In this article, we examine the significant weekly order flow and market structure developments driving NYSEARCA:GDX price action.

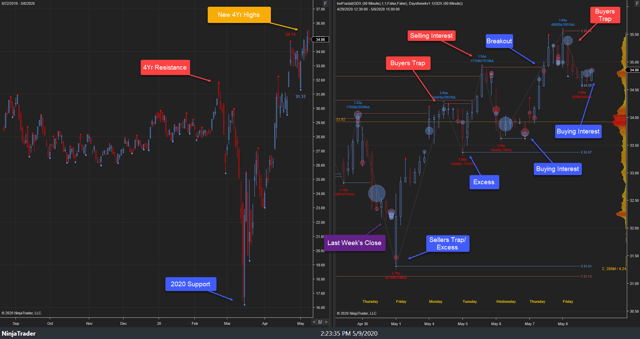

As noted in last week’s GDX Weekly, the highest probability path was for price discovery higher, barring failure of 31.84s as support. Balance developed, 34.25s-33.37s, early week near key resistance. A buy-side breakout attempt and subsequent pullback developed in Tuesday’s trade as buying interest emerged, 33.73s, before the rally resumed to 35.56s where sell excess formed, halting the rally ahead of Friday’s close, settling at 34.86s.

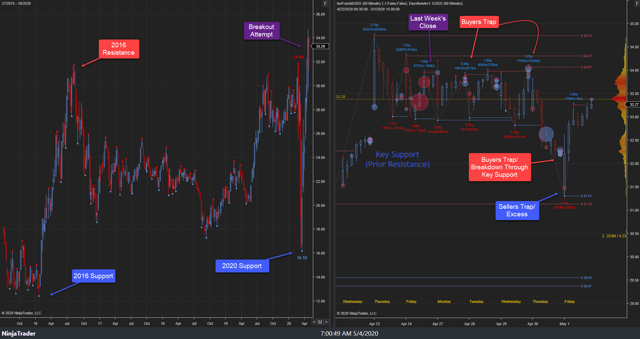

04-08 May 2020:

This week’s auction saw minor price discovery higher to 34.25s in Monday’s auction as last week’s late buyers held. Buyers trapped at Monday’s high, halting the rally as a minor pullback ensued into Monday’s close. The pullback continued early in Tuesday’s trade, achieving the weekly stopping point low, 33.37s. Buy excess formed there, halting the pullback before the rally resumed amidst a buy-side breakout through key resistance to 34.91s. Sell excess formed there, halting the rally as selling interest emerged, 34.81s/34.75s, into Tuesday’s close.

Tuesday’s late sellers initially held the auction as the pullback continued to 33.62s in Wednesday’s auction. Buying interest emerged, 33.73s/33.69s, into Wednesday’s close. Wednesday’s late buyers held the auction as the rally resumed to 35.49s in Thursday’s trade, driving price higher through Tuesday’s resistance as sellers failed there. A minor probe higher developed, achieving the weekly stopping point high, 35.55s, early in Friday’s auction. Buyers trapped there amidst sell excess, halting rally. A minor pullback ensued to 34.58s ahead of Friday’s close, settling at 34.86s.

This week’s auction saw the rally phase continue to 35.56s, challenging the April high, 34.74s. Within the larger context, the larger buy-side breakout through 31.84s, four-year resistance, continues to hold.

Looking ahead, the focus into next week will center upon market response to key resistance, 34.75s-35.56s, within