The TJX Companies (NYSE:TJX) reported its Q1 2020 results on May 21 which coincided with a strong day for apparel retail stocks in general. The stock ended the day up ~7% at closing while its peers also enjoyed a strong day including ~7% gain for Ross Stores (ROST) and 10% gain at Burlington Stores (BURL). We think TJX represents a leader in the off-price channel that is better-positioned than many other retail segments, especially in the face of the pandemic and potential economic repercussions for the years ahead.

2020 Q1 Review

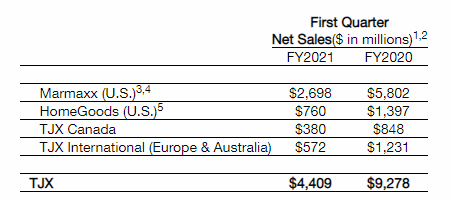

TJX reported 2020 Q1 results that included partial impact from the virus and accompanied store closures. The first quarter covers the thirteen weeks ended on May 2, 2020, and results were significantly impacted by store closures that began on March 19, 2020. The company was forced to furlough most of its store employees and began reopening its stores beginning on May 2. So far, the company has opened more than 1,600 of its locations and it is actually seeing sales above last year's comparable period. Management expects to reopen most of its stores by the end of June subject to the health situation. Clearly, investors are looking past the Q1 results and potential impact on Q2 performance due to the shutdown. Management also provided very reassuring comments on the momentum before the pandemic hit. For example, TJX saw +5% comps growth for all four divisions in February. The key takeaway from the Q1 earnings is that there has been a strong rebound in sales after stores are reopened and there is no indication of permanent damages to consumer demands based on the trends observed thus far.

(Source: Press Release)

COVID-19 Impact

It is not surprising to hear from TJX that sales in stores that were reopened for more than a week experienced stronger sales than last year. There are lots of pent-up demand from consumers for various items such as clothing, accessories, and home decor. E-commerce is becoming more prevalent and convenient, however, the in-person shopping experience and treasure-hunt feeling still attracted many shoppers to TJX stores. The company also benefited from having many locations in strip malls and close to grocery stores where foot traffic remains strong.

A key benefit of this crisis for the off-price sector and industry TJX is the abundance of merchandise at discounted prices going forward. TJX took a $500 million inventory mark-down during the quarter for off-season items but the company is much better prepared from an inventory perspective due to its business model that relies on less inventory and faster inventory turnover. TJX has an inventory turnover of around 5x. Other full-price retailers such as Macy's (M) reported inventory turnover of ~3.0x, Kohl's (KSS) at ~3.7x, and JC Penney (JCPNQ) at ~3.3x. Management expressed optimism that once the existing inventory is cleared in Q2 it will be able to capitalize on the market chaos to acquire great merchandise at deep discounts.

In terms of TJX's product offerings, the company has about 50% of its 2019 revenue from clothing with large assortments in home goods and accessories at well. The company has taken steps to reduce its variable costs which accounted for 35% of the total non-inventory expenses. However, it still incurred large sums of fixed expenses and employee costs during the shutdown period. It issued $4 billion of senior notes with an average interest rate of 3.85% in addition to drawing down the full $1 billion from its revolver. It cut its dividends temporarily and has suspended share buybacks. Lastly, it reduced its 2020 capital expenditures from $1.4 billion to $400-$600 million.

E-commerce has always been a tiny part of the off-price model and accounted for 2% of TJX's revenue. Burlington Stores (BURL) even shut down its online site due to its inability to make a profit. The lack of e-commerce presence is a result of the unique purchasing model at TJX that depends on opportunistic purchases based on merchandise availability and fast inventory turnover. The smaller ticket size also makes a full-fledged e-commerce operation difficult to maintain considering how little contribution it made to overall sales.

Valuation and Performance

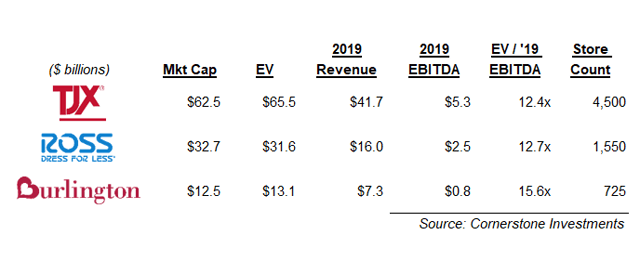

TJX currently has a market cap of $63 billion and trades at an EV/2019 EBITDA of 12.4x. Given the significant uncertainty in 2020 or even the 2021 forecast, we think it is prudent to use 2019 financials for comparison purposes. The stock is valued similarly to its closest national competitor Ross Stores (ROST) while the smaller Burlington Stores enjoys a higher multiple due to its bigger whitespace and room for margin improvement. TJX has grown its revenue at a CAGR of 7.5% during the past five years which supports its low teen valuation over struggling retailers such as department stores.

(Source: Public Filings and Bloomberg)

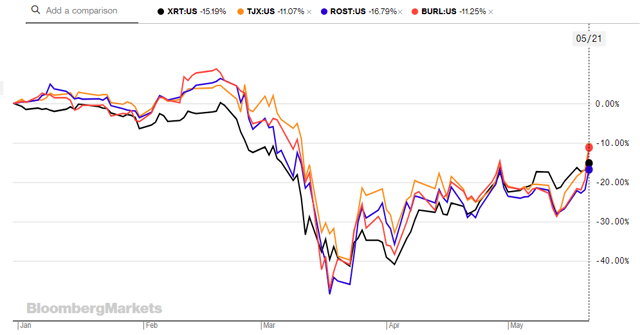

In 2020 so far, the off-price sector has performed in-line with the broader retail industry. The SPDR S&P Retail ETF (XRT) declined 15% this year so far while TJX dropped 11%. The ETF is skewed by certain e-commerce names included in its top 10 holdings including Wayfair, Etsy, Amazon, Chewy, and eBay. Historically, the off-price retailer has performed well during recessions as consumers trade down during tough economic times. Given the current pandemic and potential for a prolonged period of weak economic growth, we think the off-price segment represents an attractive sector that is worth taking a look for investors looking for contrarian bets.

(Source: Bloomberg)

Looking Ahead

TJX is the leading off-price retailer in the world and differentiates itself from Ross and Burlington with its global footprint and a wider array of sub-brands and merchandise categories. The company reported Q1 results that were significantly impacted by the virus-related shutdowns but management provided a strong indication of upcoming recovery. As stores began to reopen, initial results were encouraging as shoppers returned for good deals. We think the company is well-positioned financially and strategically to capitalize on the expected shakeout in retail. TJX is likely to be one of the survivors in retail and has the opportunity to grab market share from traditional department stores. Investors looking for recession-resistant contrarian bet could consider TJX within the retail space. For investors looking for a higher growth name in the off-price sector, Burlington Stores offers better growth prospects albeit at a higher multiple.