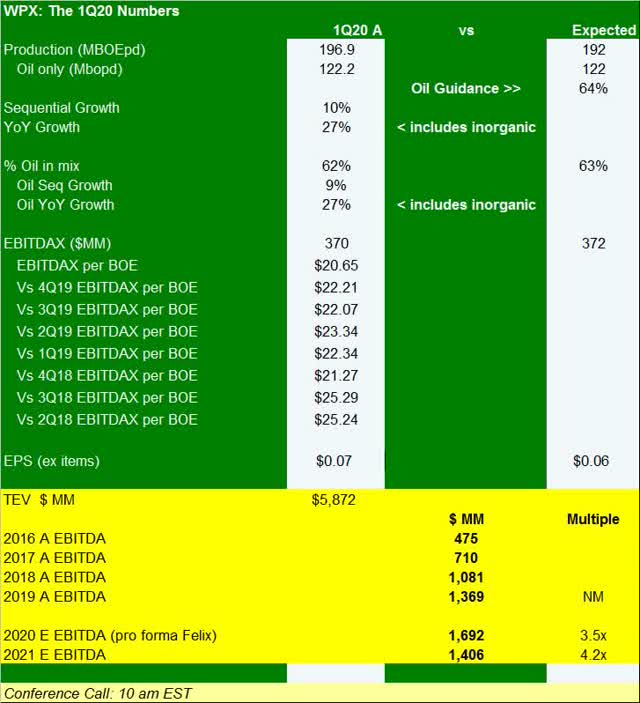

This is a Z4 Research Quick Pre Call Update

Be aware when viewing the 1Q20 numbers.

- They closed the Felix deal on March 10th adding ~ 60 MBOEpd and taking full volumes to > 250,000 BOEpd (62% oil).

- Volumes and costs were as expected and the bottom line was in line.

- Few will care about the rearview mirror of the quarter in light of new guide posts for guidance noted below.

Guidance:

- Capex Guidance: Chopped again with two scenarios outlined below (cutting an additional $150 to $450 mm depending on which path they decide to follow). This takes spending well below prior guidance of $1.338 B (mid point) which itself was a downward revision in March from the original midpoint of $1.738 B.

- WPX had 15 rigs running late in the first quarter and now sees exiting 2020 at just 6 (5 Delaware, 1 Bakken).

- They had 4 completions crews which are all now stacked and they're build a bit of DUC inventory in preparation for 2021.

- Production Guidance: Suspended (sort of). Prior guidance midpoint was 235 MBOEpd (64% oil). Based on two scenarios of when they get back to work they have guided 2020 exit rates.

- Scenario 1 - resume completions in 3Q20, budget at $1.2 to $1.3 B: in this case oil production exits year at 130 Mbopd (vs 122 average in 1Q which had the partial quarter of Felix in it) and maintenance in 2021 is $650 to $700 mm.

- Scenario 2 - resume in 4Q, budget hits the lower end at $0.9 to $1.0 B; oil production exits year at 130 Mbopd and maintenance in 2021 is $650 to $700 mm.

- Both of these budgets assume oil at just $35 in 2021 and maintenance in both cases driving a cash neutral to $100 mm free