Main Thesis

The purpose of this article is to evaluate the Vanguard Utilities ETF (NYSEARCA:VPU) as an investment option at its current market price. While I have favored the Utilities sector for a while, in the short-term I had been very concerned with the escalating cost to own the sector. This led me to a more neutral outlook, although I still felt the sector would provide some relative safety during a broad market sell-off. In hindsight, even my more cautious view was too optimistic. VPU has been hit hard, and its share price is down markedly. With virus concerns sweeping the globe, even the most defensive of assets have come under fire. While unnerving, I see this as an opportunity. As interest rates have declined and VPU's sharp rice has plummeted, its current yield is now especially attractive. Further, the fund's valuation, while still a bit on the pricey side, is much more reasonable than it was just a month ago. Finally, while estimates for corporate earnings are broadly seeing declines, the Utilities sector is not expected to see much of an impact, as of now. This is a positive story for the underlying companies within VPU's portfolio.

Background

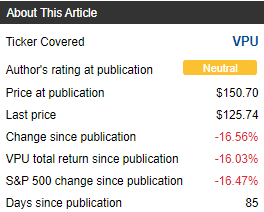

First, a little about VPU. The fund's stated objective is "to track the performance of a benchmark index that measures the investment return of stocks in the utilities sector" and is managed by Vanguard. The fund trades at $125.74/share and yields 3.15% annually. I suggested getting cautious on VPU during my last review, although I anticipated the Utilities sector being a reasonable hedge if equities saw a correction. In hindsight, I was not nearly bearish enough. While VPU is indeed down slightly less than the market, it has seen a sharp drop in the interim, as shown below:

Source: Seeking Alpha