50 years ago, it seemed that Americans mostly listened to the same songs, but invested in very different portfolios of individual assets, including stocks. Today, it seems no two of our musical playlists are alike, but now enormous percentages of our discretionary and retirement assets are invested in the same uniform portfolios of stocks, most notably, in funds tracking the S&P 500 index. As one last indicator of how musicals have become more individual, note that most of the top-selling platinum albums of all time are from the 1970s and 1980s, and not since then. That's not just because we've stopped buying physical albums or started consuming more music through online streaming services, but because those technologies have made it easier for each of us to find our own individual preferences rather than just buying what everyone else is buying. Surprisingly, even though information and choice in financial markets have increased just as much over that same time, many stock portfolios seem to be getting more homogenous and less individual, even though we have the technology to enable portfolios matching individual tastes.

I see many parallels between the technologies of recording and distribution music and the distribution of packages of stocks and bonds, which is why it has surprised me how our application of these financial technologies has progressed so differently:

- In the 1970s, we mostly bought music on vinyl discs. These discs were large and hard to play on the go, but had an audio quality many audiophiles still find better than any recording technology since. During this decade, the main way to buy stocks was to call a human broker and pay a commission to buy one of the few stocks they happened to be paying attention to that day.

- In the 1980s, we started buying more music on

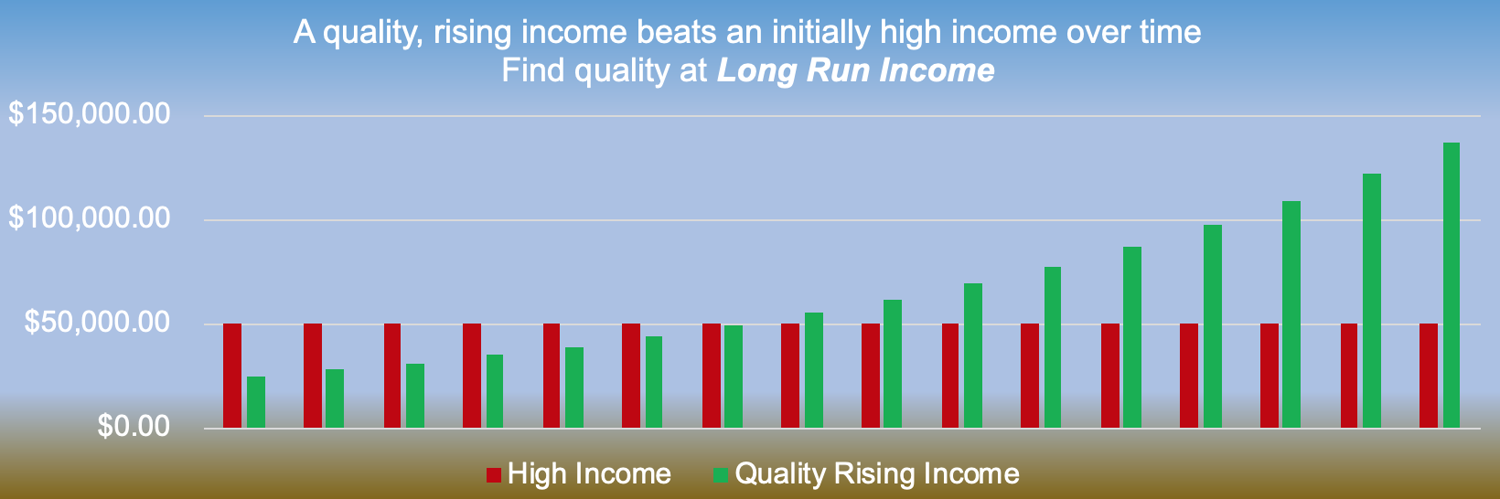

Are you looking to improve the income-generating ability of your portfolio, not just this year, but for decades to come? Members of Long Run Income get my regular short form analysis, "dividend check" reviews on dozens of quality stocks, screens, model portfolio updates, and ideas like these that can significantly increase your investment income over time, as well as access to our members-only chat room for discussing your questions. See more of my latest ideas with your free trial to Long Run Income.