DISCLAIMER: This article is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this article is not an offer to sell or buy any securities. Nothing in it is intended to be investment advice and it should not be relied upon to make investment decisions. Cestrian Capital Research Inc or its employees or the author of this article or related persons may have a position in any investments mentioned in this article. Any opinions or probabilities expressed in this report are those of the author as of the article date of publication and are subject to change without notice.

First, That Big News In The Small Article

Take a look at this note. Pretty nondescript, right? Just the normal vendor-press-release type stuff.

We think not.

We think this is a big deal.

But first, let us walk you down recent memory lane.

Then, we'll explain.

A Glance At The Abyss

Maxar Technologies (MAXR) is a company on a mission. Through 2018 and most of 2019 the company was peering into, if not the abyss, then certainly a rather deep, disused and flooded mine shaft. This was due to the unwelcome combination of (1) a balance sheet jacked up with leverage from overoptimistic leveraged acquisitions carried out by the former management team and (2) a revenue, EBITDA and cashflow shortfall caused by the on-orbit failure of one of the company's Lockheed Martin (LMT) built remote sensing satellites. The consequences of these dual pressures on the stock have been much discussed in these pages and elsewhere. In short, it wasn't pretty. This is the stock on the way down.

Source: YCharts.com

The market punished the stock for having a balance sheet with unsustainable levels of debt versus its cashflows, which were net negative (after capex and change in working capital) for much of the above period. OK - so far so rational.

The Story Leads The Stock

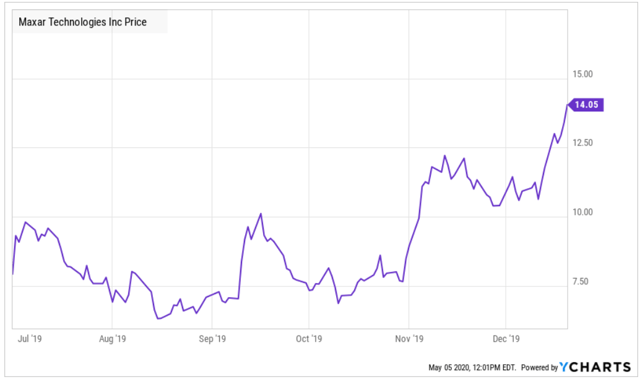

In the second half of 2019, the market became irrationally optimistic on the stock in our view. You can read our posts about that here on SeekingAlpha. (Our non-subscriber articles on MAXR can be found here). The management team were talking a good game about staying ahead of the company's debt covenants, of doing a deal here and a deal there to keep the wolf from the door (a sale and leaseback of the Palo Alto office, that kind of thing). And a small refinancing of the most urgently-due debt took place, leaving the company with a short-dated high-yield issue costing c.10% interest per annum.

The stock doubled. Overly optimistically, in our view. After all the balance sheet remained structurally challenged - too much debt and no particular way to repay it. Along the way the management team had added a poison pill meaning a sale of the business was less likely. Which we didn't, and don't, think is shareholder-friendly. So all in all we thought the move from $7-ish to $14-ish was too racy by half.

Reality Improves

The game changed on 30 December last year, when MAXR signed a deal to sell its MDA division to a private equity fund, for a price of CAD$1bn, paid in cash. This was a huge achievement by the management team. The deal was expected to close sometime in Q2 or maybe Q3 of 2020, with the usual completion hurdles to cross - antitrust and other regulatory matters. Then came the Covid-19 crisis, which caused the market to worry that this transforming deal would fail to close. This wasn't a baseless concern - other such corporate sales to private equity are currently falling by the wayside. MAXR handled this concern directly, issuing a press release saying that the deal would not be impacted by the Covid-19 situation. Good news, right?

Apparently not. The market swooned, thinking that it was being sold a dummy. But just a few weeks later, the deal completed ahead of time, on the agreed terms. Again, nice work by the MAXR team. CAD$1bn (about $US770m at the time) brought in to ease the balance sheet difficulties.

Upcoming Catalysts

The key catalyst for a step-up in the stock is proof that the vertically integrated business model can work. Specifically, that the company's SSL division can successfully build the new "Legion" class remote sensing satellites and then have them launched, put on orbit, and made operational. This isn't a given. There is plenty that is new to SSL about the new spacecraft and as a result plenty of operational risk. Well, there was news on that front last week. Big news. Doesn't look like big news. But we think it's big news.

The company announced that it was working live with Raytheon (RTX) to complete the build of the spacecraft (RTX provides componentry) and, further, that launch slots had been booked with SpaceX in 2021. Now, as we understand it, booking launch slots in this busy time for the space industry requires a cash deposit. And so we assume that MAXR has placed a cash deposit for its launches. Which means the whole Legion project just got a lot more serious - in other words it is all looking a lot more likely to happen than was the case last year.

Why we say this is big news is - given that last time the company made a statement of intent - that "the MDA sale is going to happen" press release - the intent came to pass, so we are inclined to believe the company this time around too. If Legion satellites get on orbit in 2021 and start performing to spec, we think that can be a big catalyst for the stock. We don't think the market is factoring that in at this point. Right now you can buy the stock for somewhere between $10-$12 most days - the same price it was at in mid December before that CAD$1bn sale was announced.

In addition, there's a more speculative prize on the horizon - one we ourselves discount but we're more cynical than most. The Canadian satellite telecoms company Telesat (owned by Loral (LORL) and PSP Investments, one of the larger Canadian state retirement systems) is due to procure a fleet of low-earth-orbit communications satellites for a new constellation it plans to launch. MAXR, again through its SSL division, is rumored to be competing for this contract. Were MAXR to secure the business that would be great news for the stock and, we hope, would lead MAXR's team to sell the lumpy, low margin SSL unit and focus MAXR on its recurring revenue, high value services divisions. We think that MAXR is less likely than others to win the Telesat contract, for the sole reason that Telesat will, we believe, assign a high value to vendor financing in vendor selection. MAXR is highly unlikely to be able to provide vendor financing - that balance sheet rearing its head once again. However, so far we have underestimated the MAXR team and we would be happy to be wrong on this one. If MAXR wins the Telesat contract, on top of Legion success, then that can push the stock up further.

In short, this is a company where the fundamentals are getting better by the month, but where the stock is still priced as if the company were circling that mine shaft. We remain at Buy as a result.

Cestrian Capital Research, Inc - 5 May 2020.

Thanks for reading our note. If you enjoyed it, try our SA subscription service, The Fundamentals.

We operate the ONLY space-sector service on SeekingAlpha.

Here's what you get:

- Deep sector expertise & broad coverage in the space sector.

- Pro-grade analysis, easy-to-understand presentation.

- 100% independent, clear and direct opinion of stocks' prospects.

- Long-term investment picks and short-term trading ideas.

- Absolute alignment with our own investing. We run a real-money service and we give you the heads up on every move we make. Any trade we make, you get to trade first.

We speak directly to our covered companies, often at CEO level.

Click HERE to learn more!