Biogen, Inc.

Biogen, Inc. (NASDAQ:BIIB) provides pharmaceutical drug therapies for patients primarily with neurological and neurodegenerative diseases. Its treatments for Multiple Sclerosis (MS) generated $8.5 billion in 2019, nearly 60 percent of revenues. In particular, the TECFIDERA medication has made up at least 30 percent of revenue since 2017, including $4.4 billion in 2019. Gross margins have been above 85 percent since 2017.

Anti-CD20 therapeutic programs, mostly related to treating lymphoma, grew revenue 46 percent over the last two years to more than $2.29 billion, making up 16 percent of revenue compared to less than 13 percent in 2017.

Two other revenue streams are experiencing strong top-line growth. Biogen's Spinal Muscular Atrophy (SMA) treatment SPINRAZA has grown revenues nearly 140 percent since 2017 and accounted for more than 14.5 percent of revenue in 2019 compared to 7 percent in 2017. Meanwhile, biosimilars - mainly used to relieve arthritis - grew revenues 94 percent since 2017 to more than 5 percent of revenue in 2019.

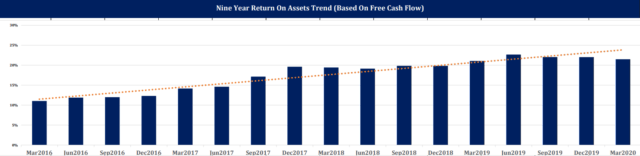

Based on comments from management, R&D efforts seem roughly evenly split between increasing the efficacy of existing drugs and earlier-stage tests of potential drug candidates. From 2017 to the end of 2019, total operating expenses grew just 8 percent while gross profit grew 16 percent. These factors have driven Biogen's long-term increase in return on assets.

Source: Risk Research

Patents, New Drugs

The patent of Biogen's drug TECFIDERA was challenged in 2019 by generic drug maker Mylan (MYL). Courts decided in Biogen's favor in early 2020, but an appeal process is ongoing. It seems likely Biogen will retain its original rights to the formula through 2028. More details on the case can be found here.

Biogen is also nearing certification of aducanumab, a drug that could reduce the cognitive and functional decline caused by Alzheimer's disease. Stage 3