Overview

Agilent Technologies is a good business protected by a strong moat with ample room to grow. Bill Ackman and Pershing Square initiated a position in Agilent late last year around the current share price, so I decided to take a more in-depth look to assess the potential.

While I may not be quite as bullish as Ackman, I think Agilent should produce respectable 10%+ returns from current levels with solid upside. The stock is a great investment anywhere below $65, levels it has touched multiple times over the past year, likely producing at least mid-teen’s annual returns for several years.

After a quick industry overview I will do a deeper dive into the structural advantages of the business and discuss prospective returns

Industry

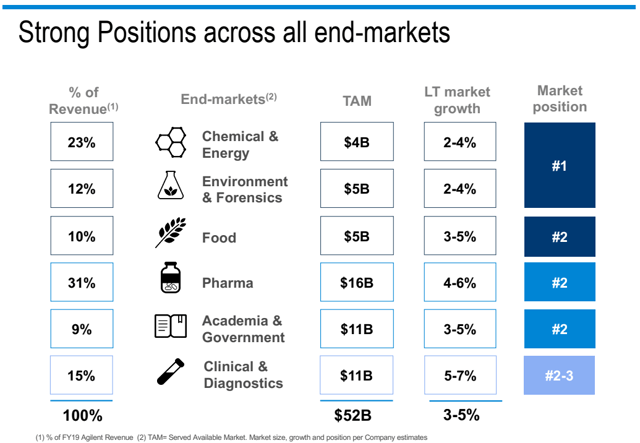

Agilent competes in the analytical measurement space and provides instrumentation, consumables, and services to testing labs across the world. The company operates in three reportable segments: Life Sciences and Applied Markets, Diagnostics and Genomics, and CrossLab. Each of these segments serve the attractive and growing end markets below.

Source: Q3 2019 Institutional Investor Meeting

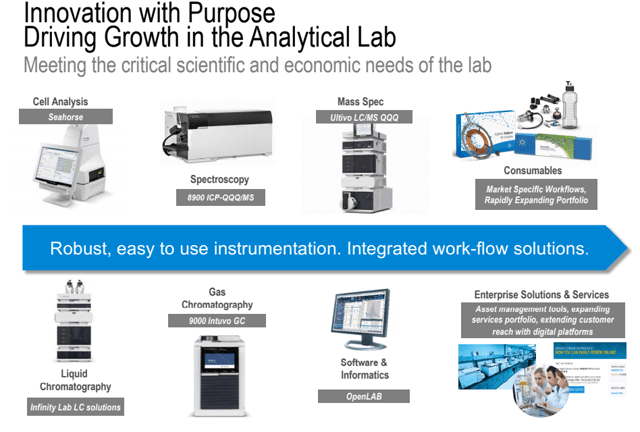

Agilent essentially supplies instrumentation such as chromatography machines, mass spectrometers, and cellular analysis devices along with the associated software and consumables (like test vials and reagents). The equipment is used to perform tests such as cancer and DNA diagnostics, chemical properties of drugs and food, and environmental contamination.

Source: Q3 20129 Institutional Investor Meeting

The nature of the industries served and services provided lead to an attractive business model and a number of structural advantages.

Competitive Position

Agilent checks several boxes that I look for when identifying businesses with enduring competitive advantages that lead to attractive economics. Specifically, the company essentially operates in an oligopoly and enjoys high switching costs across a vast client base.

Oligopoly

Agilent operates in an oligopolistic space