. International (see graph) has by far been the superior performer over the past five years, still up (excluding dividends) 74% compared to about 41% for the S&P 500 at recent price levels. The stock is now down nearly 28% from its 52-week high. The following is not a direct quote but paraphrases (from the company 10-K) their business:

SCI is North America’s largest provider of death care products and services. At December 31, 2019, the company operated 1,471 funeral service locations and 482 cemeteries (including 290 funeral service/cemetery combination locations), which are geographically diversified across 44 states, eight Canadian provinces, the District of Columbia, and Puerto Rico.

Deemed an essential service, death care service companies continue to generate revenues even as many other industries are in lock-down mode. The question is whether or not their financial situation is stable enough to weather the temporary dampening of activity.

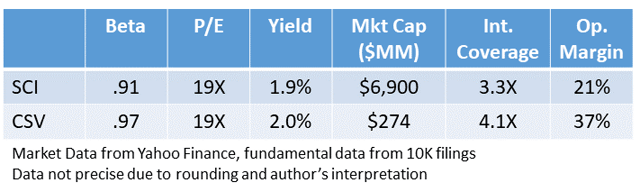

The generous operating margins enjoyed by these businesses and ample cash flow (evidenced by interest coverage) suggest there is unlikely a threat to the dividends. For SCI the payout ratio is