This article first appeared on Trend Investing on April 8, 2020; therefore, all data is as of this date.

In this 'coronavirus beaten down stocks/funds' series of articles I look at both stocks and funds that have been beaten down due to the COVID-19 (coronavirus) market sell-off and are near or below their 5 year low, are very well valued, and have potential to rebound strongly as we recover.

Today I look at Canada, a market that has been heavily sold off towards a 5 year low, and trades on a PE ratio of just 10.6.

Canada

iShares MSCI Canada ETF (NYSEARCA:EWC) - Price = USD 22.26

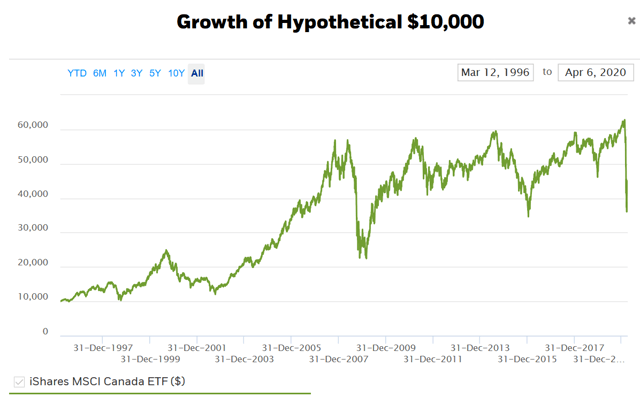

As shown on the charts below the EWC fund is now back near its 5 year low or the 2015 low. The EWC fund is down 27% from its peak from early Feb. 2020.

iShares MSCI Canada ETF fund - 5 year price chart (in USD)

Source: Bloomberg

iShares MSCI Canada ETF fund - 25 year performance chart (in USD)

Source: iShares.com (Canada)

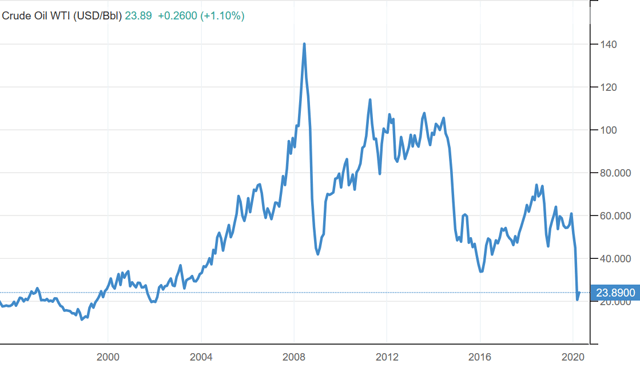

A 25 year oil price chart - Dips in 2008, 2015 and now

The chart below shows the oil price dips of 2008, 2015, and 2020. Note how these match up with the chart above for the Canada ETF.

A 25 year chart comparing the TSX index [blue] with the US S&P 500 [green]

The chart below shows that the TSX and S&P 500 ran parallel from 1995 to 2012. From 2012 to 2020 the US S&P 500 moved significantly ahead mostly due to the US tech boom doing well, and the Canadian mining based economy battling along.

Source: Yahoo Finance

A look at what drives the Canadian economy

According to Wikipedia:

(Canada) is the 10th largest GDP by nominal and 16th largest GDP by PPP (Purchasing Power

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles: