Twilio (NYSE:TWLO) is a dominant player in the growing Cloud Communications Platform industry. Twilio's ability to offer customers more efficient and secure communication technologies is highly valuable in the modern era. The company is at the forefront of numerous technological trends set to grow in importance. As the world enters an increasingly technology and digital-based economy, demand for Twilio's broad-ranging communications platform will only increase.

While the current pandemic will undoubtedly have a negative impact on Twilio's business in the near term, it may actually improve the company's overall value proposition. The coronavirus will likely accelerate the digitization of the global economy, making digital communications more important than ever. Twilio is very well-positioned to capture a large percentage of the growth that is likely to occur in cloud communications.

Twilio's stock price initially felt a huge impact from the coronavirus. The company's stock price has started to rebound in recent weeks.

A Changing Economy

The global economy is becoming more and more reliant upon new technologies. As technological innovation allows for quicker and more efficient communication between businesses/organizations and their customers, it will not be surprising to see businesses/organizations integrate digital communications at growing rates. Twilio will be one of the primary beneficiaries of this trend as it is a global leader in this arena.

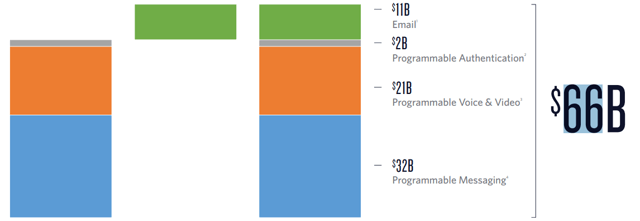

The market for cloud communication platforms is growing at a rapid rate. Twilio estimates that its total addressable market stands at around $66 billion, with $2 billion, $21 billion, and $32 billion coming from programmable authentication, programmable voice and video, and programmable messaging, respectively. What's more, this market will likely continue to grow at a rapid rate for the foreseeable future given current technological trends.

Twilio's total addressable market is already massive and will likely continue to grow rapidly moving forward.

Source: Twilio