Investment Thesis

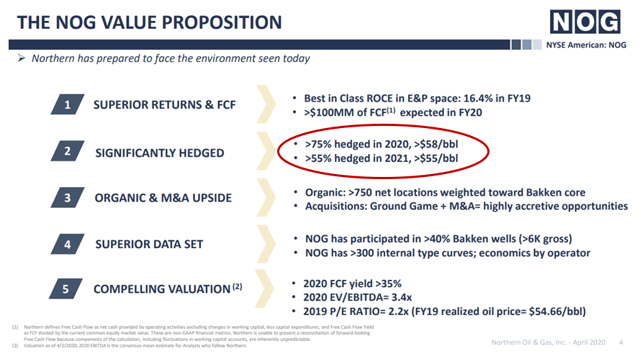

Northern Oil and Gas (NYSE:NOG) is in a unique situation due to strong hedging and no near-term debt maturities to build substantial cash flow during the downturn, and emerge strong and ready to capitalize on opportunities.

When Hedging Works as Designed

Hedges can be a distasteful topic in the oil and gas E&P social and investor circles, but in situations like we find ourselves in here in 2020, risk-averse hedging can make all the difference for a company.

Few examples of this are greater than with Northern Oil and Gas, who not only is superbly hedged at a great price for 2020, but has substantial volumes hedged at another great price for 2021. With the oil price crash well below its prices and the futures remaining well below, the hedges Northern has are tremendous in value.

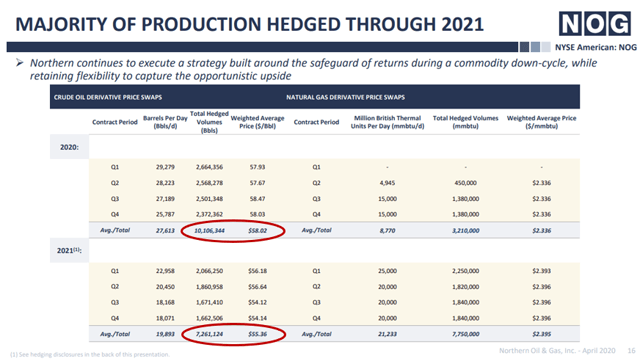

According to Northern, it has > 75% of its 2020 production, or 10,106,344 barrels, hedged at $58.02/bbl, and >55% of 2021 production, or 7,261,124 barrels, hedged at $55.36/bbl:

Source - April Presentation - With red highlights by author

Substantial Profits to Date, With More to Come

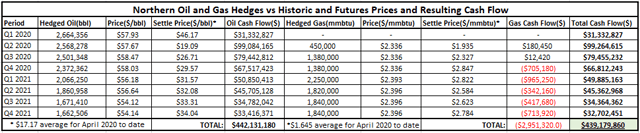

To assess the base value of Northern's hedges, we simply compare their volumes with historical and future strip prices throughout the contract periods.

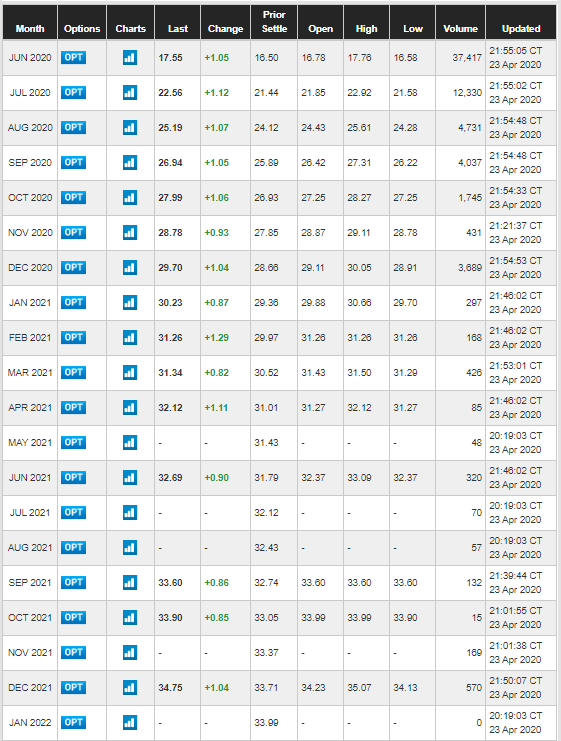

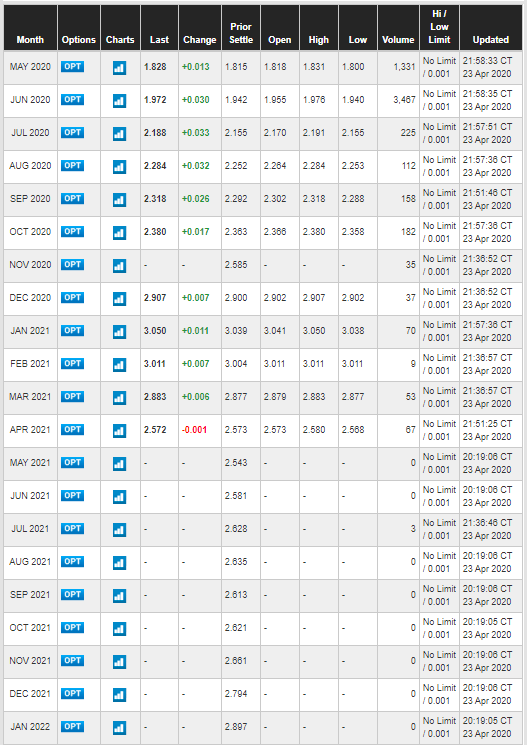

Here are the futures going forward for West Texas Intermediate and Henry Hub. Note that the WTI contract has already rolled over, but the Henry Hub contract front month doesn't roll over until the 28th:

Source - CME WTI Futures

Source - CME Henry Hub Futures

Below, then, are the realized (Q1 2020) and forecast future net cash flow from Northern's hedges through 2021:

Source - Author

As you can see, Northern has already realized $31MM in cash flow from its hedges in Q1 of this year. It is currently projected to realize another $99MM in Q2, and