When it comes to chipmaker Nvidia (NASDAQ:NVDA), those who have waited will soon be rewarded. While the US/China trade war and the coronavirus delayed things a bit from the latter part of 2019, the Mellanox (MLNX) deal is finally about to close. That means that it is time to start considering the financial impact of the deal, and the immediate reaction should be street analysts raising their estimates.

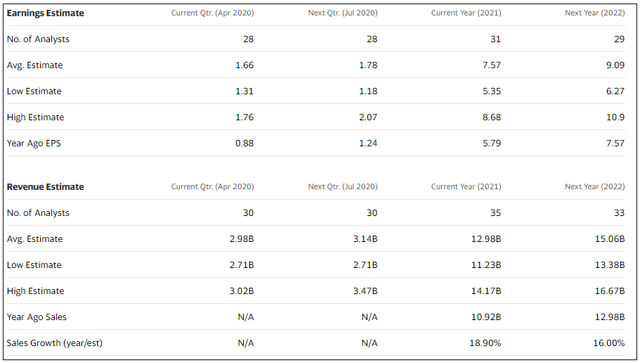

In the graphic below, you can see where estimates stood at the end of last week. Since Yahoo is missing some numbers, here they are: year ago for the April 2020 period would be $2.22 billion (meaning about 34% growth for this year's estimate), and for the July 2020 period the year ago is $2.58 billion (about 22% year over year growth). As a point of reference, Nvidia's current fiscal year will end in January 2021, so this is not a company on the typical calendar reporting cycle.

(Source: Yahoo! Finance analyst estimates page)

It was back on February 13th when Nvidia provided guidance for the period we are almost finished with. At that earnings report, management called for revenues of $3 billion, plus or minus two percent. Due to the coronavirus, this forecast was reduced by $100 million from what it could have been. With the company not reporting results until May 21st, we'll first get numbers from competitors like Intel (INTC) and Advanced Micro Devices (AMD). That will likely result in some estimate changes, although as seen above, the street is currently just below Nvidia's guidance midpoint for fiscal Q1. Mellanox itself is slated to report earnings later this week on the 23rd.

Nvidia investors not familiar with Mellanox may be wondering what they are getting for roughly $7 billion, so here is the original presentation shown when the deal