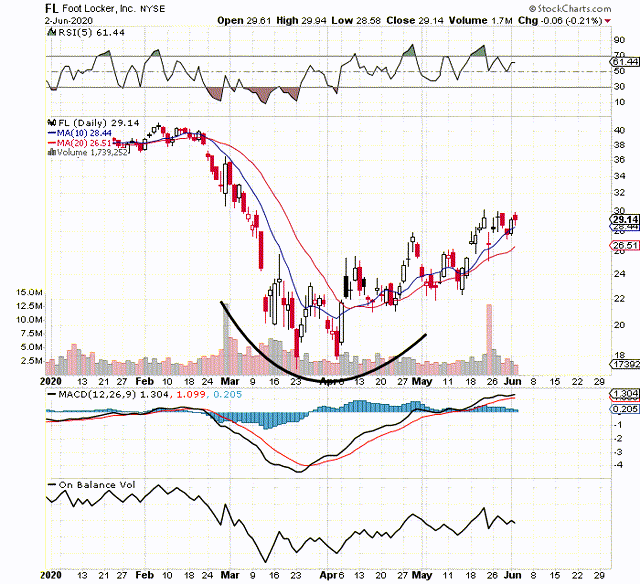

Josh Arnold made a very good call on Foot Locker (NYSE:FL) back in March when many thought the world was going to end. Josh actually recommended the stock around the $21 level. Shares actually dropped to close to $18 a share at the height of the panic. Fast forward a couple of months and change and shares are now trading just above the $29 handle. Suffice it to say, that is an impressive return on investment over the past 10+ weeks.

Foot Locker this year has been an excellent trading stock for a few reasons. First, there is plenty of liquidity as we can see from the tight bid/ask spreads in its options' chains. Implied volatility spiked aggressively back in March when equity markets tanked. The combination of high implied volatility, liquidity, a retailer with significant financial strength and a keen valuation definitely brought traders to this stock in a big way in the first quarter of this year.

With equity markets continuing to shrug off what is happening on main street, volatility has ebbed quite a lot in recent months. The retailer has just come off the back of a negative earnings print of -$0.67 in the first quarter along with lower than expected sales numbers of $1.18 billion in the first quarter. After a sharp share-price drop post the announcement 12 days ago, shares have recovered well as the market seems to be pricing in the re-opening of stores coming down the track. Therefore, let's look at the investment case for Foot Locker going forward.

Although profitability dropped ever so slightly in Foot Locker's latest fiscal year, the fundamental story of the retailer was strong coming into the first quarter of this year. Gross profit hit $3.56 billion in 2019, the dividend and share-buybacks remained strong and the balance sheet was in

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setup's through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification which is key. We started with $100k. The portfolio will not not stop until it reaches $1 million

-----------------------