Thesis

NextEra Energy (NYSE:NEE) is a world-class Fortune 200 energy company that has sold off due to the coronavirus. Given a history of strong stock performance combined with underlying fundamentals and a recent update, I believe there is an opportunity to buy in at a discount to intrinsic value today and start a position or add.

I will give an overview of historical performance and then recent management updates, which give me confidence in performance in the coming quarters. I believe in a shaky time like today, a strong historical performer and a regulated utility are a great way to defensively position in equities.

Overview

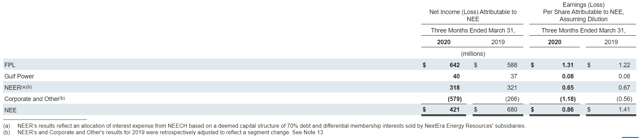

NextEra Energy has two primary businesses: FPL, which serves roughly 5 million customers in Florida and is one of the largest electric utilities in the US, and NEER, which is the world's largest generator of renewable energy. It also acquired Gulf Power in 2019, which generated $321 million of net income in 2019 (compared to the overall base of $680 million in 2019).

(Source: 10-Q)

As you can see from the above net income performance, the business is profitable and has shown some signs of weakness in Q1 this year versus last year. However, if you dig deeper into these numbers, you see that FPL generated 11.6% ROE on its retail rate base - an impressive figure.

(Source: Investor Relations)

Defensive Positioning

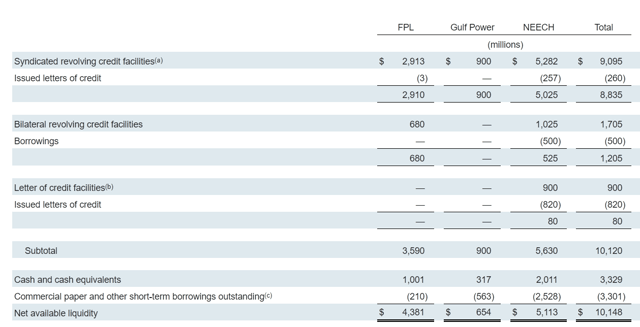

NextEra has approximately $10.1 billion in available net liquidity across its core businesses. Combined with its regulated nature and its scale in Florida and with NEER, it makes for a conservative equity play in a volatile market like today.

Here is the breakdown of the liquidity profile, showing ample room for drawdowns in the credit facilities and letters of credit:

(Source: 10-Q)

No Slowdown in Long-Term Goals

Management expects to build 5 gigawatts of renewables capacity this year, and it added 1.6 gigawatts of wind, solar, and storage to the pipeline in Q1 2020. Further, it mentioned on the recent earnings call that it will spend $1 billion on battery projects in 2021, and NextEra will be the first company to spend that amount on energy storage ever.

This is a stunning statistic that shows management's belief and ability to reinvest, and its ability to allocate large amounts of capital into research during trying times. Further, it will boost the competitive moat around NEE and its affiliates as competitors cut spending. This is truly long-term thinking.

FPL expects to add 10 gigawatts of solar capacity in the next 10 years, and as Florida's energy market consolidates, it will achieve greater pricing power with scale. The Ten-Year Site plan for FPL and Gulf Power, which the company expects to merge, shows the range and nature of this strategic thinking. The merger may result in additional cost synergies that have not been modeled yet into the stock.

In addition to reinvesting for future growth, the company was sympathetic to its customers. In May, the typical FPL and Gulf Power residential customer received a 25-40% decrease in their bill due to coronavirus, according to management.

Opportunities with Coronavirus

Supply chain considerations and constraints are top of mind for new construction given coronavirus. However, management in April reiterated that they are seeing "no drop-off, no slowdown" in construction pipeline and deal-making.

From an investor's perspective, coronavirus can offer NextEra Energy an opportunity for consolidation in tough times. As management mentioned in late April 2020, "For those two reasons, it could create project [merger and acquisition] opportunities for [NextEra], where smaller developers need a rescue plan."

Return Profile and Financials

Management also reiterated a steady return profile for investors going forward. It expects adjusted earnings per share to grow at 6-8% through 2021 and 2022, in addition to an updated dividend policy which will translate to a growth rate of at least 10% year-over-year growth, per recent commentary. This shareholder-friendly activity shows that management is able to weigh its long-term priorities with shareholder interests well.

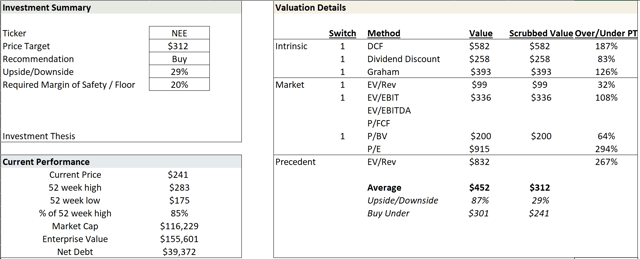

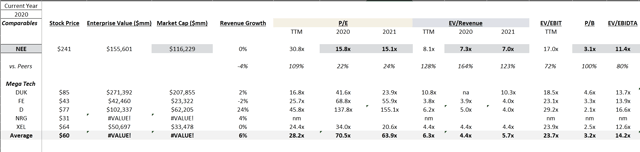

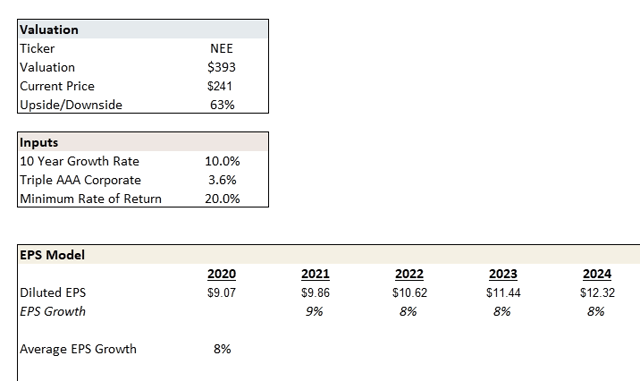

Digging deeper, I developed a valuation model that looked at comparables and intrinsic valuation. The summary of these is displayed in my dashboard below, which includes public filing information from the company.

I took a series of approaches below and averaged them, also scrubbing those that were not relevant. As you can see, my model shows an upside of ~29% from current prices.

For the comparable analysis, I looked at several other utilities and marked them on a variety of valuation metrics, including P/E, EV/EBIT, and P/BV.

I further even incorporated Graham's EPS approach, given the dividend growth that management anticipates in the coming years. I incorporated analyst estimates for EPS growth into the model that resulted in 50%+ upside from current prices.

Risks and Considerations

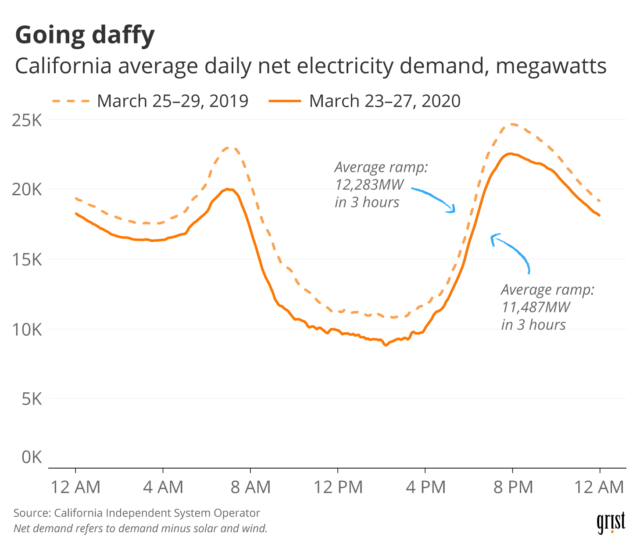

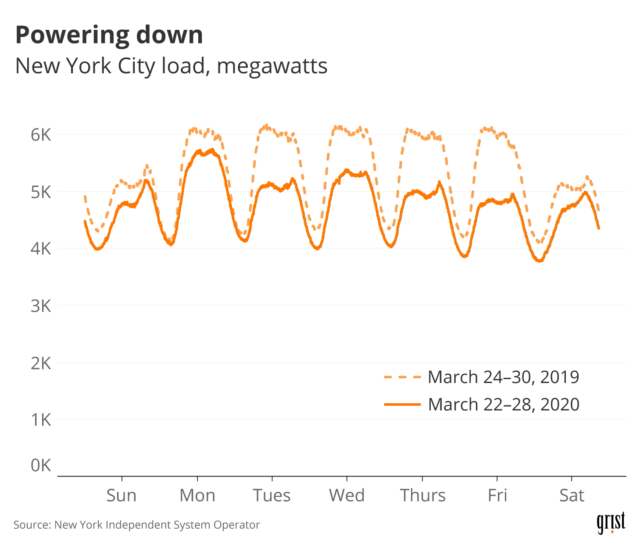

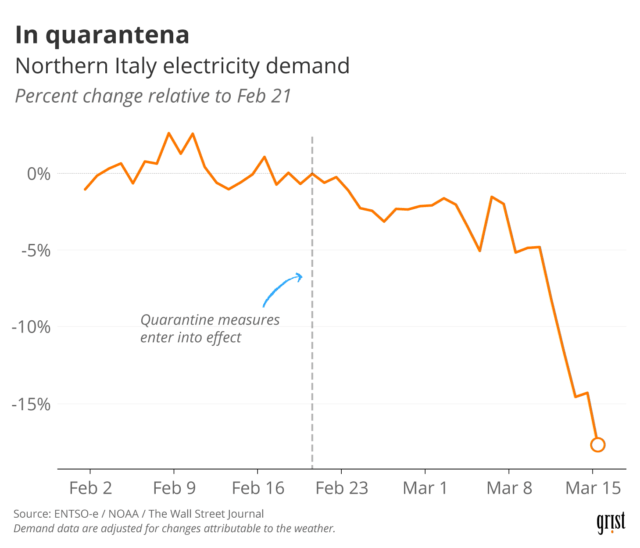

The first consideration is the dynamics with coronavirus. We have to consider changes in energy use patterns - which are complicated and relatively unknown at this point. Early indications suggest overall energy usage is down because business use is down, but residential is up.

To get a sense, we found some comparable metrics on energy usage. You can see a slight drop. I believe this is temporary and usage will come back up over time.

(Source: Grist)

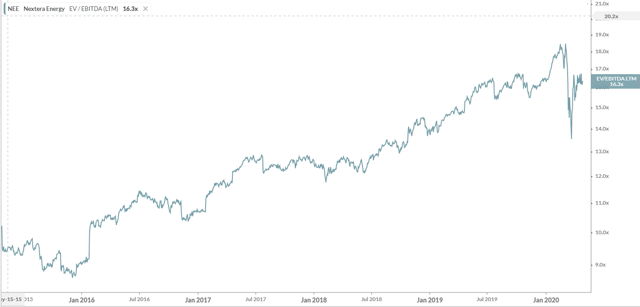

Another key consideration is valuation. As a renewable energy play, and clearly a leader in that area, many passive investors have crowded into the trade. This has driven up demand higher than supply of the shares, and the multiple has been driven up. Still, we can see it trades a bit below late 2019 numbers, which gives some margin of error.

(Source: Koyfin)

Conclusion

NextEra Energy is a world-class utilities player and one of the largest solar players in the world. Accordingly, it is not cheap on a fundamental basis. However, management has proven themselves to be able to think long-term and reinvest in strategic projects, and has also committed to shareholder-friendly terms like dividend growth for the next several years.

Combined with a series of valuation metrics that show the business undervalued, I believe it is a good time to start or build a position in the company as a defensive play in these times.