Recently, Otis (NYSE:OTIS) has spun-off from United Technologies (RTX). I wrote about Otis shortly before the spin-off but think the time is right to dig a little bit deeper into several topics.

Sometimes, spin-offs can be great bargains, but in this case, it looks like Otis is a mediocre play. The core of my thesis is that equipment growth is key and new elevator sales are more relevant than services sales. Services have a higher EBIT margin, and this can be misleading, as it makes Otis look cheap. Other elevator companies have a better positioning than Otis when it comes to new equipment.

At the same time, it doesn't look like Otis is sufficiently cheap to make up for the difference.

Elevator market introduction

Please note that though I will keep referring to elevators only throughout this article, the companies discussed also sell escalators.

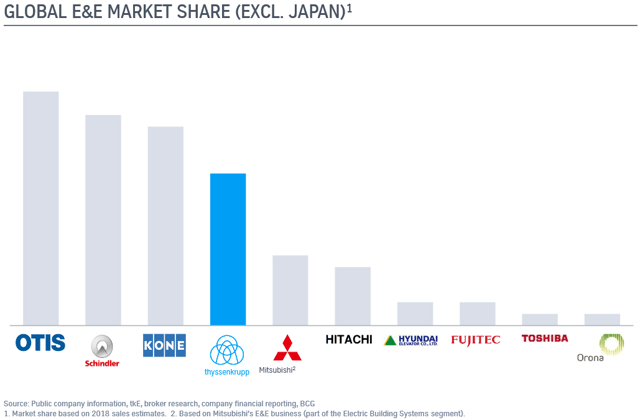

Because elevators are highly complex and potentially dangerous (therefore regulated) products, the market for it is highly concentrated and controlled by a few global corporations.

Source: thyssenkrupp Elevator December 2019 CMD presentation.

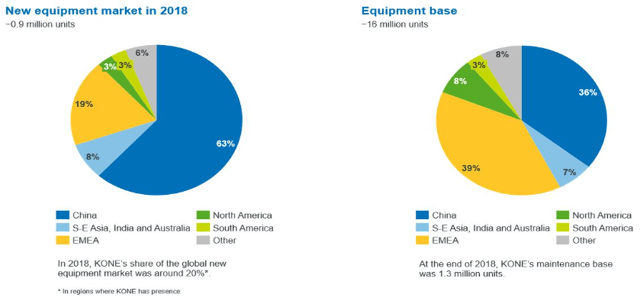

Europe has traditionally been the largest market for elevators (as can be observed in equipment base in the right-hand pie chart below), which is why three out of the global top four elevator companies are European.

Source: KONE

Nowadays, however, global new equipment sales have gravitated towards China. But the installed base still generates a substantial amount of maintenance, repair, and modernization revenue. This is important as maintenance and repairs happen at much better margins than new equipment sales.

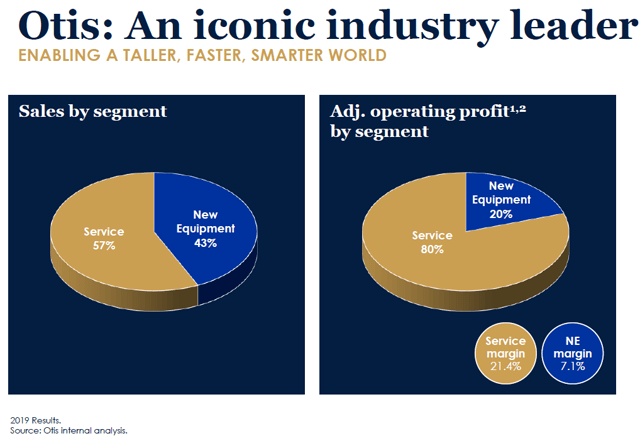

Otis says in its spin-off presentation that service profit is about 2.5x new equipment profit over a product's lifecycle. The segment sales split of Otis is shown below.

Source: Otis presentation.

Typically, when an OEM installs a new elevator in a building, this results in a service