Quick Take

Castle Biosciences (NASDAQ:CSTL) went public in July 2019, pricing its IPO shares at $16.00.

The firm is commercializing cancer diagnostic and prognostic testing products and services.

CSTL has grown revenue and gross profit at an impressive trajectory and the firm expects to launch its next predictive skin cancer test by the end of 2020.

My bias on the stock is Bullish.

Company

Friendswood, Texas-based Castle Bio was founded in 2007 to bring ‘actionable genomic information to the diagnosis and treatment of skin and uveal cancers.’

Management is headed by founder and CEO Derek Maetzold, who has held senior roles at Encysive Pharmaceuticals, Schering-Plough, Amylin Pharmaceuticals, and Sandoz Pharmaceuticals.

Below is a brief overview video of one of the firm’s tests:

Source: Castle Biosciences

The firm has developed or is developing genomic tests for skin and uveal (ocular) cancers as follows:

Customer Acquisition

Castle sells its testing services via a direct sales force and also has a ‘medical affairs group’ which it uses to educate physicians and enhance its marketing efforts.

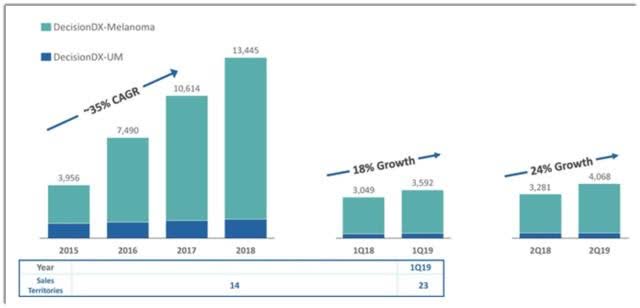

Below is a company chart on the growth in number of genetic profiling reports in recent years:

Market

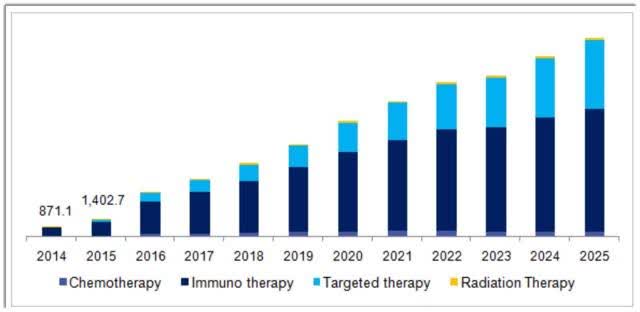

Skin cancer is the most common form of cancer in the U.S. According to a 2017 market research report by Grand View Research, the melanoma therapeutics market was $4.2 billion in 2016.

The market was expected to grow at a CAGR of 11.21% from 2014 through 2025, as shown in the chart below:

Per the World Health Organization, 132,000 cases of skin cancer are diagnosed each year, with a forecasted increase of 4,500 cases worldwide as a function of the reduction of ozone levels in the years to come.

The Asia Pacific market will likely grow at a strong rate due to a rise in the incidence of skin cancer

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!