When Mr. Market succumbed to coronavirus after February 19, everything seemed to collapse in unison. In reality, some sectors fell a bit harder while others were a bit less bad, but on the whole, everybody who had money in stocks felt ill. When it comes to the snapback (or bear-market rally) we’ve enjoyed since March 23, we’ve been seeing some meaningful separation. The SPDR S&P 500 ETF (SPY) bounced 23%. But coronavirus-induced expectations of future profitability sent the SPDR Select Sector Healthcare ETF (XLV) up 31%, bringing it to within 7% of its pre-crash high. But Healthcare ETFs were not created equally, so it’s time to look under the hood and finetune portfolio exposure to this sector.

© Can Stock Photo / Yakobchuk

Liftoff

General out-performance relative to the market can be seen in any number of ways. Figure 1 charts the ETF’s performance (the red line) over the past three adventure-filled months relative to SPY matched up with trends in the PortfolioWise Power Rating (the horizontal bar running along the bottom of the chart that’s been alternating between green and yellow as the rating shifts between bullish and neutral), and the mountain graph below that which charts the Chaikin Relative Strength indicator.

Figure 1

The significance of the liftoff looks much bolder, however, if we factor in company-specific metrics. We do this by analyzing how the stocks held in an ETF portfolio fare under our 20-factor Power Gauge “technamental” rating model, which is an important component of our US Equity ETF Power Ranks.

The significance of the liftoff looks much bolder, however, if we factor in company-specific metrics. We do this by analyzing how the stocks held in an ETF portfolio fare under our 20-factor Power Gauge “technamental” rating model, which is an important component of our US Equity ETF Power Ranks.

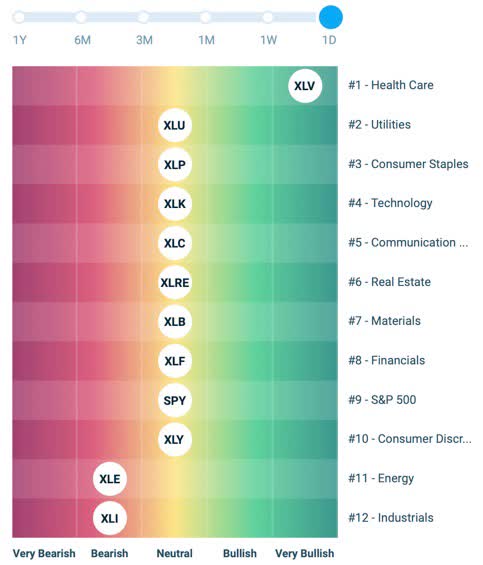

Figure 2 shows the current PortfolioWise Sector Rating Grid, which provides a visual comparison of S&P 500 and Sector Select ETFs, and incorporates the aforementioned company-specific metrics.

Figure 2

For most of the coronavirus season, the ETFs lined up like a vertical pole planted right in the center of the grid’s horizontal axis, the neutral position, with Energy Select Sector SPDR ETF (XLE) being the lone outlier mired on the lower left (bearish) side of grid; XLE was joined in bear country just this week by the Industrial Select Sector SPDR ETF (XLI). But what had become a pattern of neutral-to-negative dreariness was, on April 14, boldly broken when the Select Sector Healthcare ETF separated from the pack by jumping to the right (bullish) edge.

For most of the coronavirus season, the ETFs lined up like a vertical pole planted right in the center of the grid’s horizontal axis, the neutral position, with Energy Select Sector SPDR ETF (XLE) being the lone outlier mired on the lower left (bearish) side of grid; XLE was joined in bear country just this week by the Industrial Select Sector SPDR ETF (XLI). But what had become a pattern of neutral-to-negative dreariness was, on April 14, boldly broken when the Select Sector Healthcare ETF separated from the pack by jumping to the right (bullish) edge.

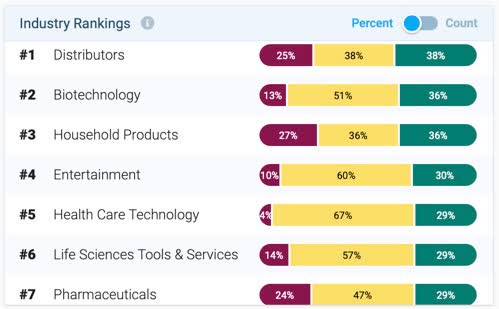

Figure 3 uses Chaikin Industry “Power Bars” - the ratios of bullishly (green) to neutrally (yellow) to bearishly (red) ranked stocks in the group - to provide another perspective.

Figure 3

Considering all industries in the market, four among the top seven industries (out of the 64 we could see if we were to scroll down) are part of the Healthcare sector: Biotechnology, Healthcare Technology, Life Sciences Tools and Services, and Pharmaceuticals. The other industries within the healthcare sector (Healthcare Equipment and Healthcare Providers) come in at numbers 11 and 17, respectively. While we have concluded that the healthcare sector is a strong place to look, XLV is not the only option.

Considering all industries in the market, four among the top seven industries (out of the 64 we could see if we were to scroll down) are part of the Healthcare sector: Biotechnology, Healthcare Technology, Life Sciences Tools and Services, and Pharmaceuticals. The other industries within the healthcare sector (Healthcare Equipment and Healthcare Providers) come in at numbers 11 and 17, respectively. While we have concluded that the healthcare sector is a strong place to look, XLV is not the only option.

Searching for Healthcare Ideas Beyond XLV

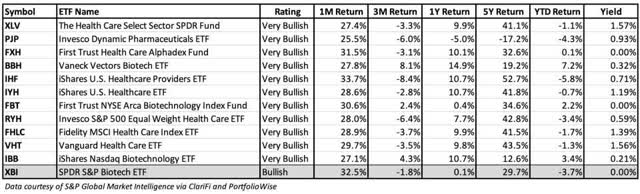

I screened on PortfolioWise for Healthcare ETFs rated Very Bullish with 1 month relative (to SPY) performance no worse than minus 5% (yes, I tolerate a bit of lagging; screeners who get too picky, especially during times like these, wind up with weak result sets). I also eliminated ETFs whose metrics were at the low end of the spectrum in terms of trading volume, trading liquidity and assets under management (AUM).

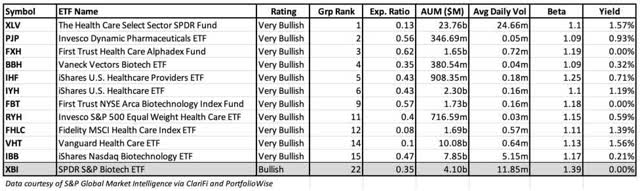

Tables 1a and 1b provide basic information of the ETFs that passed the screen, and also on the SPDR S&P Biotech ETF (XBI), which I manually added, despite its “mere” Bullish rating, because of its large size and market stature. The Tables are sorted from Highest down by Group Rank (which compares ETFs in the same group based on raw 0-100 Chaikin Power Rank scores).

Table 1a

Tie-Breakers: Choosing From Among The Candidates

Tie-Breakers: Choosing From Among The Candidates

The top-ranked ETF, the sector flagship, is obviously a reasonable choice, and judging from AUM, volume and liquidity, many investors agree. But the various data points relating to past price performance cue that other Very Bullish ETFs also deserve consideration, as does XBI.

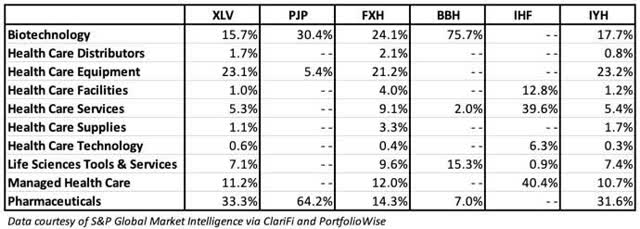

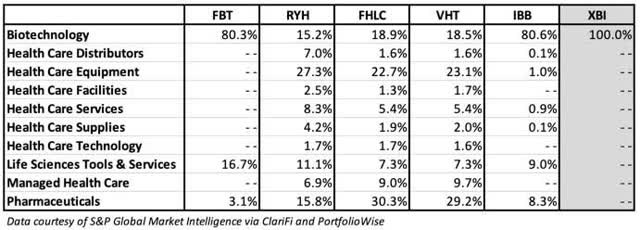

I decided to take a closer look at portfolio composition by drilling down below the sector level to sub-industry, the finest level of categorization within the Healthcare sector to see if there were a different and more nuanced categorization method worthy of consideration. This information is shown in Tables 2a and 2b.

Table 2a

We can now see there are four types of Healthcare ETFs from which we can choose: (1) Broadly Diversified, (2) Pharma-oriented, (3) Services-oriented, and (4) Biotech-oriented.

We can now see there are four types of Healthcare ETFs from which we can choose: (1) Broadly Diversified, (2) Pharma-oriented, (3) Services-oriented, and (4) Biotech-oriented.

1 - Broadly Diversified Healthcare ETFs

This, the largest, group includes:

- The Health Care Select Sector SPDR Fund (ETF home)

- First Trust Health Care Alphadex Fund (FXH) (ETF home)

- iShares U.S. Healthcare ETF (IYH) (ETF home)

- Invesco S&P 500 Equal Weight Health Care ETF (RYH) (ETF home)

- Fidelity MSCI Health Care Index ETF (FHLC) (ETF home)

- Vanguard Health Care ETF (VHT) (ETF home)

For those who want just-plain Healthcare - no details, not specifics - this is the group of ETFs to consider and it would be hard to argue against choosing any one versus any of the others. But given that we all must make some sort of decision, unless one has a particular reason to favor a particular fund family, or sub-industry that gets a bit more attention in a particular ETF, the default choice, XLV, with its number one group ranking, is a solid selection.

2 - Pharma-Oriented ETFs

There’s one ETF in this group:

- Invesco Dynamic Pharmaceuticals ETF (PJP)

PJP, with a 30% stake in biotech, is actually an interesting hybrid between what may well be the subindustry of the future and the once-hot business that arguably feels like your grandfather’s Cadillac; snazzy in its heyday but now, staid but solid (standard pharma). For much of my career, Big Pharma was the class of a portfolio, great returns on capital, wonderful cash flows, great growth, and a recession-resistant revenue stream that made this the group to own when the market got antsy. But times have been changing. Many of the group’s most stalwart drugs went off patent (these legally-sanctioned monopolies have expiration dates that seem way off into the distance on day one, but eventually arrive). In recent years, many once powerful revenue streams fell over this “patent cliff” (i.e., they came under pressure as companies had to slash prices to address newly enabled competition). Meanwhile, the time and expense of getting a new drug to market remain intimidating and questions are often raised about whether, at the end of the day, clinical benefits relative to what’s out there justify all the fuss. The good news is that the worst of the patent cliff looks to be behind the group now, so it should settle into a more respectable, although cooler than in the glory days, pace of business.

Today the more Biotech-heavy plays seem more suitable for those who want to recreate former R&D-driven glory. View PJT as the lower-risk lower-potential reward variation of that theme.

3 - Service-Oriented ETFs

There’s one ETF in this group:

On paper, IHF’s big stakes are in Managed Care, Health Care Services (lab testing, dialysis, radiology, fitness and nutritional counseling, home health care, etc.), and Healthcare facilities (hospitals, rehab facilities, etc.) In fact, however, 57.3% of the portfolio is invested in a few big insurance names: 22.3% in UnitedHealth (UNH), 14.3% in CVS (CVS), 7.0% in Cigna (CI), 5.0% in Humana (HUM), 4.4% in Centene (CNC) and 4.3% in Anthem (ANTM). This exceeds the 40.4% “Managed Care” stake shown in Table 2a. Business classification today, where internal corporate diversification is the norm, can be just as much art as science: As it turns out, the S&P GICS database classifies CI and CVS as Healthcare Services.

Hence formal classifications aside, think of IHF as the Health Insurance-Affordable Care Act ETF. Demand is obviously high and growing. And opportunities to control costs are improving thanks to business combinations with health-care deliverers that facilitate better control over costs. But it would be naive to assume the political sector is going to allow revenue growth in this area to respond purely to supply and demand. Indeed, even as we write, yet another existential threat to the Affordable Care Act is sitting on the calendar of the U.S. Supreme Court. That’s a threat from the Right. As anyone following U.S. electoral politics knows, though, the Left is rolling up its sleeves too, albeit with a different fight strategy.

In terms of our Power Gauge stock rating system, IHF’s top six holdings all score high, which is not surprising given the strength they’ve shown of late. But the non-financial risks are high, so IHF, with its diversification into other service-related areas such as diagnostic labs, dialysis, home health care, home infusion therapy, outpatient radiology, etc. could be an effective way to diversify away some of the risk that would attach to a purer-play health insurance/ACA exposure.

4 - Biotech-Oriented ETFs

The remaining four ETFs comprise this group:

- VanEck Vectors Biotech ETF (BBH) (ETF Home)

- First Trust NYSE Arca Biotechnology Index Fund (FBT) (ETF Home)

- iShares Nasdaq Biotechnology ETF (IBB) (ETF Home)

- SPDR S&P Biotech ETF

These are the headliners of today’s healthcare cast, the ETFs whose portfolios are most likely to include companies on the front lines in therapeutic fight against coronavirus and whatever new diseases come down the pike.

Biotech isn’t just newfangled pharma. It’s a completely different scientific approach. Pharma is chemistry-based. Biotech is genetic code-based. I’m not an expert in either (my former high school chemistry and biology teachers would certainly attest to that). But I understand enough about lifecycles (in business, tech, etc.) and probability to recognize that the next generation of genuinely new therapies, those that deliver the most bang (clinical benefit) for the bucks spent on R&D, getting through the FDA and marketing, are more likely to come from Biotech than Pharma. So unless you have particular access to knowledge that points you toward particular pharma companies, I propose that any 21st-century growth-oriented portfolio plant a flag in Biotech country. Note, too, that some of the Biotech ETFs also include meaningful exposure to Life Sciences, companies analogous to 19th century peddlers who profited from the gold rush not by mining but selling shovels and pickaxes to those who did (i.e., they sell tools to the folks who do the R&D).

The lower-risk more fundamentally-friendly (i.e. likely to be favored by models such as Power Gauge) way to play Biotech is to concentrate primarily on the already identifiable big names, such as COVID-19-warrior Gilead (GILD), Regeneron (REGN), Biogen (BIIB) and Amgen (AMGN). The two ETFs that do this are BBH and FBT; both have meaningful stakes in Life Sciences as well. BBH holds only 24 positions and FBT holds 30.

But if one really wants to shoot for the moon, one can consider IBB, which holds 209 positions mainly in “emerging” companies whose names won’t be recognizable to investors who don’t specialize in analyzing Biotech. It allocated 9.96% to Gilead, 8.24% to Vertex Pharmaceuticals (VRTX), 7.73% to Amgen, 5.40% to Illumina (ILMN), 6-7% allocated to six other ETFs and then 198 other ETFs with allocations of less than 1% (in many cases, less than 0.5%). As can be seen in Table 2b, this portfolio is 80.6% Biotech. But if one wants to reach for potential new-era winners, one may not have the time or skill-set to research individually, or the needed risk-tolerance — there’s a lot to be said for IBB. (And doing one’s own research is no panacea unless one is already an expert in the field since every new drug sounds on paper or in PowerPoint to a pharmacological amateur like the greatest thing since sliced bread. Avoid this trap. Don’t fall into the trap. Many won’t be.)

XBI, the bigger-name SPDR offering, is 100% Biotech. It holds “only” 122 positions. But it leans more heavily to the no-names. Stakes in the group’s more recognizable stocks amount to only 1-2% each. Note, though, that this contributes to increasing volatility; XBI’s beta is 1.39, compared to 1.17 for IBB.

Less exposure to more “mature” Biotech names (as mature as can be in this area) means more exposure to companies whose data profiles are less Power Gauge friendly, so IBB and XBI are at the bottom of our Group Rank hierarchy (recall that XBI only appears because, in deference to its stature, I manually added it). But my deep dive into the portfolios and the individual Power Gauge ratings reminded me of the beauty of diversification. Both ETFs hold many horribly-ranked stocks, but the portfolios’ cap-weighted average ranks are highly respectable. Moreover, better times lie ahead: it takes five years or so for a newly-launched commercial drug to hit its stride, so with these companies, we can look upward rather than at the ground as we worry about stepping off patent cliffs.

Conclusion

Speaking for myself, my preferred Healthcare ETF portfolio would consist of:

- The Health Care Select Sector SPDR Fund, the top-ranked one-stop-shopping ETF for the sector;

- The First Trust NYSE Arca Biotechnology Index Fund, the slightly purer (relative to BBH) version of the big-name Biotech strategy; and

- The 1SPDR S&P Biotech ETF, the purer (than IBB) shoot-for-the-moon Biotech ETF. That said, I would not kick and scream if one wanted to substitute the iShares Nasdaq Biotechnology ETF, with combination of bigger-name exposure offset by its wider target in the no-name region, for XBI - or even split the position between XBI and IBB.