The COVID-19 crisis has created countless opportunities in the financial markets. One such opportunity, in my view, is retail all-star TJX Companies (NYSE:TJX). TJX had a hand in essentially creating mass market acceptance of the treasure hunt retail experience, wherein consumers walk into a store not necessarily knowing what kind of merchandise is inside. This model is far from unique to TJX, but I’d argue TJX has executed it better than any other. This best-in-class position has afforded TJX some enormous earnings multiples over the years, but even after a massive rebound rally, I think TJX offers relative value today and is worth a look from the long side.

A swift rebound is in the offing

One thing TJX has done extremely well in the past decade or so is boost its revenue. This has been done to some extent via expanding the store base, but primarily, TJX has been a comparable sales story.

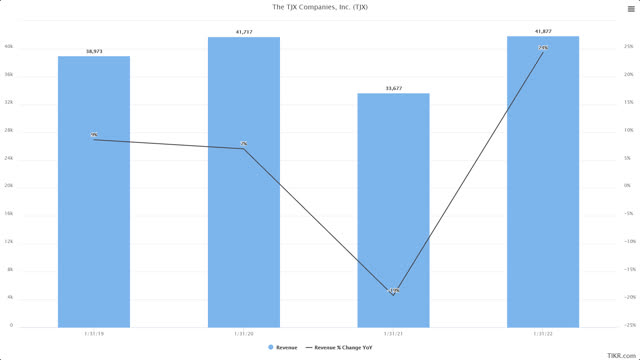

Below, we have revenue in millions of dollars, as well as year-over-year change for the past two years, as well as estimates for this year and next year.

Source: TIKR.com

TJX has managed to grow its top line at very impressive rates, examples of which can be seen in fiscal 2019 and 2020, respectively, in the above. Revenue growth neared 10% for both years despite ~$40 billion in annual revenue, which is astounding growth for a company of this size.

Obviously, this year is going to be ugly as the company’s stores were shut for several weeks earlier this year, but analysts expect a strong rebound into next year. Considering how TJX bounced back from the Great Recession and thrived in an environment where many others didn’t, I have no doubt TJX will bounce back from this setback as well.

Below, we can take a