Coherus Biosciences (NASDAQ:CHRS) is a commercial stage biosimilar company with one approved product, a pegfilgrastim biosimilar in febrile neutropenia (UDENYCA U.S. sales initiated in January 2019), which has managed to capture more than 20% of the US pegfilgrastim market in less than a year, using its pass-through status which ends in 2 years. In its pipeline, it has adalimumab biosimilar in psoriasis, etanercept biosimilar in psoriasis and RA, and ranibizumab biosimilar in wet AMD. The company became profitable in 2019, and has solid cash reserves enough for two years of operations. The company just recently announced a $200mn secondary offering, so the impact of that is also priced into the stock. Given the coronavirus depression in biopharma, this is the sort of company with solid fundamentals that we are currently looking for.

Recall that a biosimilar, or biosim, is a generic for biologics. Biologics are drugs genetically derived from living matter, and since they do not have composition of matter patents, are more easily replicated and marketed than small molecule drugs. However, that is only in theory. In many ways, a biologic is more difficult to manufacture than other drugs, so a company like Coherus is relatively well-positioned against other companies in terms of competitive hurdle. That is why Coherus not only develops and commercializes its own biosims, but it also offers these services to others seeking to access the vast US market.

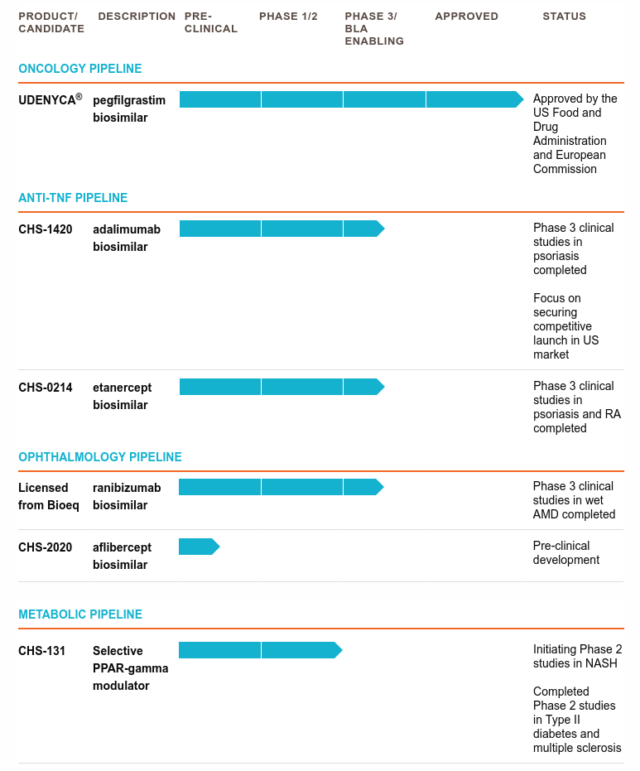

Pipeline and trials

Coherus is advancing late-stage clinical products CHS-1420, a Humira® (adalimumab) biosimilar, Bioeq’s Lucentis® (ranibizumab) biosimilar and Innovent’s Avastin® (bevacizumab) biosimilar towards commercialization, and early-stage clinical products, CHS-2020, an Eylea® (aflibercept) biosimilar, and CHS-131, a small molecule for nonalcoholic steatohepatitis (NYSEARCA:NASH) and multiple sclerosis.

Image source: company website

CHRS has a license agreement with Innovent for a biosimilar of bevacizumab (Avastin), executed in Jan 2020, and another for

Thanks for reading. At the Total Pharma Tracker, we do more than follow biotech news. Using our IOMachine, our team of analysts work to be ahead of the curve.

That means that when the catalyst comes that will make or break a stock, we’ve positioned ourselves for success. And we share that positioning and all the analysis behind it with our members.