Thesis

Alteryx (AYX) is a leading player in the business analytics space and is riding multiple market tailwinds. In a previous post, I spoke how it was being clumped together with other companies based on its revenue growth and profile, and that there was room for multiple expansion. Over the past month, we have seen that and now the business is trading closer to fair value.

Market tailwinds, channel checks, and a financial analysis lead me to continue to be long Alteryx. I will outline these reasons below.

Market Tailwinds

Source: Alteryx

Alteryx is a leading player in the business intelligence and analytics field. There is a major industry shift occurring today with the explosion and structuring of business data that allows companies to make more informed decisions. However, many companies cannot afford a team of PhDs to analyze this new data. Alteryx fills that gap by allowing business users and technical staff to both analyze data.

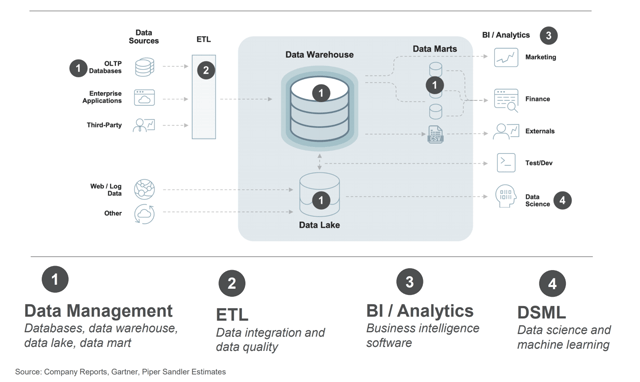

Here is a breakdown of the data ecosystem and the modern data stack:

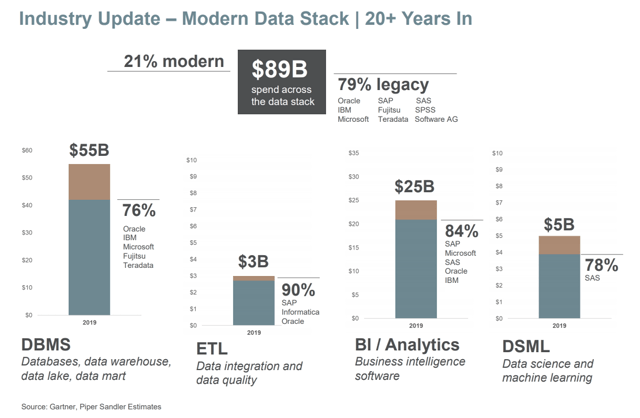

As an industry, Alteryx plays in the data science and machine learning space with many legacy vendors like SAP (SAP), Oracle (ORCL), and IBM (IBM). It is capturing market share from these vendors which are mostly on-premise. It is important to note that a significant portion of Alteryx is also on-premise, likely due to customer demand.

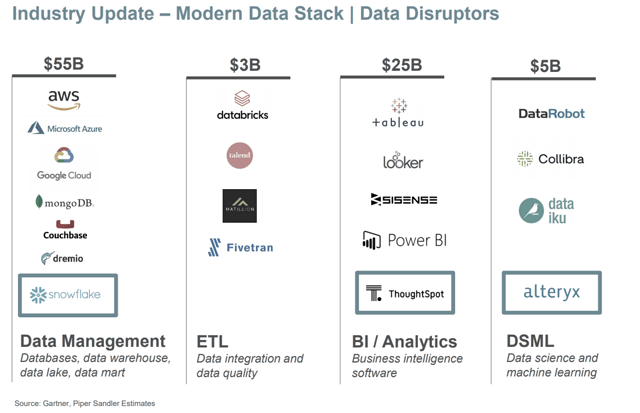

When asked about where Alteryx fits versus players like Snowflake, Couchbase, ThoughtSpot, and others, I can refer to this market map which outlines four key areas within the business intelligence universe. You can see that there are several well-funded venture companies in each of these market segments.

These are large and growing markets, and you can see that DSML itself is not as crowded as some of the other verticals.

Alteryx's vision is to