Wabash National (NYSE:WNC) is a manufacturer and distributor of a wide-range of transportation products in the US. The company has lost over 50% of its market-cap over the past 5 months. Although we will not have first-quarter numbers until May, we predict an ugly number as management has come out and said that customer pickups are nowhere near the levels we witnessed in 2019.

In fact, if we look at recent earnings trends, analysts who follow this stock now believe we will see negative earnings this quarter as well as next quarter. This then would stand to reason that we would need to see some type of recovery in the final two quarters to print a positive number for the year. Wabash reported $1.62 in earnings last year or $90 million in net income. This gives you some idea of the damage recent developments have done to certain industries.

When researching stocks which have been literally left for dead over the past month or so, the most important metric which we force ourselves to look at is the respective firm's liquidity position. Wabash in the fourth quarter reported a current ratio of 2.09 which is attractive. Furthermore, Wabash decided to draw down a further $45 million recently from its credit facility to shore up its cash position.

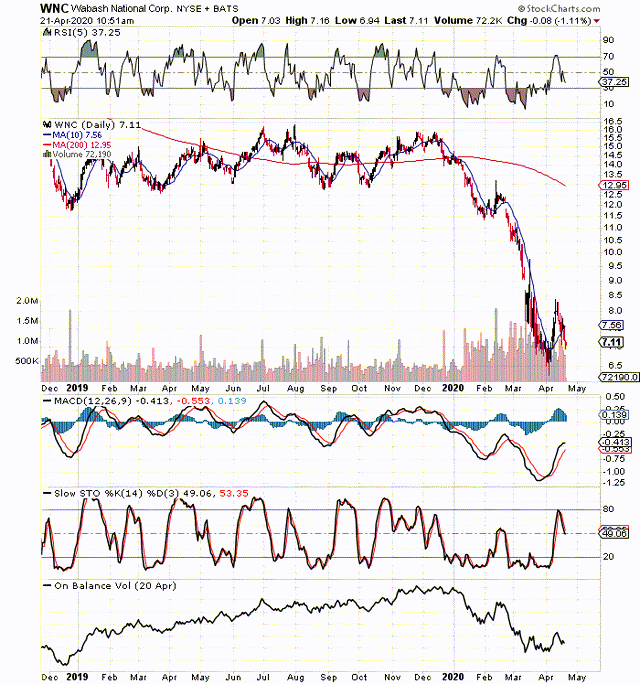

At present, Wabash trades with a book multiple of 0.7 and a sales multiple of 0.2. Shares trade at just over $7 a share. This valuation as well as the single-digit share price brings distinct advantages with respect to how we would hypothetically trade this stock. Let's have a look at how the dividend is before we get into a possible trade set-up here.

Researching the strength of the dividend is a great way to see how fundamentally strong Wabash is. The yield at

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not not stop until it reaches $1 million.

-----------------------