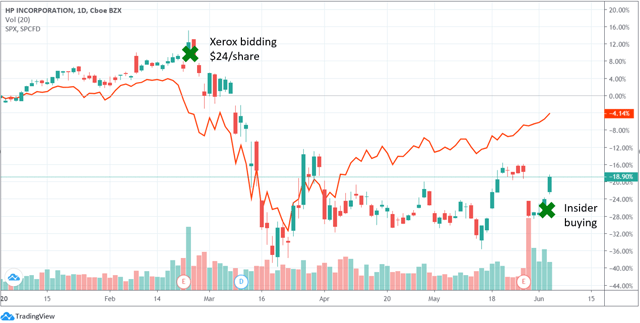

On June 2th, an insider purchase of HP Inc. (NYSE:HPQ) shares by director Robert R. Bennett got filed with the SEC. The insider purchased $748K worth of shares at $14.95, which is 38% lower compared to Xerox's (XRX) $24/share offer made in February this year to acquire HP. HP Inc. got highlighted by my Insider Outperformance Formula which picks out the winning insider stocks, which is a first positive indicator. I decided to perform an analysis to see whether the stock is undervalued, which will be the main purpose of this article. I found 4 reasons why HPQ is significantly undervalued at this price. In fact, just like the insider, I anticipate a strong recovery over the coming months and, therefore, decided to include it in Insider Opportunities' model portfolio.

(Source: Robbe Delaet via Tradingview.com)

HP Inc. company description

Since 2015, HP Inc. became the new name for the Hewlett-Packard Company, as Hewlett Packard Enterprise Company (HPE) (its cloud computing business) got spun off in a separate company. The part which is left, HP Inc., is a leading laptop, desktop, and printing manufacturer. HPQ is a company that is strongly focused to generate shareholder value. They returned $9.1 bln to shareholders last year (a staggering 38% of its current market cap), the dividend yields a solid 4.2% and they beat EPS consensus in 17 out of the past 17 quarters. Its business is divided into two segments: personal systems and print.

Personal systems division: market leadership with a focus on revenue growth

Personal systems generates 66% of HPQ's revenues and 36% of operating income and is primarily active in the US and Europe. HPQ shares market leadership in the personal computers ("PC") market with Lenovo Group (OTCPK:LNVGY), both having more than 20% market share which is growing sequentially. HP is particularly

Interested in similar winning insider ideas who are picked by my Insider Outperformance Formula? Members of Insider Opportunities get exclusive access to my real-time portfolio, an active community chat, and much more. Check out here for more information and to try out for free!