The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.

- Marcel Proust

Introduction

First, I would like to greet my new readers and thank you for all the thoughtful engagement in my last article on Berkshire Hathaway (BRK.B) (BRK.A). As there were some requests, I promise to share my ancillary notes from the Berkshire Hathaway Annual Shareholder's Meeting. Keep a lookout for it on Seeking Alpha or on Twitter, where I'm active most days.

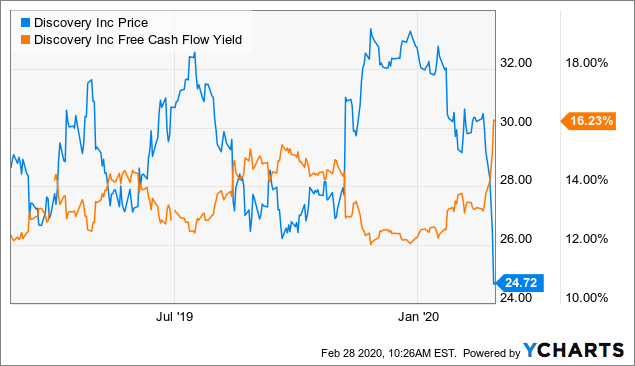

Today's article is part 1 of 2 on Discovery Inc. (DISCA) (DISCB) (DISCK). I first mentioned the company in my article on 4th March titled Capitalizing on the Correction. At this point the market had fallen -11.69% while Discovery, which was showing a free cash flow yield of 16% had fallen from $32 to $24.72, or -18%:

Since then, the class A shares (used in the graph above) have traded lower to approximately $20 (at 14th May 2020).

I was in the process of evaluating their recent quarterly earnings to update Seeking Alpha readers, when I started discussing the company with some fellow investor friends. We had all noticed in the last month the strange trading in the three listed securities of the company, made apparent because of the increased market volatility in March and consequential margin calls. Since some of this group and I have been observers and owners of the company for a long time, and intend to be for the medium to long term - barring any deterioration in the product, service of underlying business - we felt necessary to reach out to management and express our concerns.

What follows is an open letter to the management team and Board of Directors of Discovery Inc. In a separate article (Part 2) I shall