Baker Hughes CEO Lorenzo Simonelli. Source: Houston Chronicle

Baker Hughes CEO Lorenzo Simonelli. Source: Houston Chronicle

The global economy has been brought to a standstill to help stem the spread of the coronavirus. A recession is likely upon us. It may be a matter of how long it will last. Less talked about is the sharp fall in oil prices. Brent oil is sub-$30, and it has weighed on oil-related names like Baker Hughes (NASDAQ:BKR). The stock is off over 45% Y/Y. The decline likely reflects the free fall in demand for oil, but that could change.

More Stagnation In North America?

Oil prices have received the benefit of OPEC supply cuts for years. I have wondered aloud if demand for oil justified robust E&P in the oil patch. The coronavirus has led to social distancing and a free fall in demand. After President Trump's urging, Saudi Arabia and Russia agreed to a production cut. After the pandemic ends, demand for oil should rise, driving prices and E&P higher. This should benefit Baker Hughes.

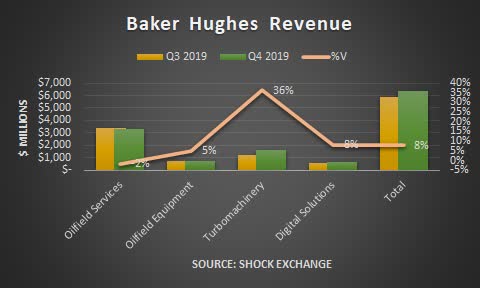

In its most-recent quarter, Baker Hughes reported revenue of $6.3 billion, up 1% Y/Y and 8% sequentially. This followed a 3% sequential decline in Q3. Along with Schlumberger (SLB) and Halliburton (HAL), Baker Hughes is one of the largest players in the North America land drilling market. This segment has faced headwinds due to budget exhaustion experienced by certain clients. In Q4, Halliburton and Schlumberger both experienced double-digit revenue declines in North America.

The company's short cycle businesses included Oilfield Services and Digital Solutions. Baker Hughes generated a combined $4.0 billion in revenue from these businesses, flat sequentially and up 5% Y/Y. They represented 62% of the company's total revenue, so their performance still has a sizeable impact on Baker Hughes's operations. The U.S. rig count was stagnant to declining for most of 2019. It fell by double digits in Q4 2019. For the week-ended

The company's short cycle businesses included Oilfield Services and Digital Solutions. Baker Hughes generated a combined $4.0 billion in revenue from these businesses, flat sequentially and up 5% Y/Y. They represented 62% of the company's total revenue, so their performance still has a sizeable impact on Baker Hughes's operations. The U.S. rig count was stagnant to declining for most of 2019. It fell by double digits in Q4 2019. For the week-ended

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year - a 33% discount.