We seek companies with fortress balance sheets, at reasonable valuations with high returns on equity and free cash flow. While we monitor and data mine over 400 high quality names daily for new ideas, we recommend investors not ignore the power of the tech megacaps.

As the global economy migrates online, and lately at an accelerated pace, we continue to advocate investors own many of the FAANG equities. Below we examine Facebook, Apple, Amazon, Netflix, Google and Microsoft. (We do include Microsoft in this bucket too, but FAAMNG sounded as strange as MANGAF).

Networks externalities, huge moats, and virtual oligopoly business models, the FAANGs have carved out niches that even the most casual investor cannot ignore. Naturally entry point is critical, and we have notified our subscribers when to buy in the past.

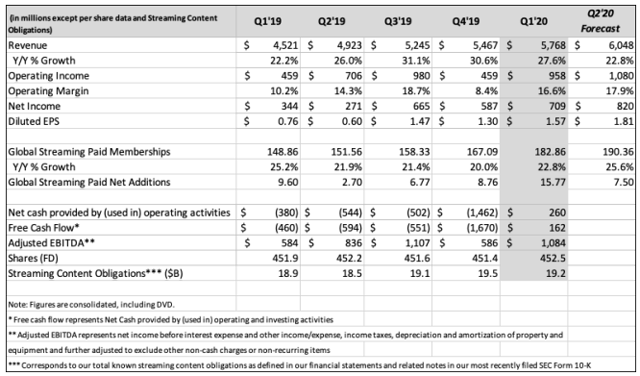

Below we summarize our take on earnings, with forward projections and valuation implications.

Amazon (NASDAQ:AMZN)

Current Price: $2306

Target: $3000, Add price $2000

We initiated on Amazon last month here. It is up a bit over 20%, and we continue to like the name. Revenue growth accelerated as expected in the quarter, up 26%, from normally high teens levels.

On the negative side, margins will be dramatically lower in the second quarter, as Covid-19 spending will approach $4BB. Much of this is one time in nature. Face masks, extra cleaning, re-routing orders to enable social distancing, and extra overtime pay as demand has spiked. Impressively, revenue growth is expected to remain at markedly higher levels, with guidance between 18-28% next quarter.

Net net, 2020 looks better on a top line basis, but lower on an earnings and FCF basis.

The company's Amazon Web Services (AWS) business exceeded expectations, growing topline 33% year over year, with EBIT up 36%. It totals almost 70% of the company's EBIT today, and in conjunction with Microsoft, will own the cloud business for years to come.

Competitors and suppliers I have spoken to in the space suggest a “roach motel” type strategy, whereby AWS bids extremely aggressively to capture business, but later raises prices. While I am far from an expert in the field, most agree that migrating an enterprise from AWS to another cloud provider is an exceedingly difficult undertaking.

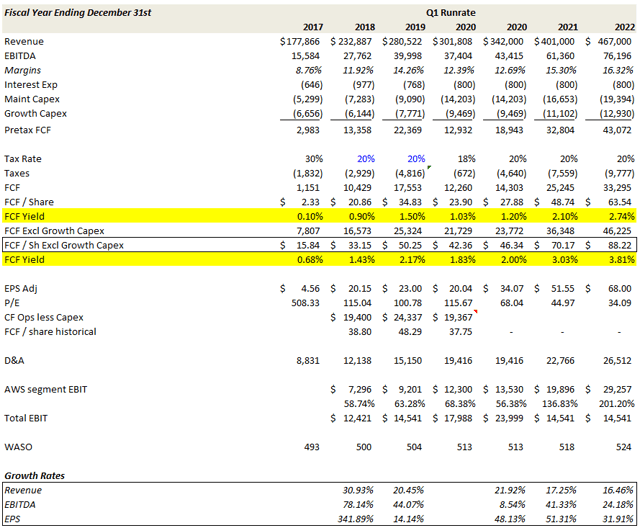

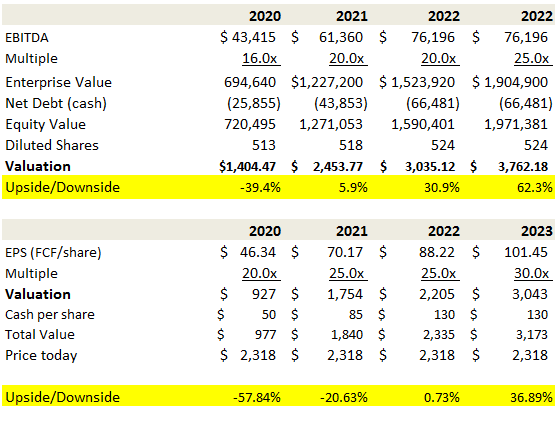

Below is our summary free cash flow model.

Source: Author spreadsheet

Note that our EBITDA figures are lower in 2020, but a bit higher in future years. Below is a range of valuation scenarios, using FCF per share metrics in lieu of earnings, as well as EV/EBITDA multiples:

Source: Author spreadsheet

While the upside/downside appears much more balanced than a month ago, we still like the longer term outlook, and put higher probabilities on the above positive outcomes. $977 to $1400 seem to be low probability prices, but is our most pessimistic, Great Depression scenario.

By 2021 at the latest, Covid-19 expenses should moderate, especially overtime pay and distribution routes / workflows which have been disrupted. Among its peer group, MSFT trades at 20x EBITDA. AMZN with better revenue growth and scale potential should be worth more.

My fair value estimate is a 20-25x EV/EBITDA multiple range, which puts the stock over $3000 in a couple of years. I would add to my position at $2000.

Our long term thesis: AWS will grow rapidly for the next two to three years, and retail margins will continue to improve as the company gains scale and fully builds out its global distribution network.

While AMZN used to be a razor thin margin online retailer, we note today that many product are now premium priced. The ease of purchasing, consumers love of the Amazon brand (number three in the world), the value embedded in an Amazon Prime membership, all add to the allure and stickiness of their customers.

We also like that Amazon is turning the corner from a free cash flow perspective, and has a net cash balance sheet.

Google (NASDAQ:GOOG)

Current Price: $1319

Target: $1600+, Add price: $1200

Google revenue grew 13% in the first quarter, EBITDA was up 6%, but adjusted EPS came in $13.41 vs $15.08 a year ago. On a GAAP basis, EPS (before gains and losses on marked to market investments) was $10.79 vs $10.81 a year ago.

Seasonally the first quarter is the weakest, and Covid-19 impacts to advertising will weigh looking forward.

From a metric perspective, Google is performing exceedingly well. Search activity has spiked, YouTube viewing is up significantly, and Android App downloads are up 30%. The Company has also seen a “massive increase in demand” for Chromebooks.

Their Zoom competing product, Meets now has over 100mm daily participants (and it is free for now, ZM shareholders be warned). But the core business of selling ads will be quite weak in Q2 and likely in Q3 too. On the plus side, Google ads can be turned back on rapidly (as the economy reopens).

End of March disclosures on their call gave us a sign of things to come: search ad revenue growth dropped in the mid-teens percentages. YouTube advertising grew only in the high single digit range. Google Cloud killed it up 52%.

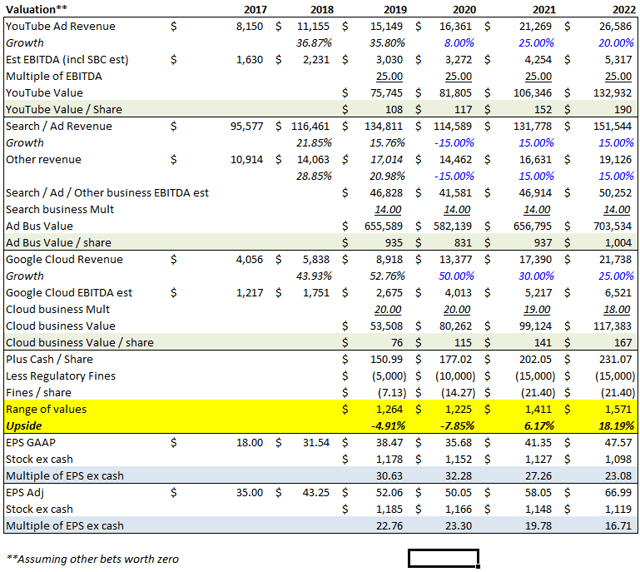

Below is our sum of the parts model, updated for Google’s new segment reporting. Notably we excluded any value from the company's Other Bets. Even though they are losing money from an operating perspective, Other Bets including investments like Waymo could be worth another $100 per share.

Monetizing Google Maps or the Android businesses also offer material upside potential in time too.

Source: Author spreadsheet

Putting these trends into our model suggests upside to GOOG, but less so since our buy suggestion on March 26th. In yellow above, we put a valuation range of $1264 to $1571 on the stock, but acknowledge that it could trade to perhaps $1000 to $1100 in a bad tape. Looking beyond 2021, and upside becomes even more attractive. We continue to foresee years of secular growth at Google.

Our simple downside math entails using $50 in (depressed) EPS this year at 20x, plus cash of $150 per share. That adds up to $1150 on the equity. So, purchasing at $1200 should offer limited downside, and solid upside. I frankly would not be surprised to see Google hit $2000 in two to three years, particularly if regulatory issues are resolved.

We wrote up Google last summer here. It has outperformed the market nicely, and is admittedly one of my largest holdings.

Facebook (FB)

Current price: $205

Target: $235+, Add price: $180

The most impressive of the FAANG’s earnings, Facebook (FB) not only had a solid quarter, but also reported flat advertising trends through the first three weeks of April (looking year over year). User metrics improved, with daily active users growing 11% in Q1 (vs 8% in prior quarters).

Ad prices dropped and, similar to Google, Facebook is seeing weakness in advertising demand. FB plans to cut costs from $54-59BB this year to a range of $52-56BB. FCF improved quite a bit in the quarter, with cash flow from ops up 20% to $11BB and capex falling $300mm to $3.55BB.

An easier name to model, we expect numbers similar to Street expectations.

Source: Author spreadsheet

With $19 in cash per share on the balance sheet today, and using a conservative $8 in 2020 EPS at 20x, suggests a $179 price tag for FB.

We view that is a solid entry point.

We recommended adding shares in the mid 150’s in March, as well as selling out of the money puts. Based on user metrics and accelerating trends in advertising, our upside case has meaningfully improved.

There is the thorny issue of a weak second and third quarter in front of us. But as long term investors, we are focused on the improving user base and earnings upside when advertising returns.

In our base case, FB should trade to at least a 20x P/E multiple next year. At $10.70 in 2021 EPS, plus $20 of cash, we get a $234 valuation. Our cash per share figures already assume a $5BB incremental FTC fine.

Regulatory risk remains an overhang on the stock, more so than the other FAANGs. But, a breakup of the company appears a far lower probability than in the past. FB has been creating goodwill amongst the public again, with better privacy disclosures and helpful Covid-19 information for users. We anticipate that fines, not a breakup, will ultimately help FB re-rate much higher, perhaps back to its historical 25x multiple.

Facebook's proposed regulations are just things it's already doing

Netflix (NASDAQ:NFLX)

Current Price: $427

Upside: Unclear. Add price: $300

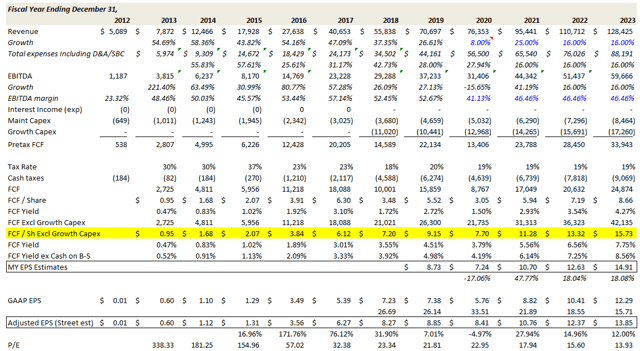

Netflix reported impressive subscriber and top line growth, summarized here.

While arguably a great stock to own amidst this pandemic, Netflix is burdened by several factors:

- Disney+, HBO MAX, Apple, Amazon Prime and Peacock are, or are going to be, fierce competitors. We view HBO MAX as a close comp, with huge quantities of new content (500 hours per year), as well as a massive library of must-watch TV (some flowing from Netflix to HBO MAX like Friends and the Office). HBO MAX launches in late May too.

- Limited historical free cash flow (nay, consistently negative FCF), as well as content cost inflation as better capitalized competitors amp up spending. Their balance sheet is fine, but carries debt as they must finance significant content spend every year.

- Stretched valuations, particularly as their markets mature and competition heats up. At 84x earnings and 32x 2021 EBITDA, we are left scratching our heads a bit.

While the quarter was solid, growth will likely slow to the mid to high teens in 2021. Covid-19 continues to pull forward demand, and against new streaming apps in the coming months, makes for tough comps next year.

There could be continued momentum buying and growth capital continuing to shift into Netflix, but we don’t view these as factors that can overcome its inflated valuation.

Indeed, NFLX growth next year will not be dramatically different vs Google for example, and yet it trades at 2-3x the multiple. Perhaps the lack of regulatory overhang at Netflix puts it in the "safe" bucket. But we see little safety at over 80x earnings.

At 25x next year’s EBITDA, our view of fair value, Netflix would trade at $316. With the stock at $427, it appears quite rich.

Below $350 and it gets pretty interesting again.

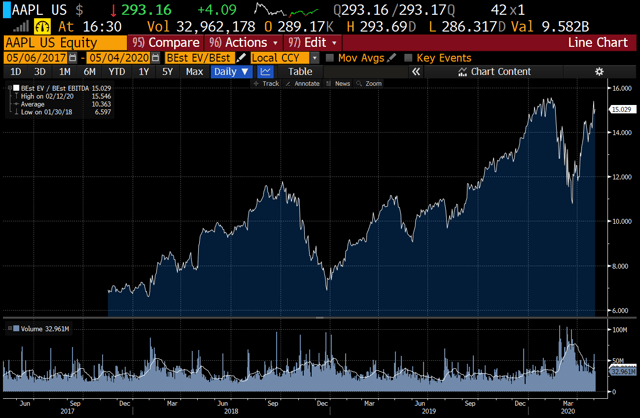

Apple (NASDAQ:AAPL)

Current Price: $293

Target: $300-325, Entry Price: $225

I have not updated models for the last two FAANGs (Apple and Microsoft).

I have owned Apple multiple times in the past, and written it up many times on Seeking Alpha. But those were the days when it was trading at 10-12x earnings. At 23.5x earnings, I am on the sidelines.

Revenue has been roughly flat since 2018, with most EPS growth coming from share repurchases. It is a great company, and a Compounder worth owning. But Apple is a maturing business, with less of a moat than some of the other FAANGs. Astonishingly, it trades at a multiple higher then when it was growing 30-50%.

Even with the market at a stretched 20x earnings multiple today, I would consider paying that at most for AAPL shares. EPS probably shakes out to around $12 this year, so that implies a $240 entry price. Our $300 price target assumes 20x next year’s $15 in EPS.

I confess to owning all the Apple gadgets, from phones to laptops to watches. The balance sheet is great, and Tim Cook is as smart and hard working as they come. But I question the impact that Covid-19 will have on demand for expensive iPhones over the next few months.

I have seen this name trade irrationally many times in its history, and fully expect we will see a better entry point. Should Apple trade to its historical 15x P/E multiple, then it could easily drop below $200.

Below are a couple of valuation charts of Apple (P/E below):

Here is another one illustrating its EV/EBITDA multiple since 2017.

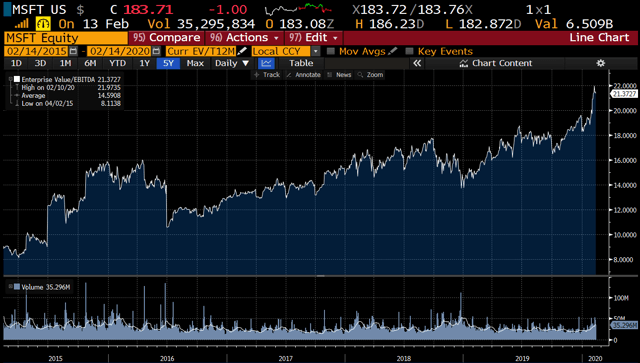

Microsoft (NASDAQ:MSFT)

Current Price: $179

Target: $200, Entry Price: $142

Microsoft appears also to be trading at valuations not seen since 2003. I cannot say enough good things about Satya Nadella, who has transformed MSFT from a chaser of others' innovative products/software (and often paying gigantic multiples on terrible businesses), to building on their lead in Office and Windows with a fantastic Azure cloud business.

But again at record high multiples, I will have to wait for a better entry point.

Microsoft perhaps is the new Visa, and may never trade below what should be a 25x multiple stock.

Here it is on an EV/EBITDA multiple basis over the past few years.

At 25x earnings, Microsoft would trade at $142. To me that is a fair value for a 15% EPS growth name.

At 30x forward earnings, Microsoft would trade to $186, just a hair above its current price.

I confess to missing this boat in March at $140 (where it traded for about a week). Anyone else remember when you could buy Microsoft for 10x earnings? I still recall Einhorn pitching MSFT at that multiple in 2011 at the Ira Sohn conference, and calling for Ballmer to resign (who was simply a terrible steward of capital).

Conclusion

We like and recommend Amazon, Google and Facebook. The advertising cycle will be tough however in the near term. But secular moves to online ad venues likely continue and may even accelerate in the coming few quarters.

While the value investor may balk at paying 20x multiples, we see no problem owning near monopolies like Facebook or Google, with years of growth to come there. The S&P 500 trades even higher than 20x at this point.

With less regulatory risk, Apple, Microsoft and Netflix have been rewarded with perhaps inordinately rich valuations. But if your investing time horizon exceeds the duration of the regulatory review process, then even better upside awaits the FB/GOOG holders.

Thanks for reading! I have recently launched a Marketplace service entitled Cash Flow Compounders: The Best Stocks in the World. These are high return on equity, high free cash flow stocks with a proven track record in compounding earnings at higher than market rates. There I will provide my BEST 2-4 ideas per month. My picks going back to 2011 have produced 23.9% annual returns, putting me well within the top 1% of bloggers (TipRanks). Sign up for a free 2 week trial to get my latest ideas!